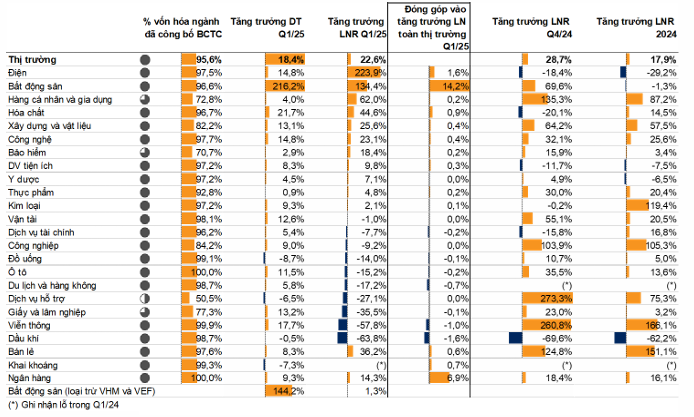

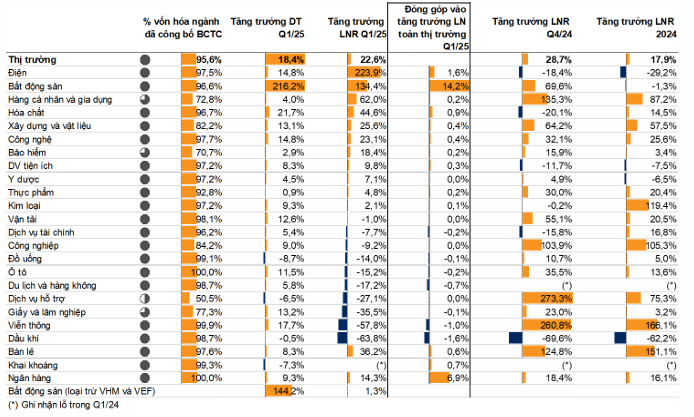

The quarterly business results for Q1 2025 showed a robust 22.6% profit growth year-on-year, indicating an improving domestic business environment and a recovering domestic demand. The Power Group (up 223.9%) and Real Estate (up 134.4%) led the net profit increase, benefiting from low bases and the economy’s positive growth momentum. In contrast, the oil and gas sector witnessed a 63.8% profit decline, negatively impacted by a nearly 9% drop in average oil prices.

|

Double-digit profit growth in Q1 2025

Source: VNDIRECT Research’s May 2025 Strategic Report

|

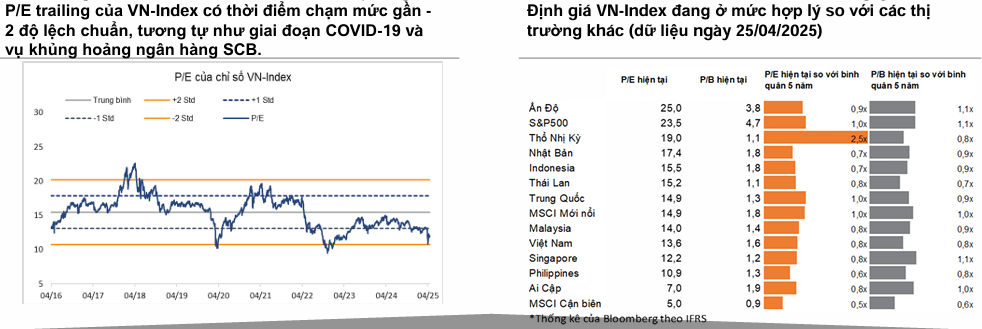

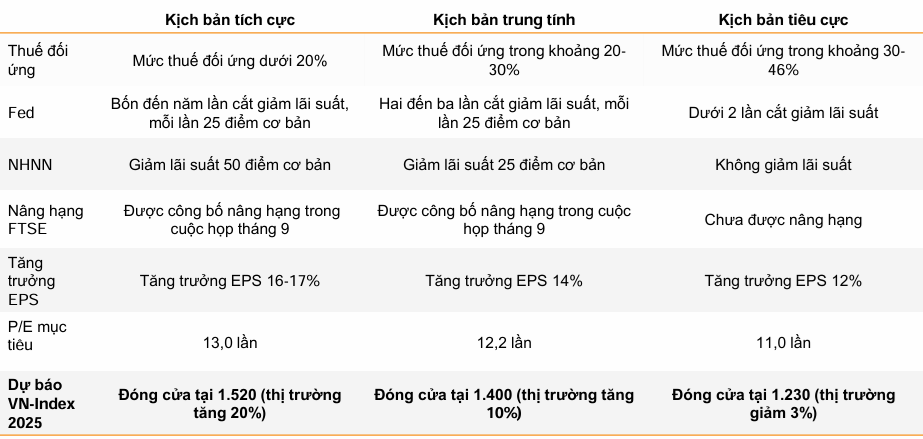

In terms of valuation, the VN-Index is trading at a 22% discount on its 5-year average P/E. Despite the challenges posed by US countervailing duties, VNDIRECT Research expects listed companies on the HOSE to achieve EPS growth of 12-17% in 2025, depending on tariff scenarios. Accordingly, the projected P/E for the VN-Index in 2025 ranges between 10.5 and 11 times.

From a P/B valuation perspective, the VN-Index is relatively attractive at 1.6 times, a 21.5% discount to its 5-year average.

Source: VNDIRECT Research’s May 2025 Strategic Report

|

In the near term, the VN-Index is expected to fluctuate between 1,200 and 1,280 points as investors await clearer signals from the upcoming US-Vietnam trade negotiations. Breaking through the strong resistance level of 1,270-1,280 points will largely depend on the trade talks’ outcome, favoring a lower countervailing duty rate of below 20%, or a scenario where the State Bank cuts policy rates to support the economy. Given the current context, short-term investors are advised to maintain a reasonable stock proportion in their portfolios and refrain from excessive leverage.

On the other hand, if the VN-Index corrects to the support region of 1,200-1,220 points, investors may consider new allocations and increasing their stock proportions.

VNDIRECT Research maintains the three market scenarios for 2025 outlined in the previous strategic report, with expectations for the VN-Index by year-end ranging between 1,230 and 1,520 points. The final outcome will heavily depend on US-Vietnam tariff negotiations, the number of Fed rate cuts, the State Bank’s policy rate decisions, and the results of FTSE’s market classification review in September.

Source: VNDIRECT Research’s May 2025 Strategic Report

|

– 19:44 10/05/2025

Why Navigate Without a Compass?

Investing in the stock market is easy, but are you truly equipped for it? Opening an account takes just 5 minutes, and buying stocks, a mere 10 seconds. But no one asks if you’ve ever been taught how to invest. There’s no formal education, no exams to pass, and no one arms you with a map to navigate the pitfalls, risks, and temptations of this challenging terrain.

Stock Market Insights: Unleashing the Power Within

The market witnessed a surprising turnaround in the afternoon session, triggered by a price surge in FPT. Convincingly, the session saw strong buying power and a significant reversal in foreign investors’ net buying position compared to the morning session. The matched liquidity of the two floors rose to a healthy VND 19.3k billion.