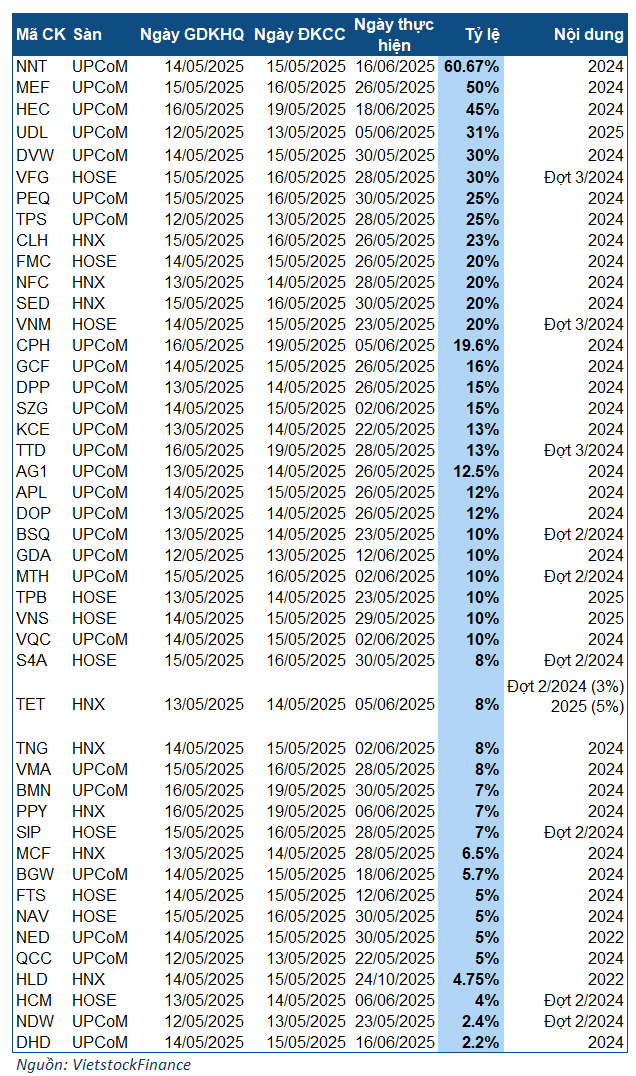

**Corporate Dividend Payout Schedule for the Week of May 12-16, 2025**

|

Companies finalising cash dividend payouts for the week of 12-16/05/2025

|

The most generous dividend distributor this week is NTT (Ninh Thuan Water JSC) with a dividend ratio of 60.67%, which is the 2024 dividend. With nearly 9.5 million circulating shares, the company is estimated to spend approximately VND 57.6 billion on this payout. The ex-dividend date is May 14th, and shareholders can expect to receive their dividends by June 16th, 2025.

This is NTT’s highest dividend payout in history, reflecting its outstanding 2024 performance. The company achieved a revenue of VND 214 billion, a 6.5% increase from the previous year, and a net profit of VND 78 billion, an over 8% increase, both record-high levels.

Following closely is MEF, finalising a 50% dividend payout (VND 5,000/share). With approximately 4.1 million circulating shares, MEF is expected to distribute over VND 20 billion in dividends, starting from May 26th. The ex-dividend date is May 15th, 2025.

2024 marks the second time MEF has distributed a 50% dividend, the first being in 2016. Prior to this, the company did not pay any dividends in 2014 but raised the ratio to 70% the following year. From 2011 onwards, MEF has consistently maintained a stable cash dividend policy, ranging from 30-45%.

Ranking third is HEC with a dividend ratio of 45% (VND 4,500/share). The ex-dividend date is May 16th, and the payout is expected on June 18th, 2025. With 6 million circulating shares, HEC will likely spend around VND 27 billion on this dividend. This is the second consecutive year that HEC has maintained a 45% dividend ratio. Since 2020, the company has sustained a 40% dividend policy.

Additionally, three companies are notable for their dividend ratios: UDL (31%), DVW, and VFG (both 30%). Their respective ex-dividend dates fall on May 12th, 14th, and 15th.

Two companies will finalise share dividend payouts next week: DHC (20%) and GEX (5%). GEX is estimated to issue approximately 43 million new shares, while DHC will issue 16.1 million new shares. The ex-dividend dates for GEX and DHC are May 14th and 16th, respectively.

– 13:58 11/05/2025

Attention Bank Shareholders: 3 Banks to Release Cash Dividends in the Coming Fortnight

“Three major banks, TPBank, VPBank, and LPBank, are gearing up to finalise their shareholder lists over the next two weeks, as they prepare to distribute cash dividends. This move underscores their commitment to rewarding shareholders for their continued support and confidence in the banks’ performance. Additionally, VIB Bank is also set to make a cash dividend payment to its shareholders on May 23rd, showcasing its dedication to shareholder value.”

“Bank Dividend Policies: Striking a Balance Between Shareholder Rewards and Fortifying Financial Position?”

“To cash dividend or to retain earnings, that is the question on the minds of bank executives as they gear up for the 2025 annual general meetings. With a volatile macroeconomic climate, striking a balance between keeping shareholders happy and fortifying the financial foundation of the bank is a delicate matter.”