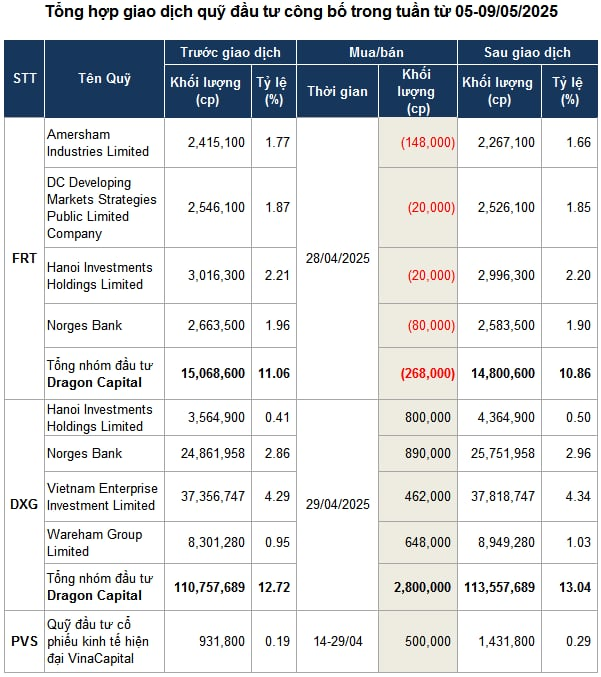

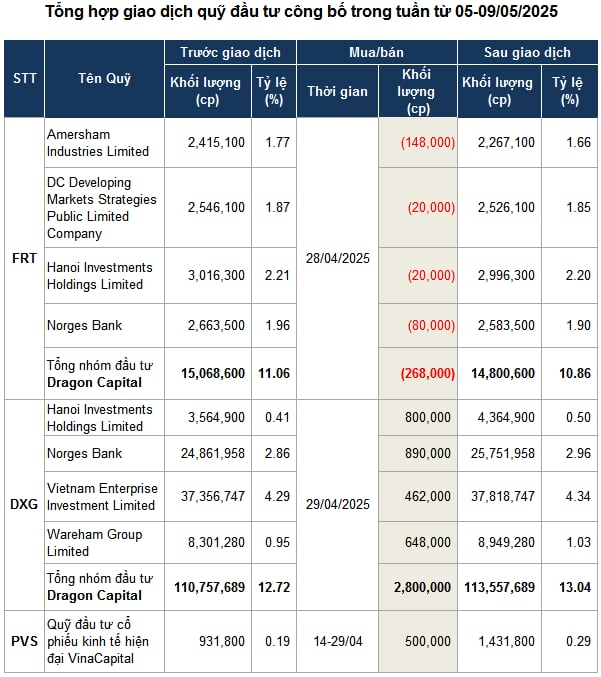

Specifically, Dragon Capital has reduced its ownership stake in FPT Digital Retail Joint Stock Company (FRT) to below 11% after selling 268,000 FRT shares in the April 28 session.

| FRT share price movement from the beginning of 2024 to the session on May 09, 2025 |

At the end of the trading session, FRT share price stood at 165,900 VND per share, down over 10% from the beginning of 2025. The transaction is estimated to have brought Dragon Capital more than 44 billion VND.

Notably, the move to divest from FRT came after the Company announced positive first-quarter 2025 financial results with a 29% increase in net revenue to nearly VND 11,670 billion and a 4.3-fold jump in net profit to VND 168 billion.

FPT Retail targets full-year revenue of VND 48,100 billion and pre-tax profit of VND 900 billion, up 20% and 71%, respectively, from 2024. After the first quarter, the Company has achieved 24% of its revenue target and 30% of its profit target.

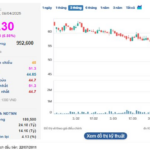

Subsequently, Dragon Capital increased its stake in Dat Xanh Group Joint Stock Company (DXG) by purchasing 2.8 million DXG shares in the April 29 session, raising its ownership to over 13%, equivalent to nearly 113.6 million units. The fund group is estimated to have spent approximately VND 42 billion on the transaction, based on DXG’s closing price on the same day.

Earlier, on April 11, Dragon Capital also bought an additional 1.8 million DXG shares, increasing its ownership from 11.92% to 12.13%.

| DXG share price movement from the beginning of 2024 to the session on May 09, 2025 |

The continuous acquisition of shares took place amid DXG share price plunging to a 7-month low and then surging. As of May 07, DXG reached VND 16,000 per share, up about 30% from its April low.

In terms of business performance, DXG recorded first-quarter gross revenue of nearly VND 925 billion, down 13% year-on-year due to an almost 19% decline in real estate transfer revenue. However, thanks to a significant decrease in cost of goods sold, gross profit increased by 8%, reaching over VND 510 billion. Net profit amounted to over VND 48 billion, up 55% from the previous year and equivalent to 13% of the full-year plan.

Source: VietstockFinance

|

– 07:28 11/05/2025

The Ultimate Real Estate Launch: 15,000 Strong for HCMC’s Central Property Sensation

On May 9, 2025, in the heart of Ho Chi Minh City at the Saigon Exhibition and Convention Center, a prestigious real estate project, The Privé, made its highly anticipated debut. Developed by the renowned Dat Xanh Group, the project launch, aptly named The Privilege Show, captivated audiences with an artistic showcase, generating buzz and excitement even before its official opening on the night of May 8.

“Dragon Capital Increases Stake in DXG to Over 13%”

“In a notable trading session on April 29, 2025, foreign fund Dragon Capital, represented by Ms. Truong Ngoc Phuong, successfully acquired 2.8 million DXG shares through four of its member funds.”

The Green Revolution: CEO Summit 2025 and the Evolution of Vietnam’s Real Estate Market

The CEO Summit 2025, hosted by Dat Xanh Group, brought together almost 200 leading real estate brokers. The event, held in a warm and elegant setting, served as a platform for large distribution companies to gain insights and strategize for the market. It marked a significant step forward in the collaboration between Dat Xanh and its nationwide distribution system for the upcoming period.