The write-off ratio is commonly used to:

The write-off ratio reflects the proportion of loaned credit a bank is forced to erase due to irretrievability. It is a crucial indicator of credit risk and loan portfolio quality. |

The most common way to calculate the write-off ratio is by:

Dividing write-offs by the total loan balance helps identify the proportion of unrecoverable loans compared to overall credit activity. This is the most prevalent measurement in bank analysis. |

What might persistently high write-off ratios indicate about a bank’s credit quality?

High write-off ratios imply that the bank has to acknowledge numerous uncollectible loans. This reflects poor credit evaluation capabilities or a risky business environment, resulting in weak credit quality. |

– 19:28 08/05/2025

VietCredit Returns to Profitability Through Financial Product Digitization

The Q4 2024 financial report from VietCredit Joint Stock Finance Company (VietCredit – stock code: TIN) reveals a positive turnaround for the business, with a post-tax profit of VND 69.6 billion and other encouraging signs.

Reaping Rewards from Investment Securities: TPBank’s Q4 Pre-Tax Profits Surge 3.4x YoY

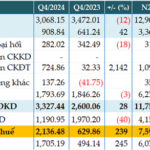

For the fourth quarter of 2024, the Joint Stock Commercial Bank Tien Phong (TPBank, HOSE: TPB) reported a profit before tax of over VND 2,136 billion, a 3.4-fold increase compared to the same period last year. This impressive performance is attributed to a significant reduction in risk provisions and a surge in investment securities income.

How Are Banks Preparing for the End of Circular 02?

Circular 02, effective until late 2024, has provided a much-needed reprieve for banks and businesses to recalibrate their strategies and financial restructuring. However, as this policy nears its end, the focus shifts to the lingering challenges of non-performing loans and risk governance within the financial system. Maintaining stability requires banks to not only optimize their bad debt coverage ratios (LLR) in balancing profitability and risk but also demands prudence in crafting their lending portfolios in the forthcoming period.

The New Land Price Framework: Unlocking the Secrets of Real Estate Credit

The introduction of Ho Chi Minh City’s new land price list will bring land prices closer to market values, ensuring transparency and fairness in land price determination. However, the implementation of this new land price list will impact the asset valuation process for credit extension and NPL resolution for credit institutions.