SHS and CEO Stocks in High Demand on the Listed Stock Market

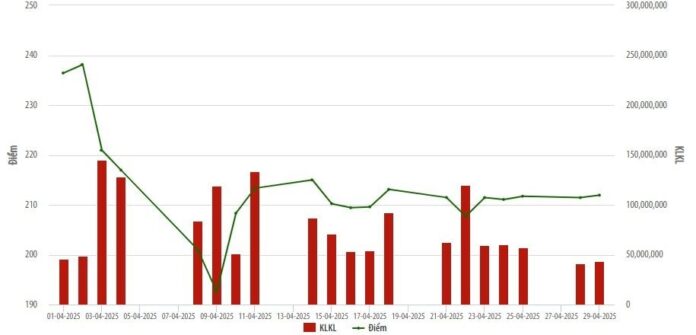

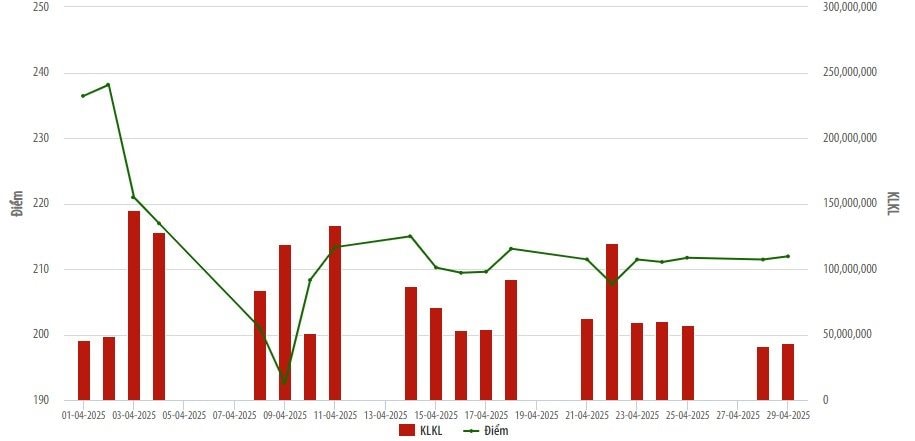

According to a report by the Hanoi Stock Exchange (HNX), in April 2025, the HNX-listed stock market experienced a significant drop at the beginning of the month on April 3, 2025, following news of a 46% tariff imposed by the US on Vietnamese goods. The market then witnessed mild recovery sessions and maintained a narrow range of fluctuations until the end of the month, with the HNX Index closing at 211.94 points, a 9.83% decrease compared to the previous month.

Listed Stock Market Trading in April 2025

Market liquidity surged with the average trading volume (TV) reaching 89.4 million shares per session, a 37.5% increase compared to the previous month. Similarly, the average trading value (TV) in April 2025 rose by 17.7%, reaching VND 1,350 billion per session. The trading session on April 3, 2025, recorded the highest TV and TV of the month, with 162.6 million shares equivalent to VND 2,600 billion traded.

The HNX30 stock group witnessed a total TV of over 1,161 million shares, corresponding to a TV of over VND 20,500 billion, accounting for 64.96% in volume and 76.15% in value of the total market trading.

In terms of liquidity, the best-performing stock in the market remained SHS of Saigon-Hanoi Securities JSC. Compared to March 2024, SHS witnessed a significant surge in TV, increasing by 31.2% to reach 391.1 million shares, accounting for 21.35% of the entire market. Following closely was CEO stock of C.E.O Investment JSC, with a TV of over 165 million shares, making up 9.04% of the market. In third place was PVS of Vietnam Oil and Gas Technical Services Corporation, with a TV of 112.4 million shares, or 6.14%.

Regarding stock prices, the strongest gainer was NFC of Ninh Binh Fertilizer JSC, with its closing price at the end of the month surging by 54.74% (equivalent to VND 15,000 per share) to reach VND 42,400 per share. In second place was SMT of SAMETEL JSC, which increased by 35.29% (equivalent to VND 3,000 per share) to reach VND 11,500 per share. Next was THS of Thanh Hoa-Song Da JSC, which rose by 34.74% (equivalent to VND 3,300 per share) to VND 12,800 per share, followed by KHS of Kien Hung JSC, which climbed by 34.03% (equivalent to VND 4,900 per share) to VND 19,300 per share.

According to HNX, foreign investors net sold on the HNX-listed stock market, with a net selling value of over VND 439.3 billion. Their total buying value exceeded VND 1,211 billion, while their total selling value reached over VND 1,651 billion. Foreign investors’ total trading value increased by 23% compared to the previous month. SHS continued to be the most purchased stock by foreign investors, with a TV of 12.1 million shares. CEO stock ranked second, with a TV of over 8.8 million shares. These two stocks have been attracting significant attention from foreign investors since the beginning of the year.

On the selling side, IDC of IDC Corporation ranked first, with a TV of 16.6 million shares, followed by PVS of Vietnam Oil and Gas Technical Services Corporation, with a TV of over 13.9 million shares.

HNG Stock Witnessed Net Buying on the UPCoM Market

UPCoM Market Trading in April 2025

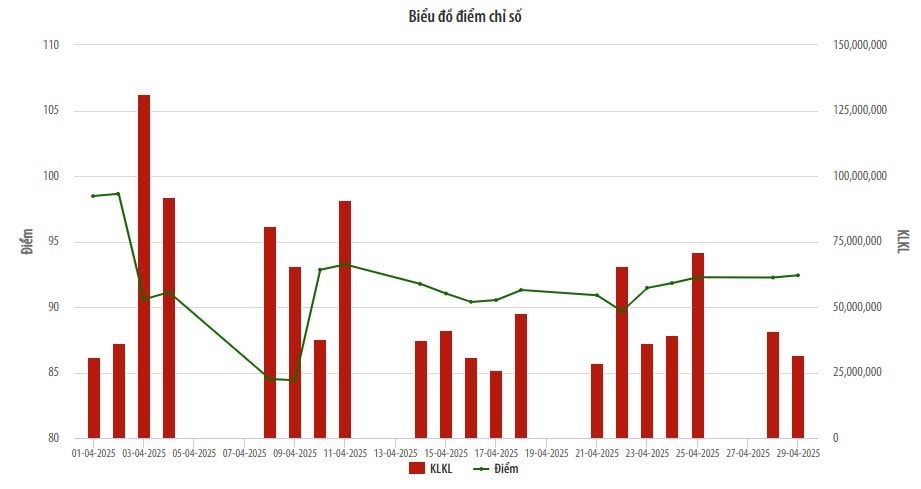

The UPCoM market in April 2025 followed a similar trend to the listed stock market, experiencing a sharp drop at the beginning of the month, followed by a quick mild recovery and sideways movement until the end of the month.

The UPCoM Index closed the last trading session of the month at 92.42 points, a 5.74% decrease compared to the previous month. The average TV increased by 13.34% from March, reaching over 61.35 million shares per session, while the average TV rose by 11.27%, reaching over VND 803.24 billion per session. The trading session on April 3, 2025, recorded the highest TV and TV of the month, with 135.37 million shares and VND 1,775 billion, respectively.

In terms of liquidity, HNG stock of Hoang Anh Gia Lai International Agriculture JSC continued to be the most traded stock on UPCoM, with 118.93 million shares, accounting for 9.69% of the entire market. HNG stock has consistently maintained its position as the most liquid stock on the UPCoM market for the past six months. BVB stock of Nam Viet Commercial Joint Stock Bank climbed from the third position in the previous month to second place, with a market share of 5.9% and a TV of over 72.36 million shares. Following closely was SBS stock of SBS Securities JSC, with a TV of over 56.7 million shares, accounting for 4.62%.

Regarding stock prices, the top gainer in April was FRM of Saigon Forestry JSC, with its closing price at VND 12,400, a 202.44% increase compared to the previous month. In second place was TIN of Tin Viet Finance Joint Stock Company, with a closing price of VND 18,200, a 105.2% surge. Additionally, the group of strongest gainers included CTX of Vietnam Construction and Commerce Investment Joint Stock Company, CMM of Camimex Joint Stock Company, and DCG of May Dap Cau Total Joint Stock Company.

The TV of foreign investors on UPCoM witnessed a significant increase (99.1%) compared to the previous month and continued the net selling trend, with a net selling value of over VND 657 billion. Their total selling value reached VND 1,299 billion, while their buying value was over VND 642 billion. ACV stock of Vietnam Airports Corporation – Joint Stock Company was the most purchased stock by foreign investors, with a TV of over 3.87 million shares (accounting for 23.34% of the market). HNG stock of Hoang Anh Gia Lai International Agriculture JSC followed closely, with a TV of over 3.05 million shares (accounting for 18.36%).

On the selling side, QNS stock of Quang Ngai Sugar Joint Stock Company remained the most sold stock by foreign investors, with a TV of over 8.73 million shares, accounting for 25.92% of the market. OIL stock of Vietnam Oil and Gas Corporation was the second most sold, with a TV of over 6.86 million shares, corresponding to a market share of 20.36%.

Market Beat: Afternoon Session Divergence, VN-Index Curbs Gains

The widening divergence in the afternoon session erased most of the morning’s gains. At the close, the VN-Index pared its intraday gains, rising just 2 points to 1,241.95. The HNX-Index edged up 0.08 points to 212.89.

The Market Mind: Caution Still Lingers

The VN-Index pared its gains, forming an Inverted Hammer candlestick pattern and failing to breach the previous peak established in mid-April 2025 (1,230-1,245 points). The cautious sentiment among investors was further reflected in the trading volume, which remained below the 20-day average. To sustain its upward trajectory, the index needs to surpass this threshold in the upcoming sessions. Nonetheless, the MACD and Stochastic Oscillator indicators remain upward-pointing and have generated buy signals. If this status quo persists, the short-term optimistic outlook is likely to extend.

Market Beat: VN-Index Turns to Late Session Tug-of-War, Holding on to Green Tint.

The market closed with positive gains as the VN-Index rose by 5.88 points (+0.48%), settling at 1,229.23. Similarly, the HNX-Index witnessed an increase of 0.65 points (+0.31%), ending the day at 211.72. The market breadth tilted towards the bulls with 404 gainers versus 323 decliners. The VN30 basket also painted a positive picture, with 15 gainers outperforming the 13 losers, while 2 stocks remained unchanged, tilting the basket towards the green.

The Shark Money Trail 09/05: Proprietary Traders Sell HOSE-listed Shares Worth Over VND 213 Billion

The self-sponsored trading arms of securities companies continued to offload stocks on the Ho Chi Minh Stock Exchange (HOSE) on May 9, while foreign investors maintained a relatively balanced trading stance.