The Vietnamese stock market witnessed notable changes during the first two trading sessions of May, with the introduction of a new technology system (KRX).

However, a question on many investors’ minds is the disappearance of ATO and ATC orders from the price board during the opening and closing price determination sessions.

This change stems from the implementation of the new KRX technology system, effective from May 5th.

Specifically, after adopting the new technology system, ATO/ATC orders in the periodic matching session will be displayed at a specified price like limit orders, instead of the previous ‘ATO’ and ‘ATC’ indicators.

In cases where there is only a buy or sell surplus of ATO or ATC orders, the displayed price of the ATO/ATC buy or sell order is the expected matching price. If there is no expected matching price, the displayed price is the latest matching price or the reference price (if there is no latest matching price).

Moreover, ATO/ATC orders will no longer take precedence over limit orders (LO orders) to buy at the ceiling price or sell at the floor price that were entered into the system earlier during order matching.

HoSE provided illustrative examples of the price levels of ATO/ATC orders in the periodic matching session after the new technology system was applied.

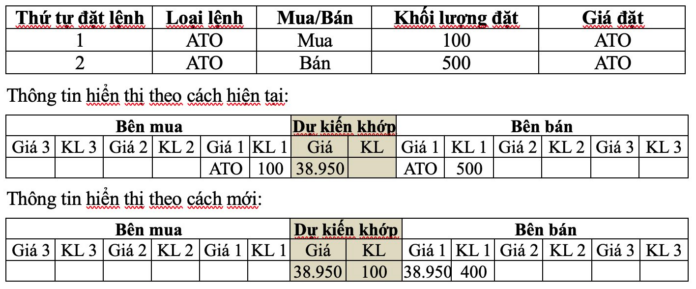

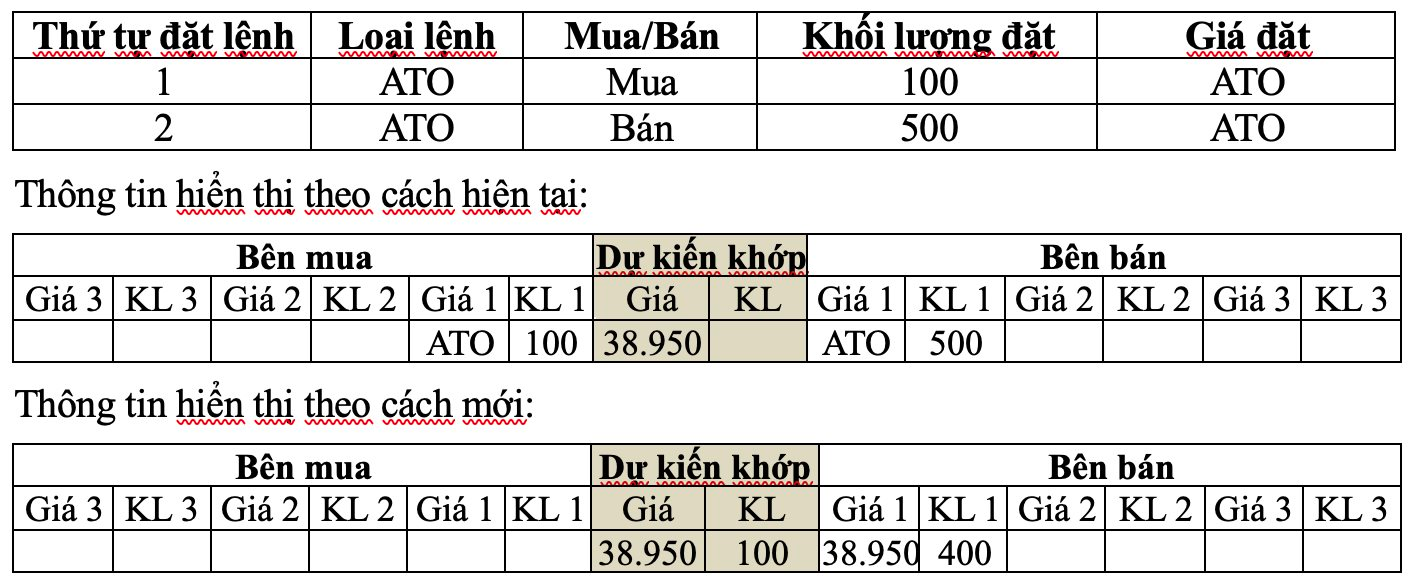

Example 1: Case with only a sell surplus of ATO order

In the periodic matching session to determine the opening price, Stock A (reference price: 39,000) has the following order book:

Explanation:

Expected matching price: 38,950; Expected matching volume: 100; Order 1 matches with Order 2: 100 shares.

In the periodic matching session to determine the opening price, the information displayed is the three best expected buy and sell prices remaining after order matching. Therefore, it will show Order 2 with a sell surplus of 400 at the price of 38,950 (expected matching price).

In the case of a buy or sell surplus of limit orders:

The displayed price of the ATO/ATC buy order is the highest buy surplus price plus one pricing unit (if the determined price is higher than the ceiling price, the ceiling price is displayed).

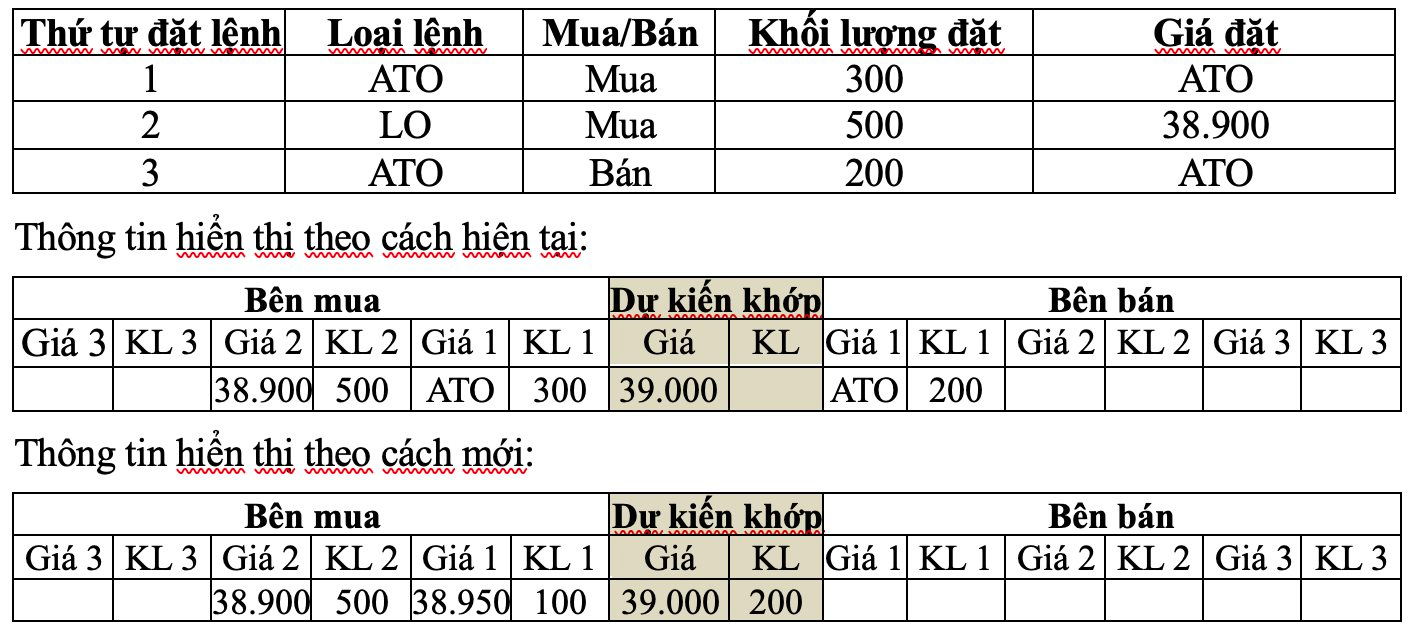

Example 2: Case with a buy surplus of limit orders

In the periodic matching session to determine the opening price, Stock A (reference price: 39,000) has the following order book:

Explanation:

Expected matching price: 39,000; Expected matching volume: 200; Order 1 matches with Order 3: 200 shares.

In the periodic matching session to determine the opening price, the information displayed is the three best expected buy and sell prices remaining after order matching. Therefore, it will show Order 1 with a buy surplus of 100 at the price of 38,950 and Order 2 with a buy surplus of 500 at the price of 38,900.

The displayed price of the ATO/ATC sell order is the lowest sell surplus price minus one pricing unit (if the determined price is lower than the floor price, the floor price is displayed).

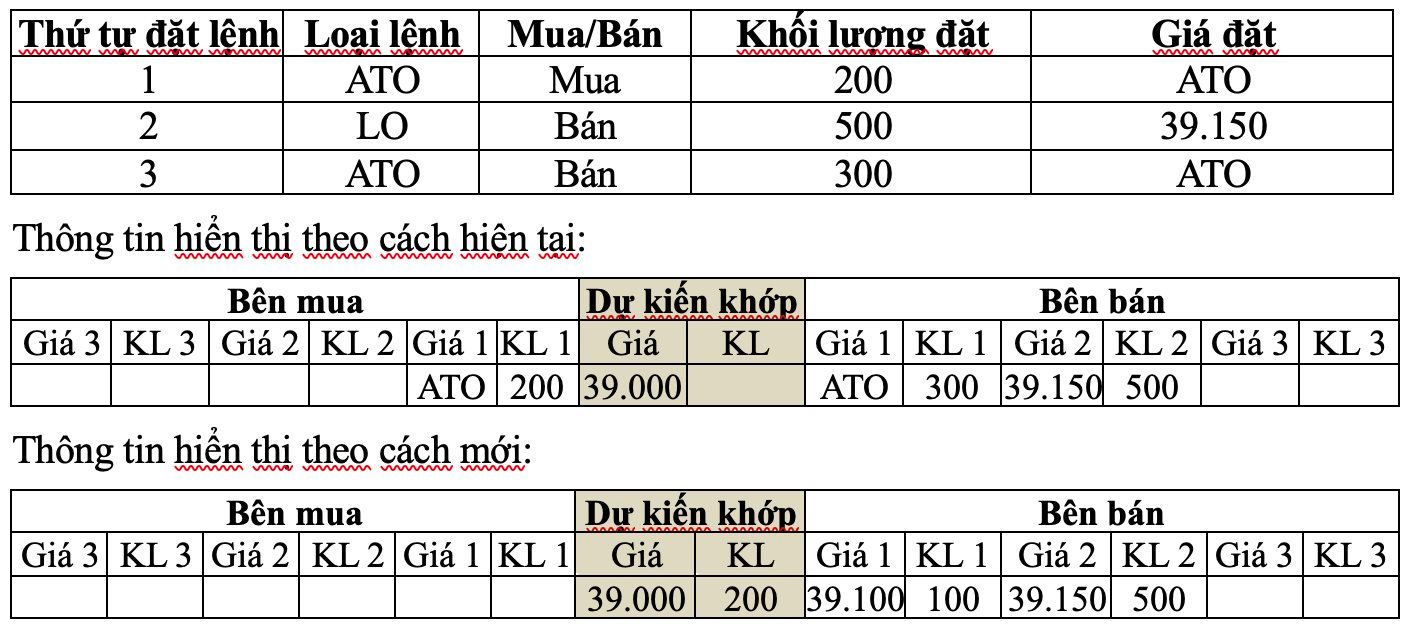

Example 3: Case with a sell surplus of limit orders

In the periodic matching session to determine the opening price, Stock A (reference price: 39,000) has the following order book:

Explanation:

Expected matching price: 39,000; Expected matching volume: 200; Order 1 matches with Order 3: 200 shares.

In the periodic matching session to determine the opening price, the information displayed is the three best expected buy and sell prices remaining after order matching. Therefore, it will show Order 3 with a sell surplus of 100 at the price of 39,100 and Order 2 with a sell surplus of 500 at the price of 39,150.

“Foreign Investors Surprise with Net Buy of Nearly VND 1,000 Billion, Heavily Investing in Real Estate Stocks”

The real estate stocks DXG and NLG witnessed a strong net buying in the afternoon, with each stock attracting over a hundred billion VND in value.

Stock Market Week May 5-9, 2025: Powerful Breakthrough

The VN-Index concluded a highly positive week of trading, recording gains in 4 out of 5 consecutive sessions and surpassing the 200-day SMA. The resumption of net foreign buying was a key factor in supporting this upward momentum. If this trend persists into the next week, coupled with stronger market participation, the VN-Index is poised to further consolidate and extend its gains.

VIX Securities Reports Q1 Profits, Surging 230% Year-over-Year

The VIX Joint Stock Securities Company (VIX) has released its Q1/2025 financial report, showcasing impressive performance and positive highlights.