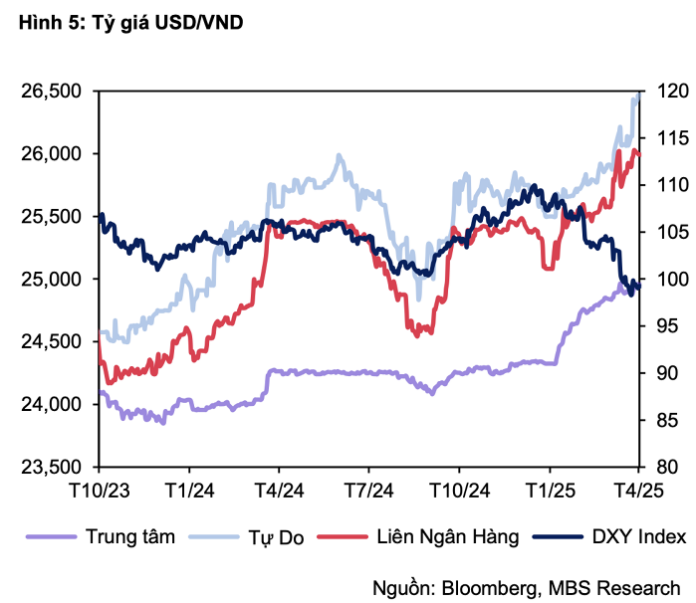

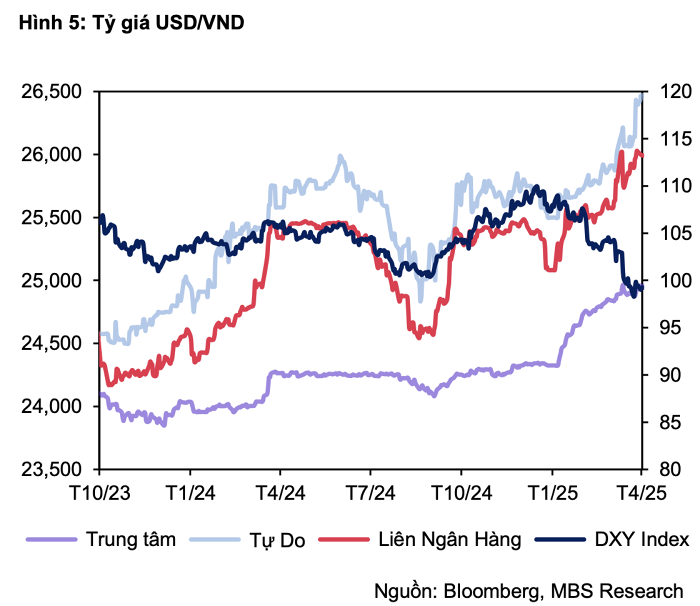

In MBS’s newly released foreign exchange market report, MBS Securities (MBS) stated that the Dollar Index (DXY) continued its sharp downward trend throughout April amid tariff turmoil.

Specifically, on April 2, President Trump declared it “National Freedom Day” for the US, imposing large-scale countervailing duties on many trading partners, including a 145% tariff hike on imports from China. However, Trump decided to delay the countervailing duties for 90 days. In addition, the pressure on the US dollar increased as President Trump repeatedly criticized and pressured the Federal Reserve, intending to remove the Fed Chair.

In this context, the DXY hit a three-year low of 98.3 on April 21 (-10.2% year-to-date). By the end of April, the dollar had fallen 4.8% month-over-month to 99.2 (-9.3% year-to-date).

Despite the sharp decline in DXY, the interbank USD/VND exchange rate maintained its upward trend. By the end of April, the USD/VND exchange rate had increased by 1.4% from the previous month to 25,994 VND/USD (up 2.1% year-to-date).

The free market rate rose to 26,470 VND/USD, while the central rate was set at 24,956 VND/USD, representing increases of 2.8% and 2.5%, respectively, since the beginning of the year 2025.

According to MBS, the rate increase was partly due to the State Treasury continuing to buy $110 million from commercial banks in April, limiting foreign currency supply. Additionally, businesses’ foreign currency demand rose amid global trade uncertainties.

Meanwhile, the deep drop in VND interbank interest rates during April caused the VND-USD interest rate differential to reverse sharply into negative territory, putting further pressure on the exchange rate.

MBS experts forecast the USD/VND exchange rate to fluctuate between 25,500 and 26,000 in 2025, as the US dollar is expected to recover from expansionary fiscal policies, high interest rates, and America’s trade protectionism. These factors are projected to bolster the dollar’s value this year.

Moreover, the unpredictable tariff policies from the US are likely to pose challenges for Vietnam’s exports and FDI attraction in the coming period and may exert pressure on the country’s already modest foreign reserves, which were depleted by last year’s sale of over $9 billion.

Nonetheless, positive macroeconomic factors such as the trade surplus ($3.79 billion), disbursed FDI ($6.74 billion), and a significant increase in international visitors (up 23.8% year-on-year) are expected to continue supporting the VND.

“May 7: Central Bank’s Continued Drop in USD Rates, Gold Prices Soar to Record Highs”

The USD exchange rates at banks witnessed a mixed trend as the SBV lowered the mid-rate for the third consecutive session. Domestic gold prices remained anchored at record highs.

The Vietnamese Dong: Could it Strengthen to 26,000 VND/USD by Year-End? Interest Rates to Remain Low.

According to a recent report on Vietnam’s macroeconomic outlook published by Tien Phong Securities (TPS, HOSE: ORS), exchange rates may continue to rise while interest rates remain low to support the economy.