According to data from the Hanoi Stock Exchange (HNX), banks continued to dominate the corporate bond market in April 2025, with approximately VND 24.3 trillion, accounting for 64% of the total capital mobilized in the month and nearly three times the same period last year. The banks mainly borrowed short-term from 2-3 years, with an average interest rate of 5.3%/year, up from 3.9%/year in April last year.

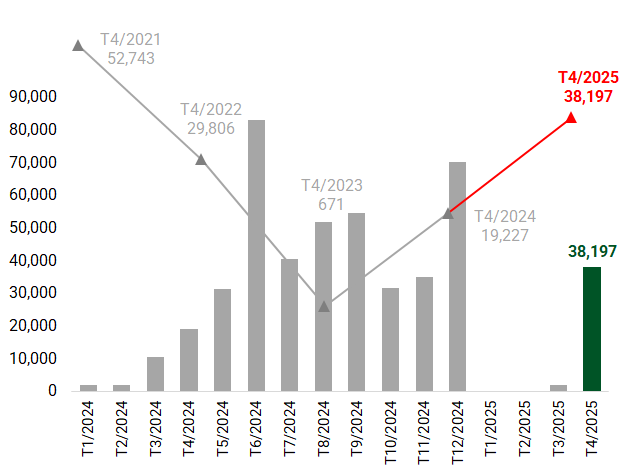

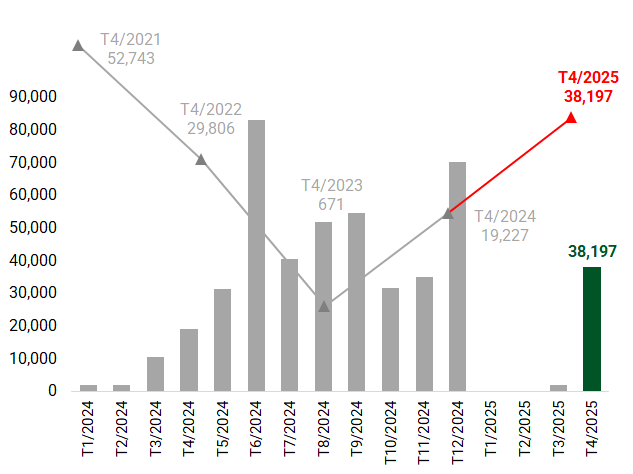

Cumulative for the first four months, the market recorded a total of about VND 42.4 trillion in bond issuances (according to HNX data updated to April 29), up about 23%.

|

April 2025 had the highest bond issuance value in 3 years (in VND billion)

Source: Consolidated by the author, may change at the time of update

|

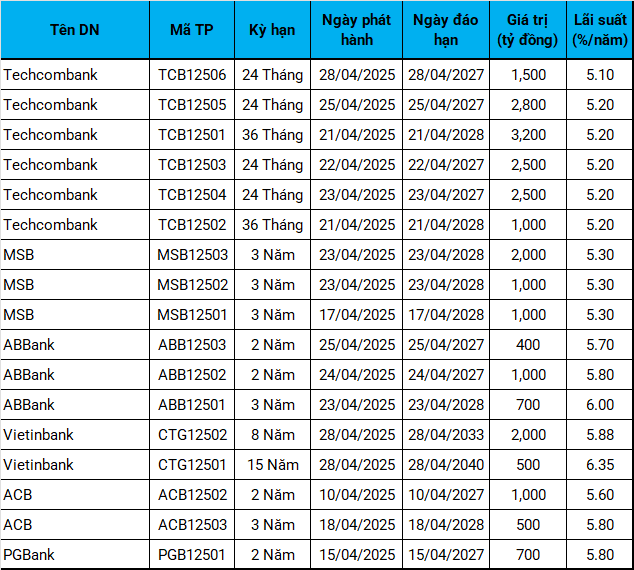

Techcombank still leads in value

Techcombank continued to stand out, raising a total of VND 13.5 trillion from bonds in the first few months of the year. The bank’s bonds had terms of 2-3 years with fixed interest rates ranging from 5.1-5.2%/year. MSB followed with VND 4 trillion in 3-year bonds at 5.3%/year. Vietinbank issued two bonds with longer terms of 8 and 15 years, with interest rates of 5.88% and 6.35% per annum, respectively.

Other banks such as ABBank, ACB, and PGBank were also active in fundraising. Notably, PGBank and ABBank offered the highest interest rates, ranging from 5.7-6%/year for 2-year bonds. In particular, ACB has raised a total of VND 3 trillion in the last two months.

Source: Consolidated by the author

|

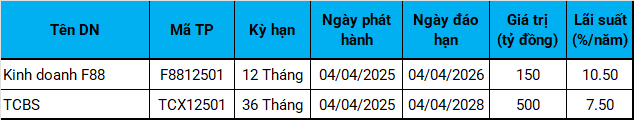

Non-bank financial group returns to the market

In the non-bank financial sector, Kien Trung Securities (TCBS) re-entered the market after almost 9 months with a VND 500 billion bond issue, a 3-year term, and a 7.5%/year interest rate. This interest rate is lower than the rates of the bonds issued last year. Meanwhile, in March, Rong Viet Securities (VDS) also successfully raised VND 500 billion with an interest rate of 8.2%/year.

F88 Business – a company operating in the consumer finance industry – maintained a steady pace of bond issuances. In April, the company raised an additional VND 150 billion with a 12-month term and a 10.5%/year interest rate, on par with the issuances at the end of 2024.

Source: Consolidated by the author

|

Water business issues 20-year bonds

In other sectors, Vingroup Group led the way by issuing three bond batches worth VND 9 trillion in April, with terms ranging from 24 to 38 months and fixed interest rates of 12-12.5%/year.

In the real estate sector, TCO Real Estate Consulting and Trading, the investor of the LUMIÈRE Evergreen project in Hanoi, issued VND 3 trillion in bonds with a 12-month term and an interest rate of 8.2%/year. This interest rate is significantly lower than the rate of nearly 9.6%/year offered by the company at the end of last year.

Notably, Xuan Mai – Hanoi Water Transmission successfully issued bonds with a term of up to 20 years, with a total value of more than VND 317 billion and a fixed interest rate of 5.75%/year. This is one of the few long-term bonds in the water supply sector, guaranteed by GuarantCo. Previously, at the end of 2024, a company in the same ecosystem, Hoa Binh – Xuan Mai Water Supply, also successfully raised nearly VND 875 billion with similar characteristics.

In the automobile sector, Tasco Auto issued its first private bond batch worth VND 190 billion, with a 4-year term and an issuance interest rate of 10%/year.

Source: Consolidated by the author

|

Increasing bond defaults

Along with the positive bond issuance value, the market also witnessed several violations by issuing organizations. Notably, Nam Phuong Energy Investment failed to fully meet its debt obligations for bonds issued from 2021 to 2022. The total value of these bonds currently outstanding is nearly VND 1.5 trillion.

Another case is BKAV Anti-Virus Software, the owner of the BKPCB2124001 bond, which was reported by VNDIRECT Securities for defaulting on payments and incurring new debt without investor agreement. The total value of the outstanding bonds is over VND 163 billion.

VNDIRECT also reported to the authorities that a subsidiary of Crystal Bay increased capital without the agreement of the bondholders.

TPS Securities also reported violations related to bonds of companies associated with Bamboo Capital, including Tracodi, BCG Land, HELIOS Investment and Services, and Gia Khang Trading Services Investment.

Additionally, loans from Hoang Son Energy Investment, Hoang Son Energy Investment 2, BB Power Holdings, and Novaland, which had been extended by 15-24 months after the Decree 08/2023 took effect, were not fully repaid when the new due date arrived, raising concerns about the issuers’ ability to meet their obligations.

– 09:53 12/05/2025

The Global Economic Imprint: Week of May 5-11, 2025: US-China Talks Begin, Fed Cautious on Rates.

The global trade war witnessed a positive shift last week as the US struck a deal with the UK and initiated negotiations with China.

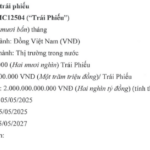

Vingroup Successfully Issues 2,000 Billion VND of Bonds

“On May 5, 2025, Vingroup successfully offered a total of VND 2,000 billion of bonds with the code VIC12504 with a term of 24 months. This significant achievement showcases Vingroup’s strong presence and reputation in the market, solidifying its position as a leading enterprise in Vietnam.”