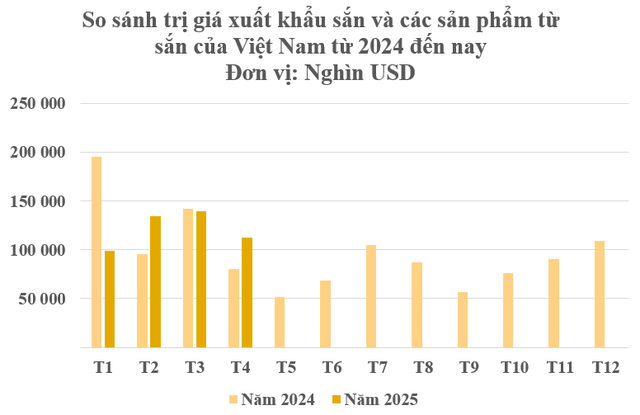

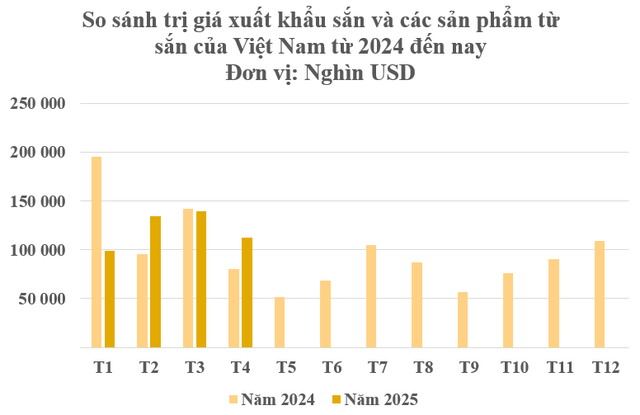

According to preliminary statistics from the General Department of Customs, cassava and cassava product exports in April reached over 391,000 tons, valued at more than $112 million, a decrease of 19.7% in volume and 18.9% in value compared to the previous month.

Cumulative exports in the first four months of the year amounted to over $485 million, equivalent to over 1.6 million tons, a significant increase of 42.3% in volume but a slight decrease of 4.8% in value.

In terms of market destinations, China remains the largest export market, with over 1.53 million tons of cassava and related products, valued at more than $454 million, an increase of 45% in volume but a decrease of 3% in value. Notably, prices dropped by 33% compared to the same period last year, averaging $296 per ton.

Not only is China the largest export market, but it is also the world’s largest consumer of cassava, primarily sourcing from Thailand and Vietnam.

According to the Import-Export Department (Ministry of Industry and Trade), the reason China purchases the most cassava and cassava products globally is due to its ethanol production and the recovery of the pig farming industry after the African swine fever. Meanwhile, as corn supply in South America faces challenges due to unfavorable weather, China increases its imports of cassava chips and starch for animal feed.

Taiwan comes in second, with over 19,000 tons and a value of over $7 million, an 8% volume decrease and a 38% value decrease. Export prices dropped by 32% compared to 4T/2024, averaging $373 per ton.

Malaysia is Vietnam’s third-largest export market for cassava, with over 12,000 tons and a value of over $4.5 million, a significant volume increase of 70% and a 22% value increase from the previous year. The average price stood at $378 per ton, following a similar decreasing trend as the two dominant markets mentioned above, with a nearly 30% decline.

The demand for cassava chips in the Chinese market has continued its downward trend since 2023. This significant drop in cassava chip imports is largely due to reduced demand from Chinese cassava processing plants. Additionally, low corn prices have led many factories to substitute cassava chips with corn.

This situation has created challenges for Vietnamese cassava processing and manufacturing plants. Despite being in the harvest season, many cassava factories plan to halt operations earlier than usual. Meanwhile, across the country, the estimated cassava cultivation area for the 2024-2025 season is over 10% higher than the previous season (2023-2024), and there is still a large amount of fresh cassava to be harvested. As a result, some cassava will likely be turned into chips or left to grow for the next season.

Given the difficulties faced by the cassava industry, the Ministry of Agriculture and Environment has approved the Project for Sustainable Development of the Cassava Sector by 2030, with a vision towards 2050. The project aims for a fresh cassava production of 11.5 – 12.5 million tons by 2030; 40-50% of the cassava cultivation area will use quality standard seeds, and 50% will adopt sustainable cultivation processes. By 2030, the goal is to achieve an export turnover of $1.8 – $2 billion for cassava and cassava products.