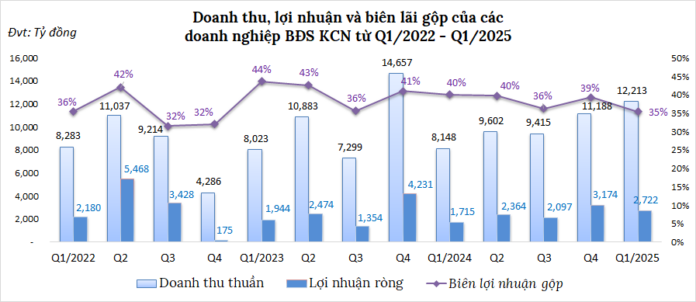

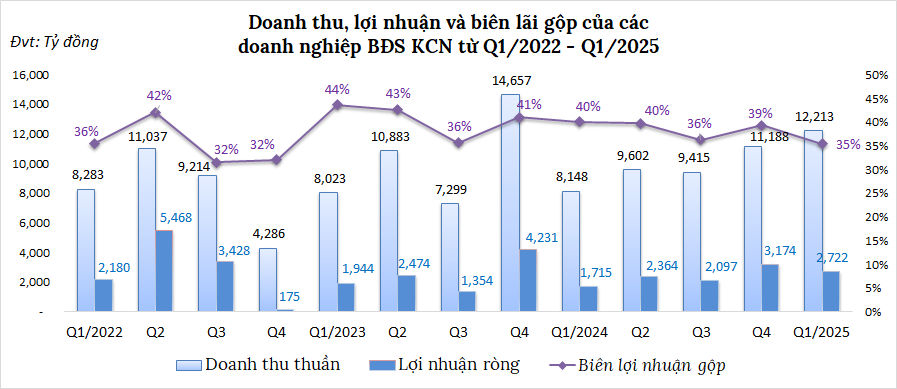

According to the financial statements for the first quarter of 2025 published by 27 industrial real estate businesses listed on the stock exchange (HOSE, HNX, UPCoM), total revenue exceeded VND 12.2 trillion, with a net profit of over VND 2.7 trillion. This marks a 50% and 59% increase in revenue and net profit, respectively, compared to the same period last year. However, compared to the previous quarter (Q4 2024), net profit decreased by 14%. The gross profit margin for this quarter was 35%, the lowest in two years.

Source: VietstockFinance

|

Temporary Victories

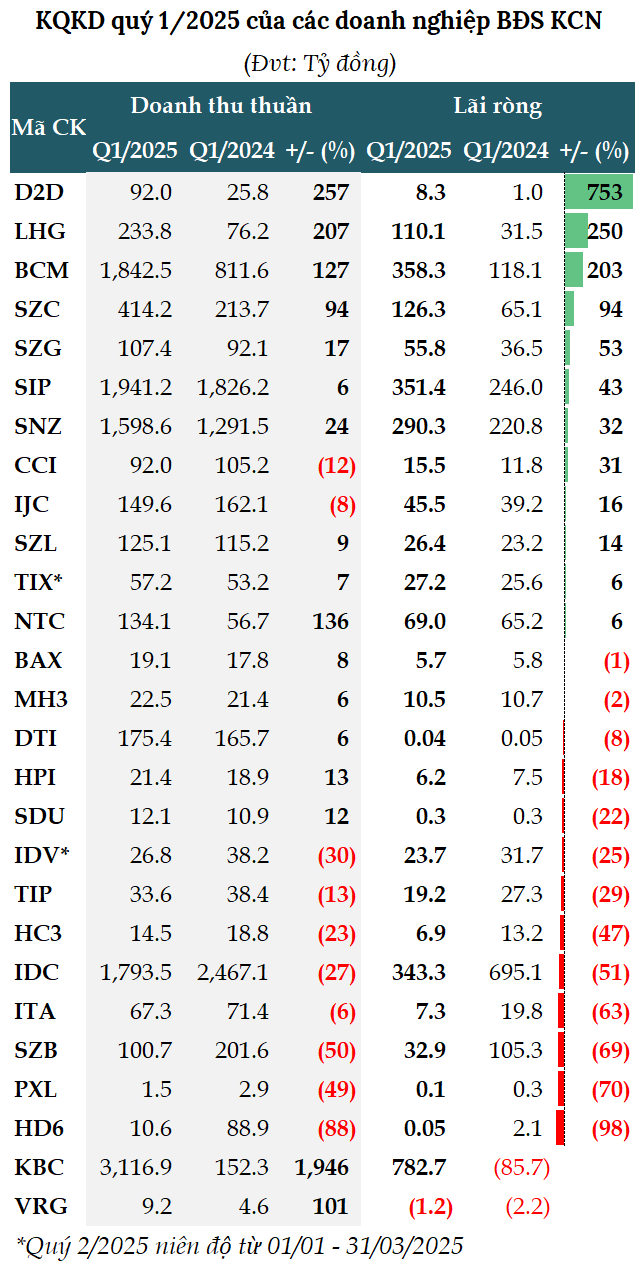

In the first quarter, 12 out of 27 businesses experienced profit growth, 13 had decreasing profits, 1 turned a loss into a profit, and 1 continued to incur losses. Notably, three companies achieved growth rates of over 300%.

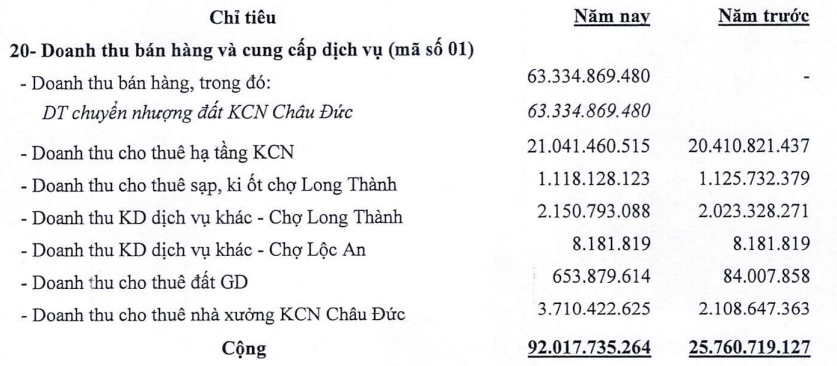

Leading the pack is the Industrial Urban Development Joint Stock Company No. 2 (HOSE: D2D) with an after-tax profit of over VND 8 billion, an impressive 8.5 times higher than the same period last year. This remarkable performance is attributed to their successful land transfer deal in Chau Duc Industrial Park. D2D has consecutively led the industry in profit growth rate for the past two quarters.

|

Breakdown of D2D’s revenue structure for the first quarter of 2025

Source: D2D

|

Long Hau Corporation (HOSE: LHG) reported a net profit of over VND 110 billion, a 3.5-fold increase compared to the previous year, thanks to a significant rise in revenue from leasing developed land and custom-built factories. This is the first quarter since Q3 2021 that Long Hau has achieved a profit of over VND 100 billion.

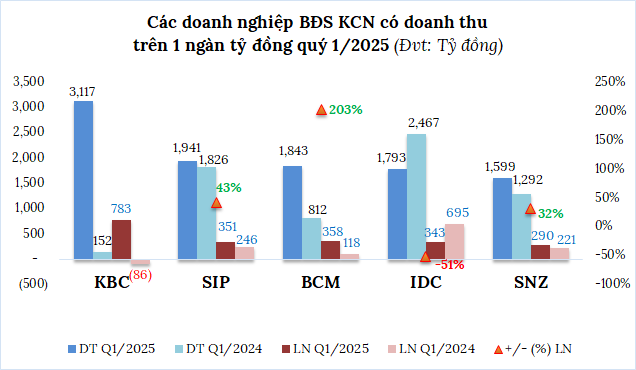

Becamex IDC Corporation (HOSE: BCM), a major industrial park developer in Binh Duong, commenced 2025 with a net profit of more than VND 358 billion, triple the amount from the same period last year. This impressive performance is mainly driven by robust growth in real estate revenue, profits from cooperation contracts, dividends, and earnings from affiliated companies.

Notably, Kinh Bac City Development Holding Corporation (HOSE: KBC) recorded a profit of nearly VND 783 billion, a remarkable turnaround from a loss of nearly VND 86 billion in the same period last year. KBC also boasts the highest profit in the industry this quarter.

Other companies that demonstrated positive results include Sonadezi Chau Duc (HOSE: SZC) with an after-tax profit of VND 126 billion, a 94% increase, and Saigon VRG Investment Joint Stock Company (HOSE: SIP) with a profit of over VND 351 billion, up by 43%.

Source: VietStockFinance

|

Ongoing Challenges

Despite these success stories, many businesses continue to face challenges, especially those that have not secured new contracts or are entangled in legal issues.

A typical example is the Vietnam Rubber Industrial Urban and Development Joint Stock Company (UPCoM: VRG), which incurred a loss of over VND 1 billion, improving from a loss of over VND 2 billion in the same period last year. VRG shared that they have not signed any new land lease contracts in the first quarter. The company’s revenue mainly comes from old contracts, with income recognized over multiple years.

Tan Tao Investment and Industry Corporation (UPCoM: ITA) managed to turn a profit of over VND 7 billion, down by 63%, thanks to other income of over VND 13 billion, nine times higher than the previous year. However, the company is still facing challenges in finding an auditing firm and dealing with the suspension of its stock trading.

IDICO, a major industrial park developer in the North (HNX: IDC), witnessed a 51% decline in net profit for the first quarter of 2025, amounting to over VND 343 billion. This decrease is attributed to a significant drop in revenue from leasing industrial infrastructure.

Source: VietstockFinance

|

Diverging Business Plans for 2025

Despite the promising industry-wide performance in the first quarter, many businesses remain cautious in their business plans for 2025.

Specifically, SIP targets consolidated revenue of VND 5,657 billion and after-tax profit of nearly VND 833 billion, representing decreases of 33% and 35%, respectively, compared to 2024. The company plans to lease out 45 hectares of industrial land and nearly 26,000 square meters of factory space this year.

Similarly, IDICO sets consolidated revenue and pre-tax profit targets of VND 8,918 billion and VND 2,596 billion, respectively, reflecting a 1% and 13% decrease compared to the previous year. Their plan includes leasing 123.5 hectares of industrial land infrastructure and 33,300 square meters of factory space.

Sonadezi (UPCoM: SNZ) forecasts a 13% decline in profit to over VND 1,400 billion, despite an 8% increase in total revenue to over VND 6,680 billion. Meanwhile, its sister company, SZC, aims for a 2% increase in revenue to nearly VND 931 billion and strives to maintain last year’s profit of VND 302 billion.

On the other hand, BCM sets optimistic goals for 2025, targeting consolidated revenue of VND 9,500 billion, a 29% increase, and a net profit of VND 2,470 billion, a 3% rise. The company plans to commence the expansion of Bau Bang Industrial Park Phase 2 (380 hectares) and Cay Truong Industrial Park (700 hectares), thereby increasing the land bank available for lease in Binh Duong. ITA aims for revenue of over VND 771 billion and a net profit of nearly VND 234 billion, double that of the previous year.

Notably, KBC, a leading industrial park developer in Northern Vietnam, sets ambitious goals for 2025, with consolidated revenue of VND 10,000 billion and a net profit of VND 3,200 billion, representing a threefold and sevenfold increase, respectively, compared to the previous year. The company plans to lease out more than 200 hectares of industrial land this year, of which over 30% of the target has already been achieved in the first quarter.

Limited Impact of Tariff Changes So Far

During the 2025 Annual General Meeting of Shareholders, several company leaders discussed the industry’s prospects in light of the new tax policies announced by the US in early April 2025.

Mr. Dang Chinh Trung, General Director of IDC, mentioned that global tariff changes are influencing the psychology of foreign investors. Some potential partners have become more cautious during negotiations, although existing contracts continue to be implemented.

Mr. Tran Manh Hung, Chairman of SIP, shared his perspective: for businesses solely engaged in land leasing and one-time revenue recognition, the impact could be significant. However, he believes that the substantial proportion of revenue from utility services will help SIP maintain stability, and the risk to the company is not substantial.

Mr. Ho Duc Thanh, General Director of D2D, offers a more positive outlook, anticipating a potential increase in industrial land rental rates due to limited supply and stable high demand. He expects that international fluctuations will attract investment flows from businesses seeking alternative destinations to China.

Thanh Tu

– 12:00, May 12, 2025

The Cement Industry’s Grey Outlook: Can Public Investment Turn Things Around?

The cement industry painted a grim picture in Q1 of 2025, with only a handful of businesses emerging from the red. However, with a boost in public investment and improving market demand, there’s a glimmer of hope on the horizon.

The Unpredictable Real Estate Market: Experts Outline 3 Potential Scenarios for Q2

The real estate market is currently in a state of cautious observation and anticipation, making it challenging to predict its trajectory. Experts forecast three potential scenarios for the industry’s growth in the second quarter of 2025.

“VNDIRECT Research: Cautiously Awaiting the Outcome of Vietnam-US Trade Talks”

VNDIRECT Securities Analysis Unit (VNDIRECT Research) forecasts that the VN-Index will fluctuate between 1,230 and 1,520 points by the end of 2025, depending on three main scenarios. The outcome will hinge on the trade negotiations between the US and Vietnam, the number of Fed rate cuts, the State Bank’s interest rate management, and the results of the FTSE’s market classification review in September.