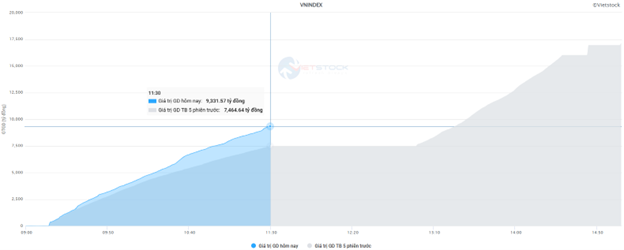

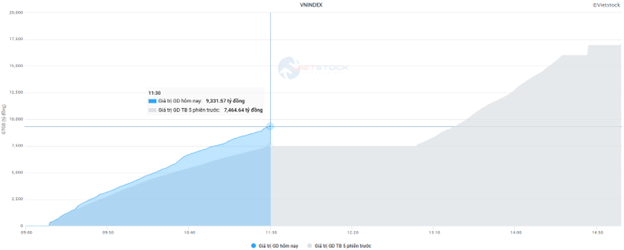

Large-cap stocks dominated today’s market activity, resulting in improved liquidity. The VN-Index trading volume exceeded 388 million units, equivalent to a value of over 9.3 trillion VND, a 25% increase from last week’s average. The HNX exchange recorded a matching volume of nearly 28 million units, with a value of over 396 billion VND.

Source: VietstockFinance

|

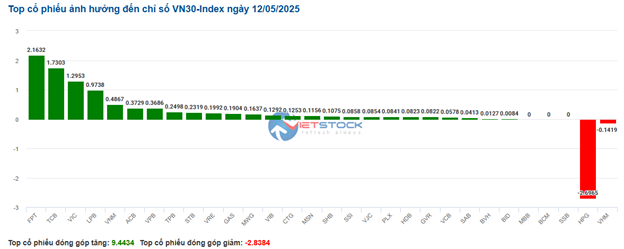

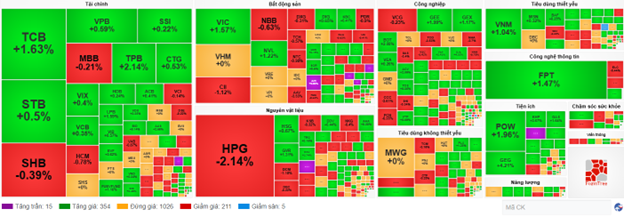

TCB, VIC, GVR, and FPT were the top performers, contributing over 5.5 points to the VN-Index surge. On the other hand, HPG posed the most significant hindrance during the morning session, erasing nearly one point, while the remaining stocks had a negligible impact.

The majority of sectors remained in the green. The technology sector took the lead, driven by the strong performance of FPT (+1.9%), CMG (+1.04%), SMT (+7.95%), and HPT (+6.55%), resulting in a nearly 2% sector gain. This was followed by utilities and consumer staples, with notable gains in GEG (+4.53%), GAS (+1.64%), POW (+0.78%), TTA (+6.76%), PPC (+1.99%); VNM (+0.87%), MCH (+3.76%), PAN (+1.28%), and SEA (+3%), among others.

Several large-cap stocks made a strong comeback, positively influencing the market. These included TCB (+4.71%), TPB (+2.85%), LPB (+1.45%), VIB (+1.14%), SGB (+1.59%), and VBB (+1.04%).

In contrast, the telecommunications sector witnessed a decline due to the performance of large-cap stocks such as VGI (-0.99%), CTR (-0.11%), VNZ (-1.78%), ELC (-0.44%), and TTN (-1.16%). However, stocks like FOX (+1.55%), FOC (+4.61%), and MFS (+0.95%) posted impressive gains. Similarly, the healthcare sector experienced a slight dip due to substantial selling pressure on the large-cap stock DHG (-1.7%).

10:30 am: Leaning Towards an Uptrend, GEG Tests July 2024 Highs

Buyers maintained their stronghold, keeping the major indices in positive territory. As of 10:30 am, the VN-Index gained 7.3 points, hovering around 1,271 points. The HNX-Index rose by 0.84 points, trading at around 214 points.

Among the VN30 basket, the number of stocks in the green outnumbered those in the red. Notably, four stocks, FPT, TCB, VIC, and LPB, contributed 2.16 points, 1.73 points, 1.29 points, and 0.97 points, respectively, to the VN30 index. On the flip side, only two stocks, HPG and VNM, faced selling pressure, dragging the index down by more than 2.8 points.

Source: VietstockFinance

|

The information technology sector stood out with a prominent green hue from the start of the session. Specifically, FPT rose by 1.55%, CMG by 0.45%, SMT by 7.95%, and HPT by 6.99%, while the rest remained unchanged or faced minor selling pressure, such as ITD, which declined by 2.17%.

Following closely was the utilities sector, which also contributed to the market’s upward momentum. Most stocks in this sector traded in positive territory, including GAS, which climbed by 1.64%, REE by 0.15%, POW by 1.96%, and GEG by 4.21%. Additionally, from a technical analysis perspective, GEG‘s share price surged during the morning session on May 12, 2025, testing its July 2024 highs (around the 16,000-16,400 range). The MACD indicator consistently formed higher highs and higher lows, suggesting a positive mid-term outlook. However, the Stochastic Oscillator entered the overbought zone, indicating the potential for short-term corrections if it signals a sell-off and exits this zone.

Source: https://stockchart.vietstock.vn/

|

Meanwhile, the telecommunications sector presented a mixed picture, with stocks like VGI falling by 0.42%, CTR by 0.32%, SGT by 0.85%, and ELC by 0.44%.

Compared to the opening, the market remained somewhat mixed, with over 1,000 stocks unchanged and buyers holding a slight edge. There were more than 350 advancing stocks and over 210 declining stocks.

Source: VietstockFinance

|

Opening: Extending Recovery in the Morning Session

On May 12, at 9:30 am, the VN-Index surged, reaching 1,277.28 points. Meanwhile, the HNX-Index also edged higher, climbing to 215.59 points.

The VN30 basket leaned towards the bullish side, with 25 stocks advancing and 5 remaining unchanged. Specifically, VIC, GAS, TCB, and LPB were the top gainers.

As of 9:30 am, the information technology sector was the most significant contributor to the market’s positive sentiment, with stocks like FPT rising by 1.38%, CMG by 0.59%, ITD by 4.35%, and CMT by 3.7%.

Following closely was the industrial sector, where most stocks traded in the green territory, including ACV, which climbed by 2.51%, HVN by 1.01%, VJC by 0.22%, GMD by 0.75%, and VTP by 0.61%.

– 11:55, May 12, 2025

Stock Market Insights: VN-Index Rebounds but Short-Term Risks Linger

The VN-Index concluded the week with a substantial surge of 41 points, successfully breaching the 200-week SMA since the index plummeted below this critical level in early April 2025. Accompanying this impressive recovery was a trading volume that surpassed the 20-day average, indicating a positive shift in market participation. Nonetheless, the MACD indicator continues to flash a sell signal, lingering below zero. This suggests that risks remain latent in the market. Investors are advised to exercise caution in the coming period should this trend persist.