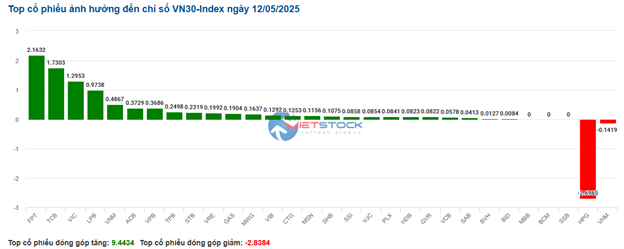

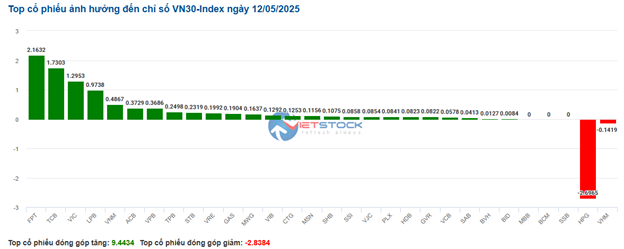

The number of stocks in the VN30 basket leaned towards the green side. Notably, four stocks, FPT, TCB, VIC, and LPB, stood out with respective contributions of 2.16 points, 1.73 points, 1.29 points, and 0.97 points to the VN30 index. On the flip side, only two stocks, HPG and VNM, faced selling pressure, dragging the index down by over 2.8 points.

Source: VietstockFinance

|

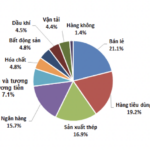

Information technology stocks painted a bright picture from the start of the session. Specifically, FPT rose by 1.55%, CMG climbed by 0.45%, SMT surged by 7.95%, and HPT jumped by 6.99%… The remaining stocks remained unchanged, except for ITD, which faced slight selling pressure, falling by 2.17%.

Following suit, utility stocks also contributed to the market’s overall upward momentum, with most stocks in the sector ending in positive territory. GAS led the gains, rising by 1.64%, followed by REE (+0.15%), POW (+1.96%), and GEG (+4.21%) … Additionally, from a technical analysis perspective, GEG stock price surged during the morning session of May 12, 2025, testing its previous high from July 2024 (around 16,000-16,400). Meanwhile, the MACD indicator continued to form higher highs and higher lows, indicating a bullish outlook in the medium term. However, the Stochastic Oscillator has entered the overbought territory, suggesting a potential short-term correction if it gives a sell signal and falls below this level.

Source: https://stockchart.vietstock.vn/

|

Meanwhile, the telecommunications sector presented a mixed picture, with some stocks declining, including VGI (-0.42%), CTR (-0.32%), SGT (-0.85%), and ELC (-0.44%) …

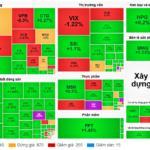

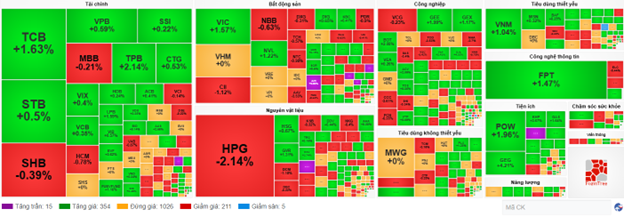

Compared to the opening, the market remained somewhat divided, with over 1,000 stocks unchanged and a slight advantage for the buying side. There were more than 350 gainers and over 210 losers.

Source: VietstockFinance

|

Opening: Continuing the recovery momentum this morning

As of 9:30 am on May 12, the VN-Index rose sharply to 1,277.28 points. Meanwhile, the HNX-Index also edged higher to 215.59 points.

The VN30 basket tilted towards the green side, with 25 stocks advancing and 5 remaining unchanged. Specifically, VIC, GAS, TCB, and LPB were the top gainers.

As of 9:30 am, the information technology sector was the most significant positive contributor to the market, with notable gainers including FPT (+1.38%), CMG (+0.59%), ITD (+4.35%), and CMT (+3.7%) …

Following closely was the industrials sector, with most stocks in the group trading in positive territory from the start of the session: ACV (+2.51%), HVN (+1.01%), VJC (+0.22%), GMD (+0.75%), and VTP (+0.61%) …

– 10:30 am, May 12, 2025

Stock Market Insights: VN-Index Rebounds but Short-Term Risks Linger

The VN-Index concluded the week with a substantial surge of 41 points, successfully breaching the 200-week SMA since the index plummeted below this critical level in early April 2025. Accompanying this impressive recovery was a trading volume that surpassed the 20-day average, indicating a positive shift in market participation. Nonetheless, the MACD indicator continues to flash a sell signal, lingering below zero. This suggests that risks remain latent in the market. Investors are advised to exercise caution in the coming period should this trend persist.

The Foreign Block: A Surprising $1.3 Billion Net Buy Last Week

Foreign investors bought a net amount of 1,260.7 billion VND, with a net buy of 1,168.4 billion VND in matched orders. The key foreign net buys on the matched orders were in the Real Estate and Basic Resources sectors.

Market Beat: KRX Listing and AGM Season Spur VN-Index to Afternoon Rally

The afternoon session witnessed a remarkable rebound, with the market closing on April 24th at 1,223.35, a gain of 12.35 points. The UPCoM followed suit, ending the day up 0.17 points at 91.63. However, the HNX-Index remained in the red, dropping 0.38 points to 211.07. The momentum from the AGM season and the KRX’s launch date announcement contributed to the index’s positive performance.