According to the April activity report, Pyn Elite Fund stated that the Vietnamese stock market recovered in the latter half of the month after a sharp decline at the beginning due to tax policy concerns. The recovery momentum was driven by the postponement of tax imposition and the optimistic Q1 financial results of many enterprises.

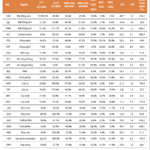

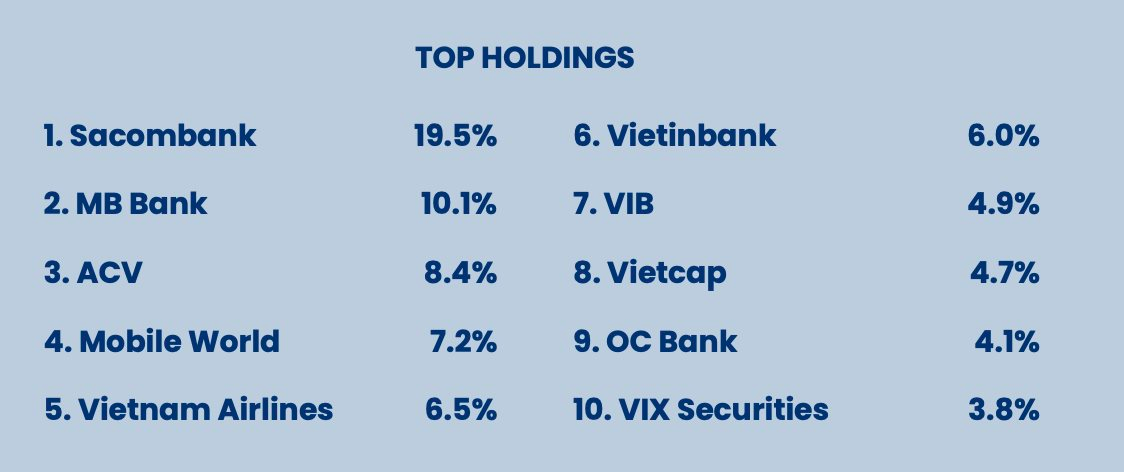

The VN-Index fell by 6.2% in April, but the fund’s investment performance only decreased by 4.5%, supported by the gains in HVN, STB, and MWG stocks. Pyn Elite Fund emphasized that 96% of the fund’s portfolio focuses on industries serving the domestic market, thus being less directly impacted by tariff-related risks.

Pyn Elite Fund viewed the recent adjustment as an opportunity to accumulate more stocks with solid fundamentals and attractive valuations. The fund remarked that most listed companies maintain optimistic growth targets, reflecting their confidence in the resilience of the Vietnamese economy.

A notable investment in Pyn Elite Fund’s portfolio is The Gioi Di Dong (MWG stock). This stock re-entered the fund’s top 10 holdings last month with a modest weight of about 4%, ranking 10th. By the end of April, MWG’s weight had increased to 7.2% of the fund’s portfolio, ranking 4th among the largest investments.

Another noteworthy point is the appearance of VIX stock in place of DNSE (DSE stock). However, this change does not necessarily imply that the fund bought more VIX stock or sold DSE. The variation could be due to the fact that VIX stock remained almost unchanged, while DSE stock fell by 12% in April.

Additionally, Pyn Elite Fund mentioned accumulating another securities stock, SHS, during the recent adjustment. According to the fund, SHS is known for its proprietary trading strategy focused on stocks. In terms of valuation, SHS stock is currently trading at 0.9 times P/B, which, according to Pyn Elite, is significantly lower than the industry average of around 1.8 times.

Positive Macroeconomic Developments

On the macroeconomic front, Pyn Elite Fund assessed that the context is evolving positively, with Vietnam officially starting trade negotiations with the US on May 7. The economy continues to exhibit strong recovery, with an 11.1% year-over-year increase in retail revenue, a 20% surge in exports, and an 8.9% rise in industrial production. FDI disbursement also increased by 7.9% due to the long-term commitment of global electronics manufacturers.

With enhanced public investment, several supportive policies have been announced, such as the proposal to extend the VAT reduction until 2026. Additionally, the Central Executive Committee issued Resolution 68 on private economic development, introducing reforms, incentives, and tax cuts to boost this sector’s growth to 10-12% annually by 2030.

Furthermore, the new trading system (KRX) successfully commenced operations on May 5, marking a significant step forward in modernizing Vietnam’s stock market. This system paves the way for new features such as central counterparty clearing (CCP) and intraday trading.

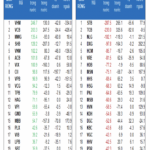

The Ultimate List of Stocks: Unveiling Steady Performers with Stellar Growth and Unique Stories

Based on the Q1/2025 financial results, our team of expert analysts has meticulously curated a list of stocks that showcase robust performance, sustained growth, and unique narratives.

Market Beat: Blue-Chip Stocks Keep VN-Index in the Green

The major indices remained in the green territory towards the end of the morning session. By lunch break, the VN-Index posted a gain of 7.62 points, reaching 1,274.92. Meanwhile, the HNX-Index edged slightly lower, settling at 214.42. Market breadth was positive, with 368 advancers outweighing 265 decliners.

Stock Market Insights: VN-Index Rebounds but Short-Term Risks Linger

The VN-Index concluded the week with a substantial surge of 41 points, successfully breaching the 200-week SMA since the index plummeted below this critical level in early April 2025. Accompanying this impressive recovery was a trading volume that surpassed the 20-day average, indicating a positive shift in market participation. Nonetheless, the MACD indicator continues to flash a sell signal, lingering below zero. This suggests that risks remain latent in the market. Investors are advised to exercise caution in the coming period should this trend persist.