CTCP Bất động sản Thế Kỷ (Cen Land) Reports First Quarter Financial Results for 2025

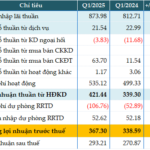

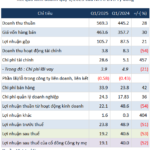

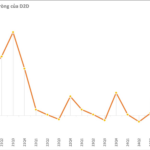

Cen Land, listed on the Ho Chi Minh Stock Exchange (HOSE: CRE), has released its consolidated financial statements for the first quarter of 2025, reporting a net revenue of 154.3 billion VND, a 68.7% decrease compared to the same period last year.

After deducting expenses, the company’s net profit stood at 3.1 billion VND, a 60.9% drop from the previous year’s profit of nearly 8 billion VND.

According to Cen Land, the real estate market showed positive signs in the first quarter of 2025, with an increase in transaction volume. However, some of the company’s projects did not generate brokerage revenue during this period.

Additionally, the lack of secondary project launches contributed to a decline in both revenue and net profit for the first quarter of 2025 compared to the same period last year.

As of the end of the first quarter, total assets amounted to over 7,289 billion VND, a slight increase of 109 billion VND from the beginning of the year. Short-term receivables stood at nearly 3,608 billion VND, accounting for 49.5% of total assets, while long-term receivables were at 2,532 billion VND, representing 34.7% of total assets.

The company’s inventory levels rose by 6% to 375.8 billion VND, including 373 billion VND worth of real estate inventory, consisting of apartments and land lots purchased from developers for resale purposes.

For the full year 2025, Cen Land aims to achieve a net revenue of 4,150 billion VND and a pre-tax profit of 300 billion VND, representing growth rates of 170% and 424%, respectively, compared to 2024.

Currently, Cen Land is one of the top-performing sales agents for MIK Group. The company aims to lead in sales for prominent developers such as Vinhomes (Vingroup), MIK Group, Sun Group, and Masterise, while maintaining relationships with strategic investors like Gamuda, CapitaLand, and Sovico.

Cen Land focuses on developing social housing projects to boost revenue in 2026

Cen Land shared its plans to focus on developing social housing projects, targeting an increase in revenue for 2026. During the General Meeting, Mr. Pham Thanh Hung, Vice Chairman of the Board of Directors of CenLand, stated, “CenLand has received numerous proposals from local authorities regarding land plots for social housing development.”

Furthermore, CenLand announced its intention to establish a college offering a Real Estate Business Administration program, including specializations in brokerage, project management, and appraisal, among others.

The Cement Industry’s Performance in Q1 of 2025: A Comprehensive Overview.

In the first quarter of 2025, several cement companies witnessed an increase in revenue, yet they reported net losses amounting to billions of Dong.

“Boosting Pre-Tax Profits: Bac A Bank’s Strategic Focus Yields 8% Growth in Q1”

“Bac A Bank, a leading joint-stock commercial bank in Vietnam, has announced its consolidated profit for the first quarter of 2025. The bank reported a remarkable consolidated profit of over VND 367 billion, reflecting an impressive 8% increase compared to the same period last year. This significant growth showcases the bank’s strong performance and continued financial success.”

A Real Estate Company Prepares to Dish Out an 84% Cash Dividend in May

In the first quarter of 2025, the company witnessed a remarkable surge in profit, with a 707% increase in PAT reaching $10.5 billion, compared to the same period last year.