A Glimmer of Hope for Small Businesses

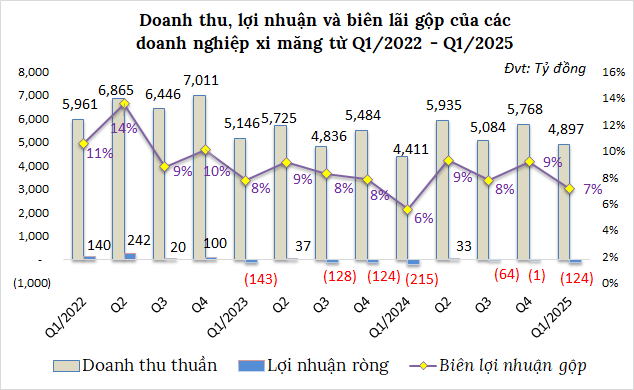

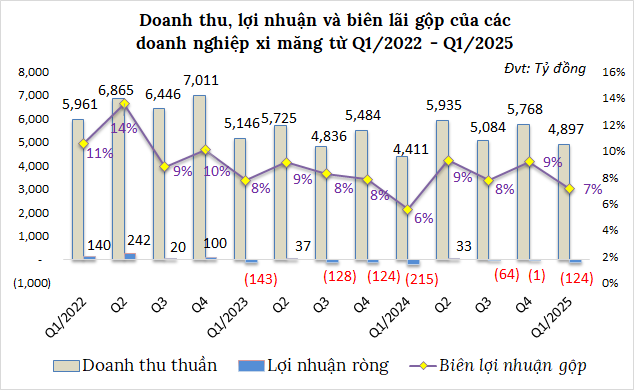

According to statistics from VietstockFinance, the cement industry is still weathering a storm. The 17 listed cement companies on the stock exchange that published financial statements from Q1/2022 to Q1/2025 show a total net loss of 124 billion VND in the first three months of this year, although this is an improvement from the 215 billion VND loss in the same period last year.

Source: VietstockFinance

|

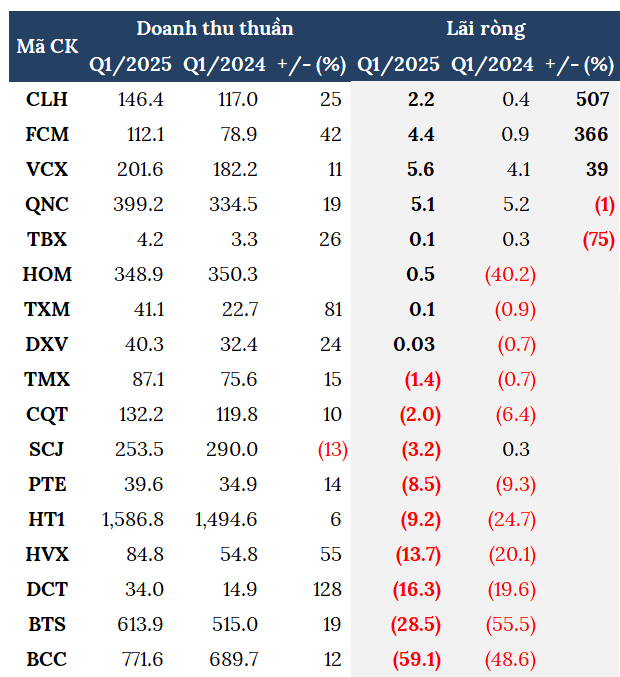

Amid this gloomy picture, a few small businesses shine through. Notably, La Hien Cement VVMI (HNX: CLH) stands out with a profit of over 2 billion VND, a sixfold increase from the previous year, thanks to improved sales volume.

The recovery of the real estate market has also benefited FECON Mineral JSC (HOSE: FCM), which posted a net profit of over 4 billion VND, 4.7 times higher than the previous year. Meanwhile, Yen Binh Cement (UPCoM: VCX) profited from reduced production costs, resulting in a 39% increase in profit to 6 billion VND.

Notably, VICEM Hoang Mai Cement (HNX: HOM), after two consecutive quarters of losses, turned a slight profit of over 500 million VND due to a revival in the Central market and cooling input material prices.

Large Corporations Still Struggling with Losses

In contrast to the positive signals from small and medium-sized enterprises, the cement industry’s giants are still grappling with losses.

|

Financial statements of cement enterprises in Q1/2025 (Unit: Billion VND)

Source: VietstockFinance

|

Topping this list is Bim Son Cement (HNX: BCC), which continues to lose nearly 60 billion VND, compared to a loss of nearly 49 billion VND in the same period last year. VICEM But Son Cement (HNX: BTS) extended its losing streak to the 10th quarter with a loss of nearly 29 billion VND.

Industry giant Vicem Ha Tien Cement (HOSE: HT1) also incurred a loss of over 9 billion VND. At the 2025 Annual General Meeting of Shareholders, Nguyen Quoc Thang, Member of the Board of Directors and General Director of HT1, stated that the first quarter usually sees low performance due to the Tet holiday, but the situation has improved significantly compared to the previous year (a loss of 25 billion VND).

Sai Son Cement (UPCoM: SCJ) also took a hit, turning from a profit to a loss of over 3 billion VND. The company attributed this to their efforts to reduce production costs, lower selling prices to clear inventory, and expand market reach, which ultimately affected profitability.

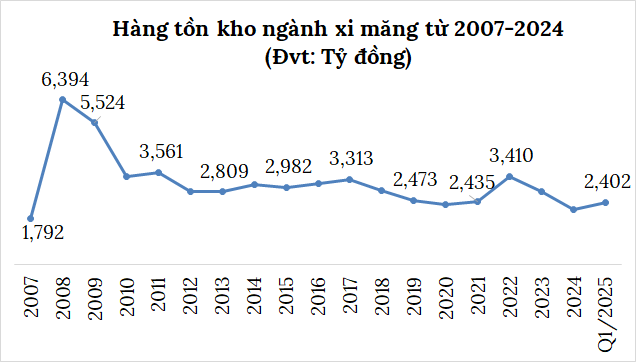

As of the end of the first quarter, the listed cement companies had a total inventory value of over 2,400 billion VND, a 12% increase from the beginning of the year. HT1 accounted for 26% of this, with 614 billion VND in inventory, a 5% decrease from the beginning of the year, representing 8% of total assets. HT1‘s finished goods inventory stood at over 255 billion VND, a 9% drop from the start of the year.

Source: VietstockFinance

|

Optimistic Plans, Hoping for a Turnaround in the Second Half of 2025?

Despite a lackluster start to the year, cement companies remain optimistic about their growth prospects for 2025.

HT1 aims for a challenging target, with revenue of over 7,162 billion VND, a 4% increase from 2024, and a net profit of 184 billion VND, triple the previous year’s figure. They plan to produce over 10 million tons of cement and clinker and sell nearly 6.4 million tons, representing increases of over 7% and 5%, respectively.

The General Director of HT1 believes that with the first quarter’s sales volume already at 19% of the annual plan and the second quarter being the peak season for the cement industry, strong growth is expected. The company is also implementing cost-cutting measures and improving operational efficiency. Their profit target for the second quarter is 123 billion VND, which, if achieved, will significantly boost their full-year performance.

BCC sets a target revenue of nearly 3,680 billion VND, a 6% increase, and a pre-tax profit of 2.4 billion VND, compared to a loss of over 8 billion VND last year. While they plan to produce over 2.8 million tons of clinker, they expect to sell only 354,000 tons.

But Son Cement aims to turn a profit of nearly 30 billion VND, compared to a loss of nearly 202 billion VND last year – the heaviest loss in over a decade. They plan to produce over 2.5 million tons of clinker but sell only 300,000 tons, striving to sell all of the expected 3 million tons of cement production this year.

Even Hoang Mai Cement, which lost nearly 70 billion VND in 2024, forecasts a profit of 15 billion VND this year. They aim to produce nearly 1.3 million tons of clinker and sell 170,000 tons, while selling all of the expected 1.6 million tons of self-produced cement.

A common strategy among these companies is to boost domestic consumption, take advantage of the wave of public investment, and tightly control operating costs.

Opportunities Arise from Public Investment and Market Potential

With public investment being strongly promoted, along with supportive macro and legal factors, construction and building materials enterprises, including the cement industry, are expected to benefit, especially in product consumption.

According to estimates by the Ministry of Construction, cement consumption in 2025 is expected to increase by about 2-3% compared to 2024, reaching 95-100 million tons. Domestic consumption is projected to range from 60-65 million tons, while exports are expected to reach 30-35 million tons.

Dr. Luong Duc Long, Vice Chairman and General Secretary of Vietnam Cement Association, shared his insights: “Public investment is being strongly promoted by the government, especially in infrastructure development and construction. The production and consumption of cement are still showing positive signals. However, the growth in cement consumption will become more apparent in the second half of 2025. The demand for cement in Vietnam has not yet peaked, and it is forecasted to reach its highest point between now and 2031. Therefore, there is still room for growth in cement production and consumption.”

However, external risks should not be overlooked. Mr. Dinh Quang Dung, Chairman of HT1, pointed out at the 2025 Annual General Meeting of Shareholders that tariff fluctuations from the US could indirectly impact Vietnam as Chinese cement diverts to Southeast Asia, intensifying competition. Additionally, disruptions in the global supply chain may affect raw material prices.

In conclusion, the cement industry is slowly recovering after a challenging period. Strategic adjustments, cost-cutting measures, and the wave of public investment may be the key to a turnaround this year. However, to return to their golden age, instead of mere optimism, cement companies need effective strategies and the ability to adapt to the increasingly fierce competition.

– 08:07 12/05/2025

“Nationwide Commemoration: 80 Mega Projects to Mark 80 Years of Independence”

On the recent 50th anniversary of the liberation of the South and the reunification of the country, 80 major and key projects and programs were inaugurated and launched nationwide. Similarly, on the upcoming 80th anniversary of National Day, the country will continue to inaugurate and launch another 80 significant projects and programs.

The Power of Investment: Unveiling a Bold Strategy with a Twist of Fate

The loss was attributed to a provision for diminution in value of investment securities of VND 41.3 billion and the sale of a portion of short-term investments at a loss.