The lingering effects of the trade war continue to pose challenges for monetary policymakers, with the Bank of England (BOE) opting to cut interest rates while the US Federal Reserve (Fed) maintains a cautious stance.

Here’s a roundup of key global economic developments from May 5 to May 11, 2025, curated by VnEconomy:

US-China Trade Negotiations Commence

The first face-to-face meeting between top trade negotiators from the US and China took place in Geneva, Switzerland, on Saturday (May 10). The roughly eight-hour-long meeting indicated a de-escalation effort by the world’s two largest economies after President Donald Trump imposed 145% tariffs on Chinese goods, prompting Beijing to retaliate with 125% tariffs on US products. According to sources, the meeting is expected to continue on Sunday and may extend into Monday (May 12).

Following the first day of talks, neither side issued any statements. However, Trump expressed optimism via a social media post, saying, “A very beautiful meeting with China, just now in Switzerland. Many good things are happening.”

US-UK Trade Deal Reached

The UK became the first country to secure a trade deal with the US since Trump announced countervailing duties in early April. As per the agreement announced on May 8, the UK can export up to 100,000 cars to the US annually at a 10% tariff rate, and any additional cars will be subject to a 25% tariff. British steel and aluminum manufacturers can export duty-free to the US, unlike their counterparts from other countries, who face a 25% tariff.

However, other UK exports to the US will still be subject to a 10% tariff—the base rate of the countervailing duty. In return, the UK will reduce tariffs on US imports, lowering the average rate from 5.1% to 1.8%. This includes a reduction in tariffs on US ethanol from 19% to 0%.

Following the announcement of the deal, US Commerce Secretary Howard Lutnick told Bloomberg that negotiations with Japan and South Korea could take longer than with the UK, as those countries have larger trade surpluses with the US. The UK is one of the few countries with a goods trade surplus with America.

UK and India Agree on Free Trade Agreement

In addition to the US trade deal, the UK also secured a free trade agreement (FTA) with India this week. As per the agreement, New Delhi will gradually reduce tariffs on imports from the UK, aiming for zero tariffs on almost all goods within a decade. In return, the UK will eliminate all tariffs on 99.1% of imports from India.

Fed Keeps Interest Rates Unchanged, Cautious about Easing

On Wednesday (May 7), the Fed announced it would keep the federal funds rate unchanged at 4.25-4.5%, aligning with earlier predictions by analysts regarding the central bank’s two-day monetary policy meeting.

At a press conference following the policy meeting, Fed Chair Jerome Powell stated that it was unclear whether the economy could sustain its growth momentum or succumb to the pressures of heightened uncertainty and a potential resurgence of inflation. Expectations for an early Fed rate cut diminished after the Fed’s statement and Powell’s remarks. Markets now anticipate the Fed to hold off on any rate changes until at least July.

BOE Cuts Interest Rates to Boost Growth

While the Fed appears more concerned about the inflationary impact of tariffs, the BOE seems worried about their effect on economic growth. On May 8, the BOE unexpectedly cut interest rates by 0.25 percentage points, bringing the benchmark rate down to 4.25%. This move went against the predictions of economic experts.

In its statement following the meeting, the BOE asserted that the US and other countries’ tariff increases would hurt the UK’s economic growth and push down inflation. However, they emphasized the unpredictability of the economic outlook. “The past few weeks have served as a reminder that the global economy can evolve in unexpected ways, which is why we need to maintain a measured and cautious approach as we consider any future reductions in Bank Rate,” remarked BOE Governor Andrew Baily after the meeting.

China Announces Monetary Stimulus Measures

On the eve of trade negotiations with the US, Beijing unveiled a series of monetary policy measures to bolster its economy. At a press conference on Wednesday (May 7), PBOC Governor Fan Gongsheng announced a 0.1 percentage point reduction in the seven-day reverse repo rate from 1.5% to 1.4%. This move is expected to lower the loan prime rate (LPR) – PBOC’s key policy rate – by around 0.1 percentage points, according to Mr. Fan.

Additionally, the PBOC will lower the reserve requirement ratio by 0.5 percentage points, injecting 1 trillion yuan (approximately $138.6 billion) in liquidity into the financial system.

The introduction of these growth-stimulating measures underscores Beijing’s urgency to revive its economy amid challenges posed by the trade war with the US, a protracted real estate crisis, and subdued consumer spending.

China’s Exports Surge, Surpassing Expectations

According to data released by the Chinese Customs on Friday (May 9), China’s exports in April 2025 rose by 8.1% year-over-year, significantly exceeding the 1.9% increase predicted by economists in a Reuters survey. Ahead of the implementation of US tariffs, Chinese manufacturers rushed to export goods, both to the US and other markets, resulting in stronger-than-expected export growth in March and April.

China’s exports to Southeast Asia in April surged by 20.8% year-over-year, up from an 11.6% increase in March. In contrast, exports to the US in April fell by 21%, leading to a decrease in China’s trade surplus with the US to $20.5 billion from $27.6 billion in March.

US Imports Hit Record High

US businesses ramped up imports ahead of the tariffs, causing March imports to soar to an all-time high. Data from the US Commerce Department on Tuesday (May 6) revealed that March imports rose by 4.4%, reaching an unprecedented $419 billion. Specifically, goods imports jumped by 5.4%, hitting a record $346.8 billion.

The US trade deficit, encompassing both goods and services, widened by 14% in March to $140.5 billion—another record high.

China Continues Gold Reserve Accumulation, Impacting Gold Prices

Data released by the People’s Bank of China (PBOC) on May 7 showed that the central bank’s gold reserves increased by approximately 70,000 ounces in April, marking the sixth consecutive month of gold purchases by the world’s most populous nation. Over the past six months of gold buying, the PBOC has added nearly 1 million ounces to its reserves, equivalent to roughly 30 tons of gold, as reported by Bloomberg.

The trend of central banks like the PBOC accumulating gold reserves continues to be a significant factor supporting gold prices. At the same time, easing trade tensions have lessened investors’ risk aversion. These opposing forces resulted in a volatile week for gold prices, with intraday swings of hundreds of dollars per ounce. Nonetheless, spot gold prices climbed 2.6% over the week.

Warren Buffett Announces Successor at Berkshire Hathaway

At the annual shareholder meeting, legendary investor Warren Buffett—aged 94 and serving as Chairman and CEO of Berkshire Hathaway—declared that this would be his last annual meeting in charge of the company. He also announced that Greg Abel would assume the role of CEO.

As Abel—aged 62—steps into this new role, he faces significant questions, including what he intends to do with Berkshire’s nearly $350 billion cash pile.

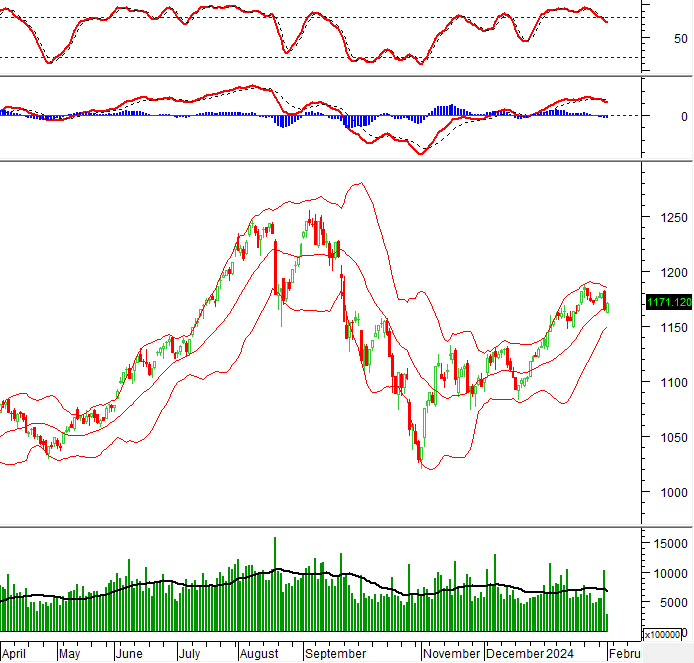

“SGI Capital: The “Haunting” 1200-Hour Mark Turns Supportive, Investors Should Stay Upbeat.”

“According to SGI Capital, the market valuation is significantly cheaper compared to past instances of 1200. Such low valuations are a prerequisite for ensuring low-risk, high-return potential.”

Silver Price Today: Rebounding Alongside Gold

The domestic and international silver prices rebounded, painting the town green after the previous session’s decline.