Based on the latest closing price (May 9) of VND25,900 per share, Biwelco is estimated to raise nearly VND184 billion from the sale of these shares.

On the stock market, VLW shares often lack liquidity. On average, only 123 VLW shares were traded daily since the beginning of 2025, and the lowest trading volume was just one share on February 11, 2025.

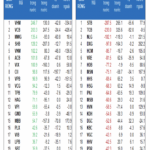

VLW shares had an average daily trading volume of just 123 shares in 2025 – Source: VietstockFinance

|

This large divestment by Biwelco comes as Vwaco is about to finalize the ex-dividend date of May 28 for its upcoming 2025 Annual General Meeting of Shareholders. The meeting is scheduled to be held on June 27 in Vinh Long province.

Currently, in addition to directly holding shares, several Biwelco executives also hold key positions at Vwaco. Specifically, General Director Van Kim Hung Phong and Board Member Tran Tan Duc are both Board Members of Vwaco, while Chief Accountant Nguyen Huu Binh is a member of Vwaco’s Supervisory Board.

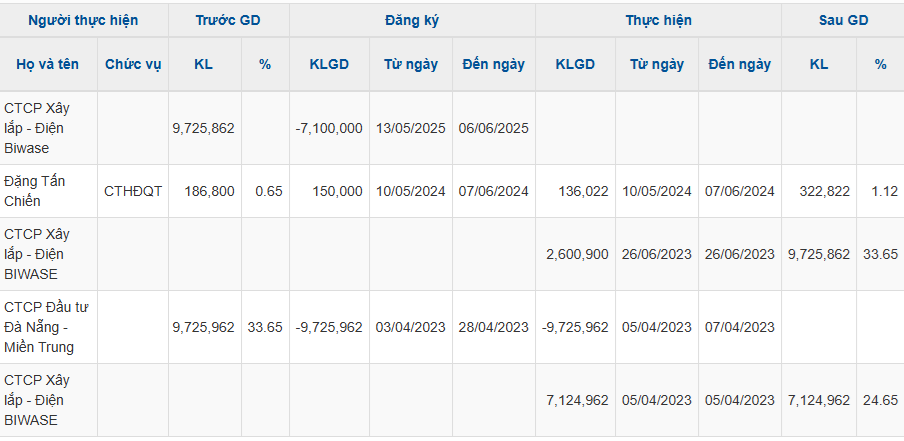

Biwelco officially held over 9.7 million Vwaco shares after purchasing more than 7.1 million shares on April 5, 2023, and an additional 2.6 million shares on June 26, 2023. Conversely, Danang – Central Investment Joint Stock Company divested over 9.7 million shares during the period of April 5-7, 2023.

Biwelco plans to sell its stake in Vwaco after two years of ownership – Source: VietstockFinance

|

Biwelco is actually a subsidiary of Binh Duong Water – Environment Joint Stock Company (Biwase, HOSE: BWE), which directly holds 52% of its capital. The purchase of Vwaco shares was one of Biwase’s notable deals in 2023 to bring additional affiliated companies under its umbrella, including DNP Quang Binh Water Infrastructure (now Biwase Quang Binh), Long An Water Supply and Drainage (LAW), Quang Binh Water Supply (NQB), and Thu Thua Urban Works.

– 13:00, May 12, 2025

Market Pulse May 12th: Bias to the Upside, GEG Tests July ’24 Highs

The buyers maintained their strong position, keeping the key indices in the green. As of 10:30 am, the VN-Index surged by 7.3 points, trading at around 1,271 points. Meanwhile, the HNX-Index climbed by 0.84 points, hovering around the 214-point mark.

The SGI Capital Fund is Now Near Capacity After a Long and Cautious Journey.

As of April, SGI Capital’s fund has been actively deploying capital, reducing its cash position to just 7.1%.

“VN-Index Extends Gains, Yet Liquidity Remains Constrained”

The VN-Index witnessed a robust surge, despite trading volume remaining below the 20-day average. This indicates cautious participation amidst the index’s approach towards the nearest resistance zone formed in mid-April 2025 (1,230-1,245 points). Should the positive momentum persist, coupled with a significant improvement in liquidity in upcoming sessions, a breakthrough from this zone is plausible. Notably, the MACD indicator continues to signal a buy, reinforcing the strengthening market trend.