Three Consecutive Profitable Quarters

According to the Q1/2025 financial report, Masan MEATLife, a member of the Masan Group (Stock Code: MSN), recorded a revenue of 2,070 billion VND, a 20.4% increase compared to the same period last year. This growth was driven by multiple positive factors across products, distribution channels, and branding strategies. The meat segment revenue increased by 22.5%, attributed to sustained high pork prices, significant growth in processed meat, and the expansion of the HORECA channel for chicken products. The livestock segment grew by 14.9%, mainly due to a 28.1% increase in the pork category. The chicken segment continues to be restructured according to long-term strategic orientations.

Notably, the collaboration with the WinCommerce retail system continues to bear fruit, with a 24.9% increase in average revenue per sales point compared to the previous year. Both fresh and processed meat segments recorded double-digit growth. In particular, the processed meat segment stood out with Ponnie and Heo Cao Bồi brands, achieving a total average monthly revenue of 240 billion VND.

Innovative products were a prominent highlight in the company’s quarterly business results. Accordingly, new product groups grew fivefold, contributing 28% to processed meat revenue—a significant increase from the previous year’s 7%. This reflects the strategic role of these products in expanding consumption and diversifying the company’s portfolio.

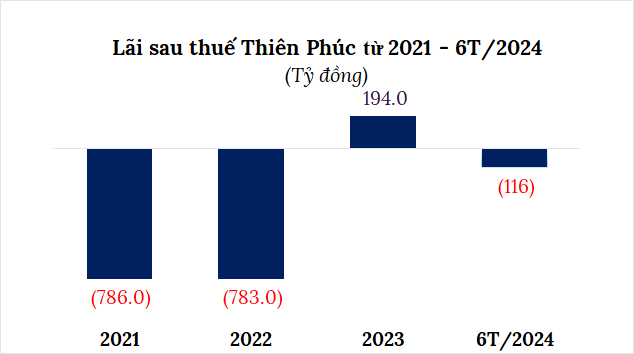

Wrapping up Q1/2025, MML achieved after-tax profit before minority interests of 116 billion VND, marking the third consecutive profitable quarter—a significant milestone in its journey towards sustainable growth.

Significant Long-Term Growth Opportunities

Vietnam is among the top ten pork-consuming countries globally. According to the OECD, domestic pork production is expected to reach 4 million tons by 2025 and further increase to 4.7 million tons by 2030, corresponding to an average annual growth rate of 3.1%.

Currently, domestic production meets approximately 95% of consumption demand, presenting a vast opportunity for the livestock industry’s development. However, the Vietnamese meat market remains largely unstandardized, with most products lacking clear branding. In contrast, consumers are increasingly prioritizing meat with transparent origins. MEATDeli—Masan MEATLife’s chilled meat brand—is pioneering the standardization trend, building consumer trust, and driving the sustainable development of Vietnam’s meat industry.

In recent years, the consumption of processed meat has accelerated in many large countries, including China. According to Frost & Sullivan, processed meat currently accounts for about 25% of total pork consumption in China and is growing twice as fast as fresh meat. This trend is expected to spread to Vietnam as incomes rise and the convenience of ready-to-eat foods becomes more prevalent.

Experts predict that processed meat will become the primary growth driver for the domestic meat industry, accounting for a larger proportion of total consumption. This presents an opportunity for businesses to expand their scale, develop value-added products, and enhance their competitiveness in the international market.

Seizing this trend, Masan MEATLife is asserting its position with strong brands like Heo Cao Bồi and Ponnie, a comprehensive distribution network spanning modern and traditional retail, Horeca, and wholesale channels, and agile product development capabilities to meet the increasingly diverse demands of consumers.

Aiming for $2 Billion in Revenue

At the 2025 Annual General Meeting of Shareholders held in April, Masan MEATLife’s leadership emphasized the company’s long-term strategy: a comprehensive shift towards a branded meat processing company and deeper collaboration with WCM. “In Q1/2025, branded meat products accounted for 56% of total sales in this category within the WCM chain. In the next phase, MML plans to work closely with WCM to introduce meat products to traditional retail channels through the WiN+ system, targeting the $2 billion opportunity,” the company representative shared.

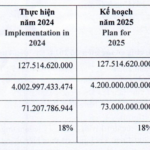

For 2025, MML sets a revenue target of 8,250-8,749 billion VND, an 8-14% increase from the previous year. The company remains focused on the processed meat segment, aiming for a 36-37% contribution to total revenue. The processed meat segment, with its high-value products, is the cornerstone of MML’s sustainable profitability. MML will also continuously optimize and enhance the value of each pig raised for meat to an average of 10 million VND, a ~10% increase from the previous year.

One of MML’s critical initiatives for 2025 is the implementation of “Meat Corners” in WinCommerce stores, aiming to increase the proportion of processed meat sales in the system from 16.6% to 20% in 2025 and towards 40% in the long term. The company is committed to transforming itself into a leading enterprise in branded meat and meat processing.

After years of challenging transformation, Masan MEATLife is now in the “harvest” phase. Three consecutive profitable quarters, double-digit growth, a clear product portfolio, and market leadership within the WinCommerce chain are strong testaments to the feasibility and sustainability of the branded meat model in Vietnam. With this foundation, MML is expected to pioneer a new chapter for Vietnam’s processed meat industry, completing the Masan Group’s consumer-retail ecosystem.

“Vietbank’s Q1 2025 Profit Soars: A Triple-Digit Surge in Core Income”

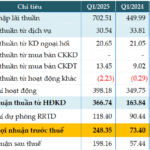

The consolidated financial statements for Q1 2025 reveal that Vietbank (VBB on UPCoM) recorded a remarkable performance with a pre-tax profit of over VND 248 billion, tripling its earnings from the previous year’s first quarter. This impressive growth is primarily attributed to the bank’s core income streams.

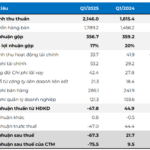

The Soaring Price of Coconuts: A ‘Coconut Tycoon’ Reports a Revenue of Nearly $40 Million but a 23% Drop in Profits

The profit margin of ACP has significantly decreased to 7.5%, a notable drop from the 12.63% enjoyed in 2023.