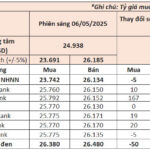

Gold prices ended last week on a positive note, with both domestic and global markets witnessing an upward trend. Specifically, international gold prices this morning (May 11th) stood at $3,323 per ounce, an increase of $83 from the opening price of $3,240 per ounce on Monday (May 5th).

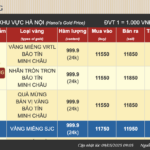

Meanwhile, in the domestic market, gold bars at Doji and SJC ended the week at VND 120-122 million per tael (buying-selling), an increase of VND 700,000 per tael on both sides compared to the beginning of the week. Similarly, gold ring prices also saw a hike of approximately VND 800,000 per tael.

What’s in store for gold prices this coming week? (Illustrative image: Cong Hieu)

A weekly survey of gold prices by Kitco News revealed a divided opinion among experts, with one-third predicting a rise in prices, one-third anticipating a decline, and the remaining one-third expecting prices to hold steady. Out of the 15 analysts surveyed, 5 (33%) believed gold prices would climb higher in the upcoming week.

In contrast, small investors remained optimistic about gold’s prospects, with 144 out of 267 participants in the Kitco online survey (54%) forecasting an upward trend, 77 (29%) expecting a decline, and 46 (17%) predicting stable prices.

Supporting the bullish outlook, experts cited the weakening US dollar and strong long-term demand from central banks and investors as key factors influencing the precious metal’s performance. Additionally, the complex monetary policy pressures faced by the Fed and the ongoing trade negotiations were not expected to be resolved quickly, creating a favorable environment for gold.

However, gold also faced several challenges. The primary catalyst for gold’s strong performance—economic uncertainty stemming from US import tariffs—had eased following successful trade agreements between the US and the UK, and more significantly, between the US and China.

On May 10th (local time), US President Donald Trump posted on the Truth Social media platform: ” We had a very good meeting with China in Switzerland. Many things were discussed and agreed upon. US-China trade relations are reset in a friendly and constructive manner. We want to see China open up to US business, for the benefit of both countries. Great progress has been made.”

Analysts suggested that the biggest short-term risk to gold prices lay in potential developments as President Donald Trump and his administration might conclude the trade war with China as negotiations progressed. This would create a less favorable environment for gold, and prices could find support at the $3,000 per ounce level.

Turning to the domestic market, Mr. Phan Dung Khanh, a financial expert, shared his insights on gold price movements. He noted that the gold market remained highly volatile and influenced by various economic and political factors worldwide.

He cautioned that investors seeking to profit from short-term price fluctuations (“surfing”) might face risks and uncertainties. Additionally, gold storage was not considered an investment channel but rather “dead money” and a safe haven in times of economic turmoil.

Economist Nguyen Tri Hieu offered a short-term prediction, stating that gold prices could dip as investors sold to secure profits. However, he remained bullish about gold’s long-term prospects, anticipating further price increases in 2025.

“Gold prices will fluctuate significantly, and there will be ups and downs, especially sharp declines when investors sell for profit-taking. But in the long term, I believe gold prices will continue to rise. Global gold prices could climb above $3,300, while domestic prices could reach the buying level of VND 125 million in 2025,” Mr. Hieu forecasted.

However, TS. Le Dang Doanh, former Director of the Central Institute for Economic Management, offered a different perspective, suggesting that gold prices could drop to the VND 110 million per tael range in the near future, while a decline to VND 100 million would be less likely.

Gold Prices Today, May 11th: Global Prices Dip, Domestic Prices Rise.

The global gold price witnessed a sharp decline on the morning of May 11, while domestic gold prices moved in the opposite direction, surprising many with a notable upward trend.

The Golden Rush: When Gold Prices Tumble

The gold market witnessed a dramatic turnaround on May 6th, with bullion prices plummeting by a staggering 1.1 million VND per tael during the afternoon session, following a sharp surge in the morning. This sudden reversal caught investors off guard, as the buy-sell spread widened significantly. However, gold jewelry prices remained resilient, showing no signs of fluctuation and maintaining their stability throughout the day’s volatile trading session.

The Golden Opportunity: Navigating the Dip in Gold Prices

In the past 24 hours, domestic gold bar prices have plummeted by over VND 3 million per tael, while gold ring prices have dropped by VND 2.5 million per tael.