The Q1 2025 financial results for the entire market as of May 5, 2025, showed overall growth compared to the same period last year, with a differentiation among industry sectors. However, the number of sectors with positive net profit growth decreased from Q4 2024, and the total net profit growth rate for the whole market recorded the lowest increase in the last six quarters.

Specifically, according to FiinTrade data as of May 9, 2025, Q1 2025 net profit increased by 11.8% year-on-year, lower than the previous quarters: Q1 2024 (+20.7%), Q2 2024 (+21.4%), Q3 2024 (+21%), and Q4 2024 (+20.9%).

The non-financial sector saw a decrease of 12.2% in net profit, while the financial sector slightly increased by 5.3%.

The following sectors recorded growth: Media (+14,361.4%), Retail (+74.5%), Real Estate (+59.3%), Utilities (+48.9%), Chemicals (+37.5%), Information Technology (+21.1%), Basic Resources (+19.8%), Insurance (+18.1%), Banking (+15.3%), Personal & Household Goods (+10.9%), Industrial Goods & Services (+9%), Construction & Materials (+8.7%), and Food & Beverage (+8.3%).

Sectors that experienced a decline include: Healthcare (-0.1%), Financial Services (-4.7%), Tourism & Entertainment (-17.5%), Automotive & Components (-19.1%), Telecommunications (-47.9%), and Oil & Gas (-56.5%). Thus, it can be observed that while Q1 2025 profits grew, the rate of increase slowed down, indicating that profits are stabilizing after several quarters of recovery from low bases.

By the end of Q1 2025, the VN-Index had only increased by nearly 3%, lower than the 13.5% rise in Q1 2024. Subsequently, it entered a strong correction phase of almost 20% in the first trading days of April, amid complex tariff issues and the US administration’s declaration of retaliatory tariffs on all trading partners worldwide.

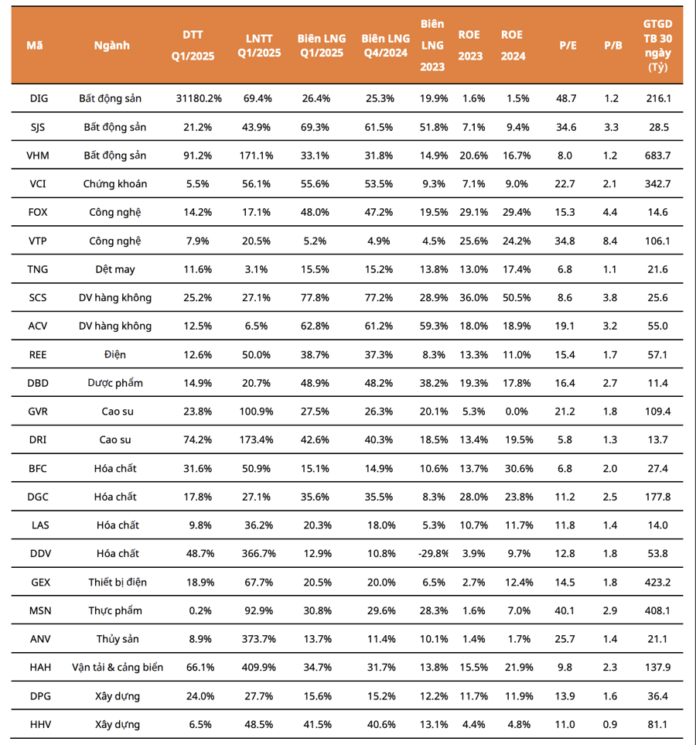

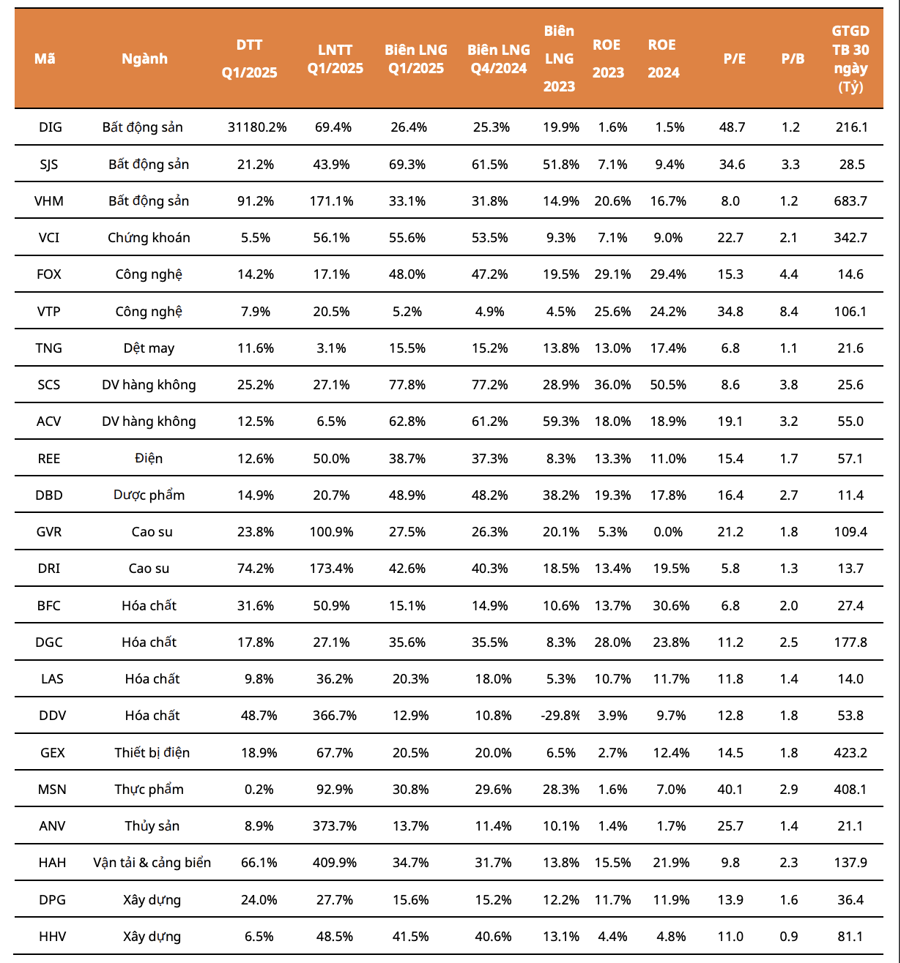

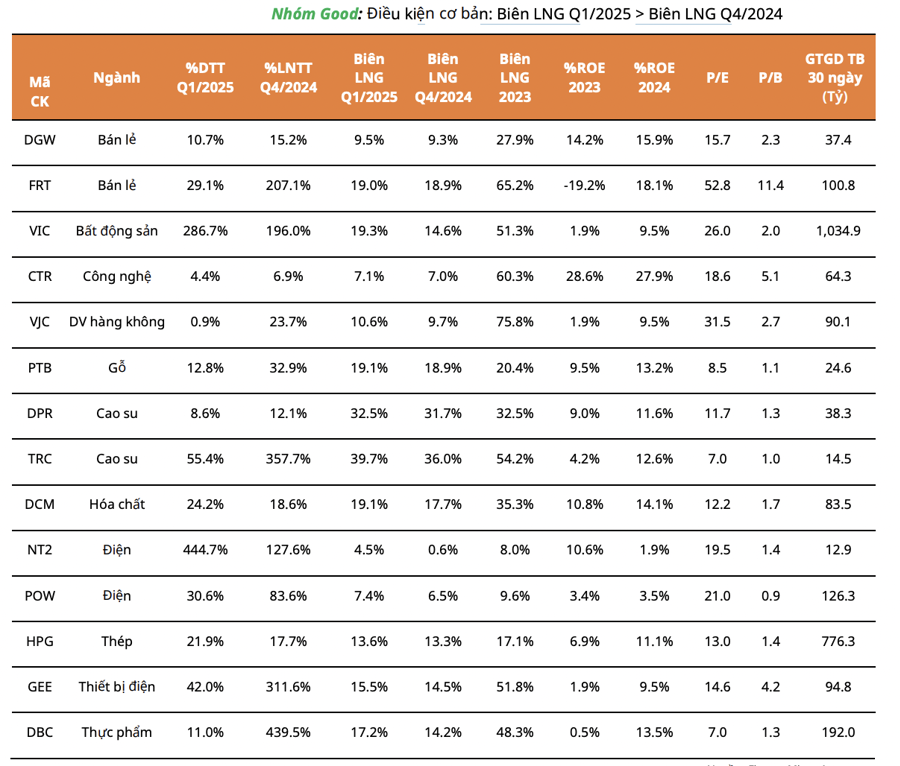

Based on the Q1 2025 financial results, Mirae Asset Securities proceeded to screen for stocks with stable performance, maintaining good growth, and having their own unique stories. The criteria were based on a combination of the SEPA stock-picking method by Mark Minervini and the Canslim investment approach by William O’Neil.

According to the selection results, essential sectors such as Food & Beverage and Electricity remain safe choices due to their stability. Particularly, the adjusted Power Plan 8 and the amended Electricity Law aim to create a more competitive electricity generation market, while electricity consumption is expected to continue growing in 2025.

Additionally, sectors with compelling stories and recovery prospects are suitable choices when they become attractively priced.

These include: Real Estate: Low-interest rates and the gradual resolution of legal issues for projects. The amended Real Estate Business Law and Construction Law, which took effect in early 2025, further boost the recovery.

Retail: The recovery of domestic and international consumer demand, along with the government’s policy to promote domestic consumption.

Fertilizers & Chemicals: The impact of tariff policies has led to a decrease in global crude oil prices, and gas prices tend to follow oil prices, which will positively affect the profit margins of chemical and fertilizer companies. Additionally, from July 1, 2025, fertilizers will be subject to a 5% VAT on output, allowing companies to refund input VAT, reduce production costs, and improve profit margins.

Rubber: Global supply shortages, combined with high rubber prices, resulted in a 31.4% increase in the average export rubber price in Q1 2025 compared to the same period last year.

Construction: With an 8% GDP growth target, the government will accelerate public investment disbursement, creating favorable prospects for the construction industry.

Mirae Asset has selected and evaluated stocks based on a comparison of gross profit margins between the latest two quarters and the previous year, focusing on revenue and profit growth. Another criterion is liquidity, ensuring a certain level of trading volume for the selected stocks.

Market Beat: Blue-Chip Stocks Keep VN-Index in the Green

The major indices remained in the green territory towards the end of the morning session. By lunch break, the VN-Index posted a gain of 7.62 points, reaching 1,274.92. Meanwhile, the HNX-Index edged slightly lower, settling at 214.42. Market breadth was positive, with 368 advancers outweighing 265 decliners.

Market Pulse May 12th: Bias to the Upside, GEG Tests July ’24 Highs

The buyers maintained their strong position, keeping the key indices in the green. As of 10:30 am, the VN-Index surged by 7.3 points, trading at around 1,271 points. Meanwhile, the HNX-Index climbed by 0.84 points, hovering around the 214-point mark.

Stock Market Insights: VN-Index Rebounds but Short-Term Risks Linger

The VN-Index concluded the week with a substantial surge of 41 points, successfully breaching the 200-week SMA since the index plummeted below this critical level in early April 2025. Accompanying this impressive recovery was a trading volume that surpassed the 20-day average, indicating a positive shift in market participation. Nonetheless, the MACD indicator continues to flash a sell signal, lingering below zero. This suggests that risks remain latent in the market. Investors are advised to exercise caution in the coming period should this trend persist.

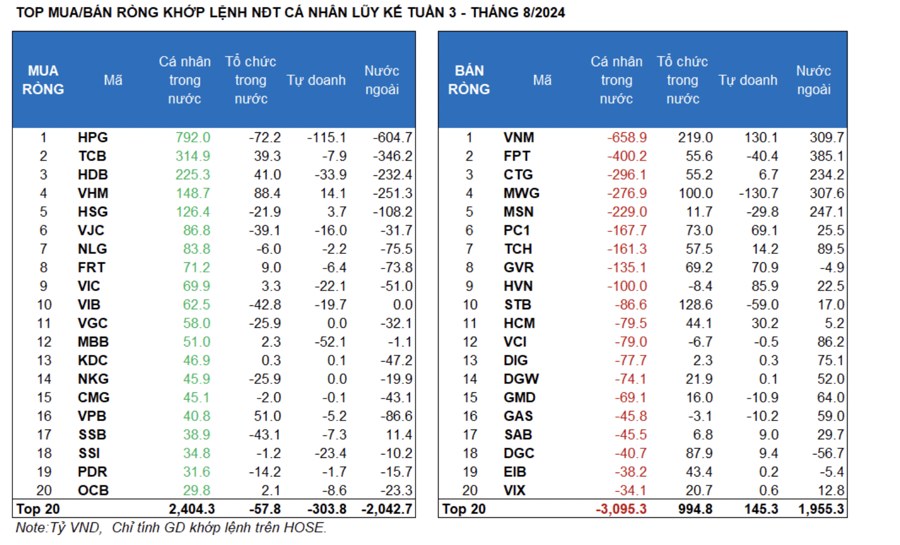

The Flow of Funds: Stocks Profit after 10 Sessions of Climbing, to Sell or to Hold?

Although the VN-Index suffered a minor setback in the past week’s trading sessions, it has shown remarkable resilience with ten consecutive positive performances since the sharp decline on April 22nd. Numerous stocks have delivered impressive returns, with some even yielding profits of 15-20%.