A significant update on trade tariff tensions between superpowers caused a strong rebound in the stock market on Monday’s session. Blue-chip stocks witnessed a substantial influx of capital, with the VN30 basket’s liquidity surging to its highest level in 11 sessions. The VN30-Index, representing these large-cap stocks, has now recovered to levels seen before the countervailing tariff shock of April 2nd.

The VN30-Index closed 1.46% higher at 1372.04 points. Notably, the closing level on April 2nd, just before the counter-tariff news, stood at 1376.94 points. Meanwhile, the broader VN-Index trailed slightly, climbing 1.26% to 1283.26 points, still about 2.62% or 34.6 points lower.

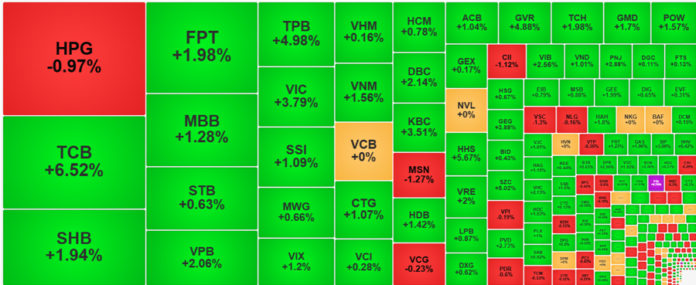

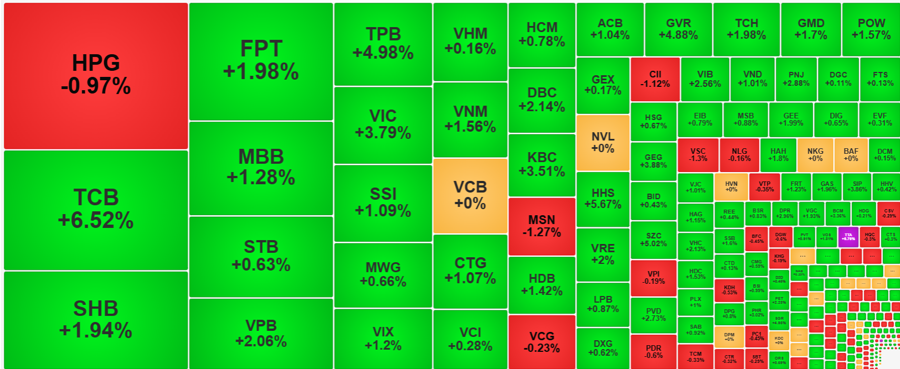

The strength of the blue-chip stocks was noteworthy, with 27 gainers and only 2 decliners in the basket. The top three performers—TCB, VIC, and FPT—contributed significantly to the index’s gain, adding 12.3 points to the overall increase of 19.79 points. Additionally, 18 other blue-chips in the basket rose by more than 1%.

The VN30 basket also witnessed a notable surge in trading volume, with transaction values surpassing VND 13,283 billion, a 54% increase compared to the previous Friday’s session and the highest in 11 sessions. This increase primarily drove the overall trading volume on the HoSE, as the VN30 basket accounted for an additional VND 4,647 billion, outpacing the overall market’s absolute increase of VND 3,849 billion. This suggests that other stock categories experienced a decrease in liquidity.

The top 10 most liquid stocks on the market were all from the VN30 basket. HPG led with a transaction value of VND 1,630.2 billion, despite its price falling by 0.97%. TCB, SHB, and FPT also crossed the VND 1,000 billion mark. Notably, the VN30 basket accounted for 67.4% of the total trading volume on the HoSE, the highest proportion observed so far this year.

The robust performance of blue-chip stocks naturally benefited the VN-Index. However, it lagged behind the VN30-Index due to the muted performance of some large-cap stocks: VCB closed unchanged, VHM rose marginally by 0.16%, and BID gained 0.43%. On the other hand, TPB, GVR, BCM, and VIB, which carry significant weight in the VN30-Index, all posted gains of over 2%.

Mid-cap and small-cap stocks also witnessed positive momentum, although their gains were less uniform. The Midcap index rose by a modest 0.77%, while the Smallcap index trailed with a 0.44% increase. On the HoSE, 196 stocks advanced while 111 declined, with 107 stocks posting gains of 1% or more. Notable liquid stocks outside the blue-chip category included VIX, which climbed 1.2% with a transaction value of VND 368.7 billion; DBC, up 2.14% with VND 265.8 billion; KBC, rising 3.51% with VND 258.4 billion; TCH, gaining 1.98% with VND 221.1 billion; and GMD, up 1.7% with VND 199.3 billion. Lower-liquidity stocks also saw significant gains, including TDH and TTA, which hit the ceiling price, VNE climbing 5.92%, SGR up 4.95%, and DSE advancing 4.12%…

On the downside, most decliners had low liquidity and carried less significance. Only three stocks with transaction values exceeding VND 10 billion—MSN, CII, and VSC—posted losses, with MSN falling 1.27% with a transaction value of VND 238.7 billion, CII dropping 1.12% with VND 135.3 billion, and VSC declining by 1.3% with VND 87.5 billion. In total, the 111 declining stocks accounted for just 16.6% of the day’s trading volume.

Foreign investors net-sold VND 294.1 billion worth of stocks, primarily during the morning session. In the afternoon session, their net-selling activities eased to VND 97.6 billion due to net-buying in several stocks. FPT attracted the most significant net-buying, with VND 239.2 billion, followed by GVR (VND 64.2 billion), PNJ (VND 49.3 billion), VNM (VND 41.1 billion), DXG (VND 38.2 billion), NLG (VND 36.6 billion), VRE (VND 21 billion), and VIC (VND 27.3 billion). On the selling side, VCB led with net-sales of VND 222.6 billion, followed by HPG (VND 157.7 billion), STB (VND 114 billion), VHM (VND 76.1 billion), MSN (VND 68.4 billion), VCI (VND 55.7 billion), and CTG (VND 40 billion).

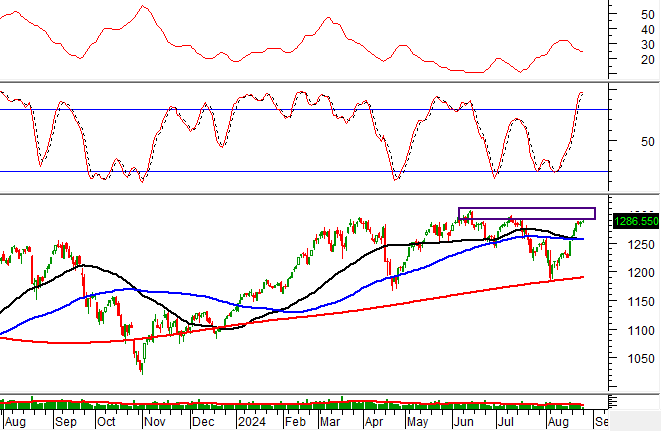

Technical Analysis for May 12: A Tug-of-War Market

The VN-Index and HNX-Index rallied, with both MACD and Stochastic Oscillator indicators previously signaling a buy, suggesting an improved short-term outlook.

Market Pulse, May 12: US-China Tariff Cuts Spur VN-Index Rally

The market closed with positive gains; the VN-Index rose by 15.96 points (+1.26%), reaching 1,283.26, while the HNX-Index climbed 1.91 points (+0.89%) to 216.04. The market breadth favored the bulls with 502 gainers versus 260 decliners. A sea of green was seen in the VN30 basket, as 27 stocks advanced, 2 declined, and 1 remained unchanged.

Stock Market Insights: Capital Awaiting the “Winter Wind”

The unexpected progress in US-China trade tariff negotiations provided a welcome boost today, building on the hints and speculation from last week. Large funds and investors were active in blue-chip stocks, driving a wave of enthusiasm despite a slight dip in liquidity for mid- and small-cap stocks. Today’s trading activity echoed that of May 8th, indicating that the market is eagerly awaiting a significant catalyst.

“Pyn Elite Fund Boosts MWG Holdings, Elevates VIX Shares to Top 10 Portfolio Holdings.”

Pyn Elite Fund views the recent market correction as an opportune time to accumulate fundamentally strong stocks at attractive valuations.