The VN-Index surged 41 points (3.3%) to 1,267, rebounding to the high price range of the sharp fall caused by tax news. Improved liquidity reflected enhanced investor sentiment and a resurgence of short-term money flow. Foreign capital also returned, with a net buy of VND 1,260 billion in the past week.

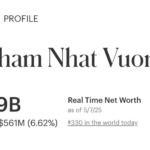

Vingroup’s stocks led the rally, with VIC at the center, contributing nearly 8.2 points to the VN-Index. Supporting this group was the news that Vinpearl will list 1.8 billion shares on HoSE, with the first trading session taking place on May 13. As a result, billionaire Pham Nhat Vuong’s net worth reached a new record. According to the latest update from Forbes, as of May 10, Mr. Vuong’s net worth stood at $9 billion, ranking 337th among the world’s richest people.

The recovery was also evident across industrial zone stocks, real estate, oil and gas, technology and telecommunications, textiles, and fertilizers—sectors that previously witnessed sharp declines due to tax-related news.

Short-term money flow resurfaces.

Mr. Dinh Quang Hinh, an expert from VNDirect Securities, attributed the robust gains in the first four sessions of the week to positive investor sentiment as the KRX trading system officially commenced operations.

The cooling down of tariff tensions has contributed to the buoyant sentiment. Vietnam officially entered into tariff negotiations with the US on May 7. Other tariff negotiations also revealed positive developments. The US announced its first trade agreement (with the UK) after imposing retaliatory tariffs. Trade talks between the US and China took place in Geneva on May 10-11.

“In the short term, I believe profit-taking pressure will increase next week as the recent positive news about tariff negotiations and first-quarter corporate earnings growth has been largely reflected in stock prices. In the immediate future, the VN-Index will face strong resistance at the 1,270 – 1,280 range and, further ahead, the psychological threshold of 1,300 points,” predicted Mr. Hinh.

According to the expert, if the market does not witness strong supportive information, such as significant progress in trade negotiations between the US and Vietnam, the likelihood of the VN-Index breaking through the aforementioned strong resistance levels is not high. The market needs a consolidation period after the rapid rise last week to absorb the cheap supply.

Short-term investors should consider taking profits on stocks that have risen sharply recently and may shift their focus to real estate, industrial zones, oil and gas, seafood, or sectors with strong supportive news like electricity (retail price increase).

Analysts from Saigon-Hanoi Securities (SHS) opined that the market is in a recovery phase, creating a balanced price range for many stocks after the shock decline. The market has rebounded to the price range of the trading session when the tariff announcement was made. However, according to SHS, this is not an attractive price range for further investment.

In May, SHS maintains its view that the market is still influenced by several key factors. The economy continues to grow, and interest rates remain stable at low levels, but external pressure is significant due to the high openness of the economy. Additionally, the market anticipates a potential market upgrade in September.

“Vingroup’s Total Value Surges to Nearly $43 Billion as Tycoon Pham Nhat Vuong Drops His 5th Billion-Dollar ‘Blockbuster’ IPO”

With a staggering valuation of $5 billion, Vinpearl has cemented its place among Vietnam’s most valuable companies, securing a spot in the top 15 on the stock exchange. This achievement places them just behind VPBank and ahead of notable non-banking giants such as Vinamilk, GVR, and Masan.

The First Vietnamese Person to Amass a Fortune of $9 Billion, Surpassing the Chairman of Samsung

It is important to note that Forbes’ calculations may not reflect the billionaire’s actual real-time net worth.