Kita Invest’s Performance as of December 31, 2024

As of December 31, 2024, Kita Invest’s owner’s equity stood at VND 1,237.6 billion, reflecting a modest 2.7% increase from the beginning of the year. Notably, the owner’s investment capital remained unchanged at VND 1,150 billion.

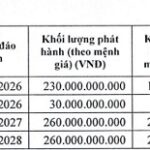

By the end of 2024, the company’s total liabilities amounted to VND 14,076 billion. Other liabilities constituted the largest portion, totaling VND 11,678 billion, followed by bank loans of VND 1,602 billion and bond issuance debt of VND 795.6 billion.

Currently, Kita Invest has three bond issues circulating in the market, all of which were issued in 2020. These bonds are approaching their maturity dates, with redemption periods ranging from early May to late July of this year.

Prior to this, the company experienced consecutive years of growth from 2021 to 2023. Specifically, Kita Invest reported a profit of VND 510 billion in 2021, which surged by 32 times to nearly VND 5 billion in 2022. This upward trajectory continued in 2023, with profits soaring by another 9 times to reach VND 45 billion.

2024 presented challenges for real estate businesses, with many incurring losses due to factors such as delayed project legalities and progress, high financial pressures, and elevated interest expenses. According to VIS Rating, these factors also contributed to the slowdown in revenue and profit recognition for real estate developers.

Kita Invest, a subsidiary of KITA Group Joint Stock Company, is the investor behind the KITA Airport City project—a 150-hectare urban area in the center of Binh Thuy District, Can Tho City. This project encompasses 5,000 land plots ranging from 80 to 170 square meters, including terraced houses, shophouses, villas, and apartment buildings. The total investment in this project stands at VND 8,000 billion.

Over the past two years, KITA Group has expanded its presence in the North with several strategically located projects. Notable mentions include KITA Capital, situated within the Nam Thang Long – Ciputra urban area, as well as Stella in Quoc Oai, Hanoi; Sukura Golf in Hai Phong; TAX Resort spanning 58 hectares in Hanoi; and the 8.2-hectare Hoa Lac urban subdivision.

The company has announced the accumulation of 700 hectares of prime land in key cities such as Hanoi, Danang, Ho Chi Minh City, and Can Tho. In addition to residential projects, KITA Group is also developing resort projects like Golden Hills and Stella Ocean Park in Phan Thiet.

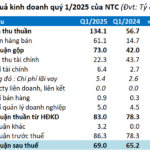

A Slight Rise in NTC’s First-Quarter Profit, Expansion of Factory Rental Services

Despite a strong revenue growth, a loss of dividend income, coupled with elevated expenses, resulted in a modest 6% year-over-year increase in net profit for Tan Uyen Industrial Park Joint Stock Company (UPCoM: NTC) in Q1 2025.

The Heir Apparent’s New Move

“In a recent development, Bui Cao Nhat Quan, the son of Novaland’s Chairman Bui Thanh Nhon, has registered to sell over 2.9 million NVL shares for personal reasons. This news comes as Novaland faces the task of repaying two bond batches, totaling over VND 1,200 billion in principal and interest. As the company navigates these financial obligations, the sale of a significant number of shares by a key insider has sparked interest within the investment community.”

“The Troubling Financial Woes of Trung Nam Group: A Daunting Reality”

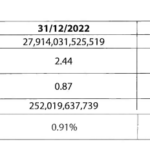

As of the end of 2023, Trung Nam Construction Investment Joint Stock Company (Trung Nam Group) had accumulated a debt of over VND 65,000 billion, 2.68 times their equity.