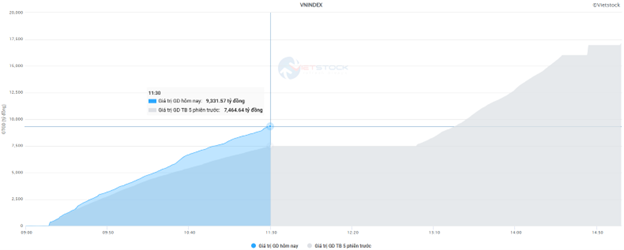

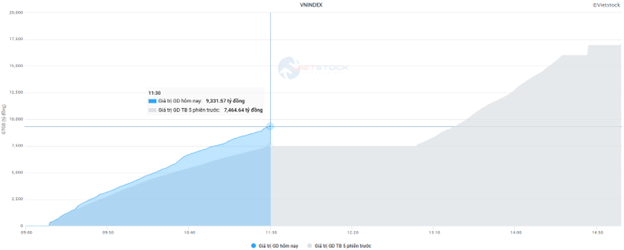

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 831 million shares, equivalent to a value of more than 19.7 trillion dong; HNX-Index reached over 56.2 million shares, equivalent to a value of more than 929 billion dong.

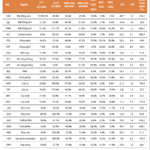

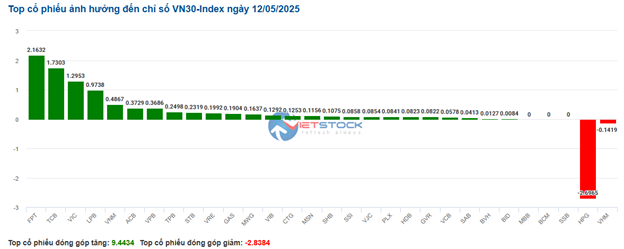

VN-Index continued to fluctuate in the first half of the afternoon session, but buying power gradually increased strongly after the news that the US and China agreed to reduce tariffs to 30% within 90 days, helping the index to surge and close in the positive green zone. In terms of impact, TCB, VIC, GVR, and FPT were the codes that had the most positive impact on the VN-Index with an 8-point increase. On the contrary, HPG, MSN, DHG, and ACG were the codes that were still under selling pressure, but the impact on the overall index was not significant.

| Top 10 stocks with the strongest impact on VN-Index on May 12, 2025 |

Similarly, the HNX-Index also had a rather optimistic movement, with the index positively impacted by the codes PVS (+3.38%), NTP (+0%), IDC (+4.91%), SHS (+0.81%)…

|

Source: VietstockFinance

|

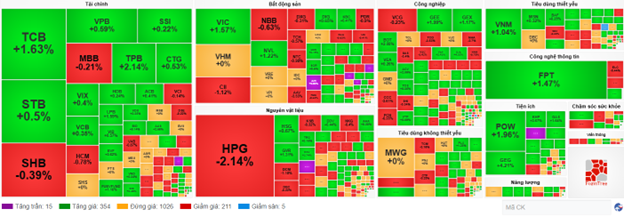

The information technology industry was the group with the strongest increase of 1.91%, mainly from the codes FPT (+1.98%), CMG (+0.59%), VTB (+0.1%) and HPT (+6.55%). This was followed by the real estate industry and the energy industry with increases of 1.61% and 1.39%, respectively. On the contrary, the telecommunications industry was the only group with a significant decrease in the market with 0.06% mainly from the codes VGI (-0.42%), VNZ (-0.63%), CTR (-0.32%) and SGT (-0.56%).

In terms of foreign trading, they continued to sell more than 298 billion dong on the HOSE floor, focusing on the codes VCB (222.47 billion), HPG (157.35 billion), STB (114.04 billion), and VHM (75.85 billion). On the HNX floor, foreigners sold a net amount of more than 390 million dong, focusing on the codes PVS (4 billion), SHS (1.66 billion), VFS (730 million), and NAG (530 million).

| Foreign trading buying – net selling movement |

Morning session: Large-cap stocks maintain the green zone for VN-Index

The main indexes remained in the green zone until the end of the morning session. By lunchtime, the VN-Index temporarily stopped at 1,274.92 points, an increase of 7.62 points. Meanwhile, the HNX-Index fell back to the reference level, reaching 214.42 points. The market breadth recorded 368 gainers and 265 losers.

As capital focused on large-cap stocks, the market liquidity this morning improved. The trading volume of the VN-Index reached more than 388 million units, equivalent to a value of more than 9.3 trillion dong, up 25% compared to the average of the previous week. Liquidity on the HNX floor recorded a matching volume of nearly 28 million units, with a value of more than 396 billion dong.

Source: VietstockFinance

|

TCB, VIC, GVR, and FPT were the main pillars that contributed the most positively, bringing in more than 5.5 points for the VN-Index. Meanwhile, HPG was the biggest hindrance in the morning session, taking away nearly 1 point, while the remaining stocks had an insignificant impact on the overall index.

The green zone still dominated most industry groups. The positivity of FPT (+1.9%), CMG (+1.04%), SMT (+7.95%), and HPT (+6.55%) was the main driving force for the information technology group to lead the market with a nearly 2% increase. This was followed by the utilities and consumer staples groups, which also attracted positive inflows, notably GEG (+4.53%), GAS (+1.64%), POW (+0.78%), TTA (+6.76%), PPC (+1.99%); VNM (+0.87%), MCH (+3.76%), PAN (+1.28%), SEA (+3%),…

With their large market capitalization, the strong performance of many “king” stocks had a positive impact on the market, notably TCB (+4.71%), TPB (+2.85%), LPB (+1.45%), VIB (+1.14%), SGB (+1.59%), and VBB (+1.04%).

On the contrary, the telecommunications group was dominated by red codes due to the impact of large-cap stocks such as VGI (-0.99%), CTR (-0.11%), VNZ (-1.78%), ELC (-0.44%), and TTN (-1.16%), although FOX (+1.55%), FOC (+4.61%), MFS (+0.95%),… still performed quite well. Similarly, the healthcare group also decreased slightly due to significant pressure from the large-cap stock DHG (-1.7%).

10:30 am: Leaning towards an increase, GEG tests the old peak in July 2024

Buyers continued to hold their ground, helping the main indexes maintain the green zone. As of 10:30 am, the VN-Index increased by 7.3 points, trading around 1,271 points. The HNX-Index increased by 0.84 points, trading around 214 points.

The number of stocks in the VN30 basket that maintained the green zone was somewhat dominant. Notably, the 4 stocks FPT, TCB, VIC, and LPB contributed 2.16 points, 1.73 points, 1.29 points, and 0.97 points to the VN30 index, respectively. On the contrary, only 2 codes, HPG and VNM, were still under selling pressure, taking away more than 2.8 points from the index.

Source: VietstockFinance

|

Stocks in the information technology industry group were brightly colored from the beginning of the session. Specifically, FPT increased by 1.55%, CMG increased by 0.45%, SMT increased by 7.95%, and HPT increased by 6.99%… The rest of the codes remained unchanged, and only one code, ITD, was still under slight selling pressure, decreasing by 2.17%.

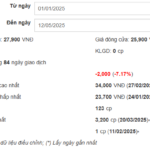

Following this was the utilities industry group, which also contributed to the market’s overall increase, with most stocks in the green zone, such as GAS increasing by 1.64%, REE increasing by 0.15%, POW increasing by 1.96%, and GEG increasing by 4.21%… In addition, from a technical analysis perspective, the GEG stock price surged in the morning session of May 12, 2025, and is currently testing the old peak of July 2024 (equivalent to the 16,000-16,400 range) while the MACD indicator has continuously formed higher highs and higher lows, indicating a positive medium-term outlook. However, the Stochastic Oscillator indicator has entered the overbought zone, so there is a risk of short-term correction if the indicator signals a sell and falls out of this zone.

Source: https://stockchart.vietstock.vn/

|

Meanwhile, the telecommunications industry group had mixed movements, with decreasing codes such as VGI (-0.42%), CTR (-0.32%), SGT (-0.85%), ELC (-0.44%)…

Compared to the beginning of the session, the state of differentiation continued with more than 1,000 codes unchanged, and buyers had a slightly dominant position. The number of increasing codes was more than 350, while the number of decreasing codes was more than 210.

Source: VietstockFinance

|

Opening: Continuing the recovery momentum this morning

At the beginning of the session on May 12, as of 9:30 am, the VN-Index increased strongly, reaching 1,277.28 points. Meanwhile, the HNX-Index also increased slightly, reaching 215.59 points.

The green zone temporarily dominated the VN30 basket, with 25 increasing codes and 5 unchanged codes. Among them, VIC, GAS, TCB, and LPB were the stocks with the strongest increases.

As of 9:30 am, the information technology industry group was leading the market with the most positive impact today, with stocks such as FPT increasing by 1.38%, CMG increasing by 0.59%, ITD increasing by 4.35%, CMT increasing by 3.7%,…

Following this was the industrial industry group, with most stocks in the group in the green zone from the beginning of the session, such as ACV increasing by 2.51%, HVN increasing by 1.01%, VJC increasing by 0.22%, GMD increasing by 0.75%, VTP increasing by 0.61%,…

– 16:04 May 12, 2025

The Ultimate List of Stocks: Unveiling Steady Performers with Stellar Growth and Unique Stories

Based on the Q1/2025 financial results, our team of expert analysts has meticulously curated a list of stocks that showcase robust performance, sustained growth, and unique narratives.

Market Beat: Blue-Chip Stocks Keep VN-Index in the Green

The major indices remained in the green territory towards the end of the morning session. By lunch break, the VN-Index posted a gain of 7.62 points, reaching 1,274.92. Meanwhile, the HNX-Index edged slightly lower, settling at 214.42. Market breadth was positive, with 368 advancers outweighing 265 decliners.

The Strategic Capital Retreat: Biwase Members Plan Massive Divestment from Vwaco

Biwase Installation – Electricity Joint Stock Company (Biwelco) has registered to sell 7.1 million VLW shares of Vinh Long Water Supply Joint Stock Company (Vwaco, UPCoM: VLW) from May 13 to June 6, expecting to reduce its ownership from over 9.7 million shares (33.7%) to over 2.6 million shares (9.1%).

Market Pulse May 12th: Bias to the Upside, GEG Tests July ’24 Highs

The buyers maintained their strong position, keeping the key indices in the green. As of 10:30 am, the VN-Index surged by 7.3 points, trading at around 1,271 points. Meanwhile, the HNX-Index climbed by 0.84 points, hovering around the 214-point mark.