The trade negotiation developments between the US and China provided an unexpected boost to the market today, despite hints over the weekend. Large funds were active in blue-chip stocks, creating strong momentum, despite a slight drop in liquidity for mid-cap and small-cap stocks. Today’s session recalled the trading on May 8th, indicating that large funds are waiting for a strong catalyst.

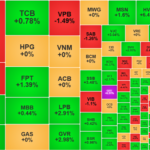

The VNI closed 1.26% higher, while the VN30 gained 1.46%. This difference stems from the index compositions, with TCB, FPT, VRE, and MWG providing strong support to the VN30. Notably, the VN30 basket’s liquidity reached its highest level since April 22nd, accounting for over 67% of the total matched orders on the HSX, a 54% increase from the previous session. Meanwhile, mid-cap stocks remained stagnant, and small-cap stocks witnessed reduced trading.

Generally, retail investors are not fond of blue-chip stocks as their upside potential is often less attractive compared to mid-cap and small-cap stocks, and it is more challenging to inflate their prices. However, the depth of liquidity in blue-chip stocks provides ample space for large funds to operate. Hence, when liquidity increases in this segment, it is usually a positive sign, indicating that large investors are more active, not to mention that price increases in this group are crucial for the overall market sentiment.

The ongoing trade negotiations continue to dominate global headlines. International stock markets, particularly US stock futures, reacted strongly to today’s US-China news: the S&P 500 rose over 2.7%, and the DJA gained 2%. The de-escalation of trade tensions between these two economic powerhouses is positive, as recent recession fears were mainly driven by this issue. Vietnam’s negotiations may also benefit from this development. The stock market, which has been plunging due to tariff concerns, is likely to recover as this burden is lifted.

Blue-chip stocks witnessed a more uniform increase today, with VIC remaining a crucial driver, while banking, FPT, GAS, and GVR also performed strongly. In this context, even if VIC and VHM experience corrections, the market is unlikely to be significantly affected. With solid consensus, the VN30 could soon return to its March peak, and as of today, there are no remaining traces of the impact of retaliatory tariffs.

The total matched orders on the two listed exchanges increased by 24% compared to the previous week, reaching 20.6 trillion, a relatively high level. In the absence of significant supportive news, it is reasonable for the market to trade sideways with low liquidity. However, when positive news emerges, the increase in liquidity and prices indicates the presence of waiting large funds, as signaled on May 8th. In other words, the market is anxiously awaiting a “game-changer.”

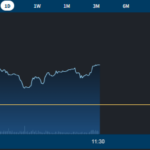

The derivatives market, naturally, followed the VN30’s lead, and the basis did not show a significant difference as the F1 contract is approaching maturity in a few days. Both long and short positions have good opportunities as there is no apparent disadvantage. Initially, the VN30 was weak and even weakened after failing to break through the 1361.xx mark, falling to 1351.xx. However, after the US-China tariff reduction news, the market rebounded, and blue-chips recovered strongly. The range from 1361.xx to 1351.xx and the subsequent recovery provided a wide enough range for trading.

However, it became more challenging afterward. The VN30 hovered annoyingly close to 1361.xx, making it uncertain whether it would continue upward or fall again. This index had an intraday peak of around 1367. In this situation, there are two scenarios. The short scenario should only be executed if the VN30 breaks below 1361.xx. The long scenario is feasible if the VN30 surpasses the morning peak, as short positions would then be incorrect and need to be corrected, creating upward pressure. However, above 1367, there is another resistance level around 1371.xx, which is quite close, providing little assurance of breaking through. This implies a relatively small safe upward range, so if going long when the VN30 surpasses the peak, it should be with a small position. The strong upward pull at the end of the session was impressive, pushing the index beyond 1371.xx, while the F1 even surpassed 1377.xx.

The market is displaying a significant confident psychological response and the potential for this to occur when supportive news is impressive enough. While the VN30 has returned to pre-retaliatory tariff levels, most stocks in the basket have not yet “recovered.” Maintaining high liquidity is crucial to confirm the consistent presence of large funds. The strategy remains to hold stocks and employ flexible long/short strategies with derivatives.

The VN30 closed today at 1372.04, right at a milestone. The next resistance levels are 1377, 1384, 1391, and 1402. Support levels are 1365, 1358, 1351, 1343, and 1331.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives, evaluations, and investment advice presented are solely those of the author, and VnEconomy respects the author’s viewpoint and writing style. VnEconomy and the author are not responsible for any issues arising from the published evaluations and investment perspectives.

The Market Tug-of-War: Heavyweight Stocks Hold the Line, Foreign Investors Surprise with Strong Buying

The VN-Index struggled to maintain its highs this morning as blue-chip stocks continued to diverge and weaken. Only 5 out of the top 10 largest capitalization codes increased, fortunately including VIC and GAS. Trading volume decreased by 10% compared to yesterday morning, with a balanced breadth confirming a tug-of-war state. A bright spot was that foreign investors unexpectedly net bought 367 billion VND after 16 consecutive net selling sessions.

“Stocks Slide as Selling Pressure Weakens, Blue-chips Rebound Ahead of Derivatives Expiry”

The market witnessed a positive shift in the afternoon session as selling pressure eased. Prices gradually climbed, especially after 2:15 pm when the VN30-Index calculations started influencing the final settlement prices. A steady ascent of blue-chip stocks propelled the VN-Index and VN30-Index to surpass the reference levels and close at their highest points for the day.

The Red Hot Electric Board: VN-Index Plunges Below the 1200-Point Mark, Foreigners Sell Off in the Highest 7 Sessions

The significant weakening of pillars, coupled with unfavorable developments in the international market, sent Vietnamese stocks into a sharp decline this morning. Investors tried to offload their positions, and while it didn’t quite turn into a panic sell-off, it still resulted in hundreds of stocks plunging. The VN-Index tumbled to 1,189.07 points…

The Market Beat on Valentine’s Day: Finance Sector Falters but VN-Index Stays in the Green

The market ended the session on a positive note, with the VN-Index climbing 5.73 points (+0.45%) to reach 1,276.08, while the HNX-Index rose 1.7 points (+0.74%) to close at 231.22. The market breadth tilted in favor of gainers, with 473 advancing stocks against 300 decliners. The large-cap sector painted a bullish picture, as evidenced by the VN30 basket, which witnessed 16 gainers, 8 losers, and 6 stocks ending unchanged, favoring the bulls.