The Vietnamese stock market witnessed a vibrant trading week following the April 30th holiday break. The VN-Index surged by a total of 41 points (+3.3%) to close at 1,267.3 points, while the HNX index climbed by 2.19 points to reach 214.13 points.

This strong upward momentum was observed during the first four trading sessions, fueled by the positive sentiment among investors with the successful launch of the KRX trading system on May 5th. Foreign investors also displayed positive trading activities, recording a net buy value of over VND 1,200 billion during the week.

Many investors expressed their enthusiasm as the KRX system operated smoothly without any significant glitches, meeting initial expectations. The VN-Index witnessed a surge in trading volume among Vin group stocks following the news that Vinpearl will list 1.8 billion shares on HOSE, with the first trading session scheduled for May 13th.

Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDIRECT Securities Corporation, attributed the positive market sentiment to easing trade tensions, including Vietnam’s official entry into tariff negotiations with the US on May 7th. Additionally, the US and China held trade talks in Geneva, Switzerland, during the weekend.

Looking ahead to the week of May 12th to 16th, several securities companies anticipate that the VN-Index is likely to face strong resistance at the 1,270-1,280 point range, with the possibility of short-term profit-taking as it approaches the 1,300-point milestone.

VN-Index shines after the KRX system launch

Analysts at Pinetree Securities Company believe that with the VN-Index touching the 1,270-point level and facing multiple resistance levels, there is a high likelihood of mild corrections early next week. However, investors need not worry as there are no signs of fund outflows; instead, there is a rotation of capital from one group to another.

“In the short term, cash flow is expected to focus on midcap stocks (medium and small-cap stocks), real estate, and may gradually shift to banking stocks. In the medium term, barring any adverse news on tariffs, the VN-Index is expected to continue its upward trajectory towards the 1,300-point region,” said Pinetree Securities’ analysts.

Mr. Hinh cautioned that profit-taking pressure is likely to intensify next week as the recent positive news regarding trade negotiations and first-quarter earnings growth has already been largely priced into the market.

VN-Index eyes further gains towards the 1,300-point mark

“Short-term investors should consider taking profits on stocks that have witnessed strong gains recently and shift their focus to sectors that haven’t recovered significantly, such as industrial real estate, oil and gas, and seafood, or stocks with strong supportive information like electricity (retail electricity price hike),” advised Mr. Hinh. He further suggested maintaining a moderate stock proportion and refraining from excessive leverage as the market approaches strong resistance levels.

CSI Securities Company shared a similar optimistic outlook for the market, anticipating that the VN-Index will advance towards the 1,300-point milestone in the coming period. Given the potential for increased profit-taking pressure, they recommended gradually selling positions and realizing profits as the VN-Index approaches the 1,300-point threshold. For new purchases, investors should patiently await a potential pullback to the 1,250-point level to establish safer buying positions.

Technical Analysis for May 12: A Tug-of-War Market

The VN-Index and HNX-Index rallied, with both MACD and Stochastic Oscillator indicators previously signaling a buy, suggesting an improved short-term outlook.

Market Pulse, May 12: US-China Tariff Cuts Spur VN-Index Rally

The market closed with positive gains; the VN-Index rose by 15.96 points (+1.26%), reaching 1,283.26, while the HNX-Index climbed 1.91 points (+0.89%) to 216.04. The market breadth favored the bulls with 502 gainers versus 260 decliners. A sea of green was seen in the VN30 basket, as 27 stocks advanced, 2 declined, and 1 remained unchanged.

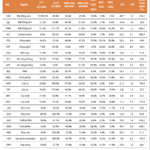

The Ultimate List of Stocks: Unveiling Steady Performers with Stellar Growth and Unique Stories

Based on the Q1/2025 financial results, our team of expert analysts has meticulously curated a list of stocks that showcase robust performance, sustained growth, and unique narratives.

Market Beat: Blue-Chip Stocks Keep VN-Index in the Green

The major indices remained in the green territory towards the end of the morning session. By lunch break, the VN-Index posted a gain of 7.62 points, reaching 1,274.92. Meanwhile, the HNX-Index edged slightly lower, settling at 214.42. Market breadth was positive, with 368 advancers outweighing 265 decliners.