Son of Navico’s CEO sees over 1.6 million shares forcibly sold

Mr. Doan Chi Thanh, Trading Director of Nam Viet Joint Stock Company (Navico, HOSE: ANV), explained the trading of ANV shares on May 6th. Mr. Thanh is also the son of Mr. Doan Toi, Navico’s General Director and Vice Chairman of the Board.

According to the explanation, Mr. Thanh had 1.64 million ANV shares forcibly sold on May 6th, resulting in a delayed disclosure. After receiving the notification from the securities company, he reported the transaction to the State Securities Commission, HOSE, and Navico as required.

Following this transaction, Mr. Thanh’s ownership decreased from 12.82% to 12.21%, equivalent to over 32.5 million ANV shares. Previously, he also had 63,500 shares forcibly sold on April 15th and another 61,600 shares on April 28th for similar reasons.

On the buying side, Mr. Doan Toi, Mr. Thanh’s father and Navico’s largest shareholder, completed the purchase of an additional 3 million ANV shares between April 11th and 18th. After this transaction, Mr. Toi’s ownership increased from 53.85% to 54.98%, equivalent to 146.6 million shares.

HQC’s Chairman registers to buy an additional 25 million shares

Following his purchase of 23 million HQC shares in late April, Mr. Truong Anh Tuan, Chairman of the Board of Hoang Quan Trading Services Real Estate Joint Stock Company (HOSE: HQC), has registered to buy an additional 25 million shares.

If the transaction is successful, Mr. Tuan’s total ownership will increase from 25 million to 50 million shares, equivalent to 8.671% of the company’s charter capital, making him a major shareholder of HQC. The expected transaction period is from May 13th to June 11th, 2025, through matching or negotiated orders.

In the afternoon session on May 8th, HQC shares surged to the ceiling price of 3,300 VND/share. Based on this price, the value of the shares Mr. Tuan registered to buy is estimated at 82.5 billion VND.

Previously, Mr. Tuan had completed the purchase of 23 million HQC shares between April 25th and 29th, 2025, increasing his ownership to 25 million shares, or 4.3375% of the capital.

SGR’s Chairman buys nearly 9.9 million shares in private placement

Saigon Real Estate Joint Stock Company (HOSE: SGR) ended its private placement of 20 million shares earlier than expected on May 7th, 2025, with nearly 9.9 million shares successfully issued, equivalent to a rate of 39.84%. The only participant in this private placement was Mr. Pham Thu, Chairman of the Board of the Company.

Mr. Thu’s transaction took place on the last day of the offering, i.e., May 7th. With a selling price of 40,000 VND/share, he spent 395 billion VND to purchase these shares.

On the other hand, if the remaining over 10.1 million shares are not successfully placed, Mr. Thu’s ownership in SGR will reach 39.84%.

CTF’s Chairman’s sister registers to divest her entire stake

Ms. Tran Thi Tam, sister of Mr. Tran Ngoc Dan, Chairman of the Board of City Auto Joint Stock Company (HOSE: CTF), has registered to sell her entire stake of nearly 1.2 million shares (equivalent to 1.21% of charter capital) from May 12th to June 10th, 2025, for personal financial needs.

Based on CTF‘s closing price of 22,000 VND/share on May 8th, the value of Ms. Tam’s transaction is estimated at nearly 25.5 billion VND.

This move by Ms. Tam comes not long after Ms. Ngo Thi Hanh, Mr. Tran Ngoc Dan‘s wife, registered to buy 6 million CTF shares from May 7th to June 5th, aiming to increase her ownership from 0.16% to 6.43%, equivalent to 6.15 million shares.

HPG’s Board member intends to transfer 8.5 million shares to relatives

Mr. Nguyen Ngoc Quang, a member of the Board of Directors of Hoa Phat Group Joint Stock Company (HOSE: HPG), has registered to sell by agreement 8.5 million shares to his son and relatives from May 14th to June 12th, 2025.

If the transaction is successful, Mr. Quang’s ownership in HPG will decrease from 1.77% to 1.63%, equivalent to nearly 104.6 million shares.

On the opposite side, Mr. Nguyen Quang Minh, Mr. Quang’s son, has registered to buy by agreement 5.5 million shares (0.09%) during the same period of May 14th to June 12th. Currently, Mr. Minh does not own any HPG shares.

At the closing of the trading session on May 8th, HPG shares stood at a price of 25,700 VND/share. Based on this price, the estimated value of Mr. Quang’s agreed transaction is over 218 billion VND.

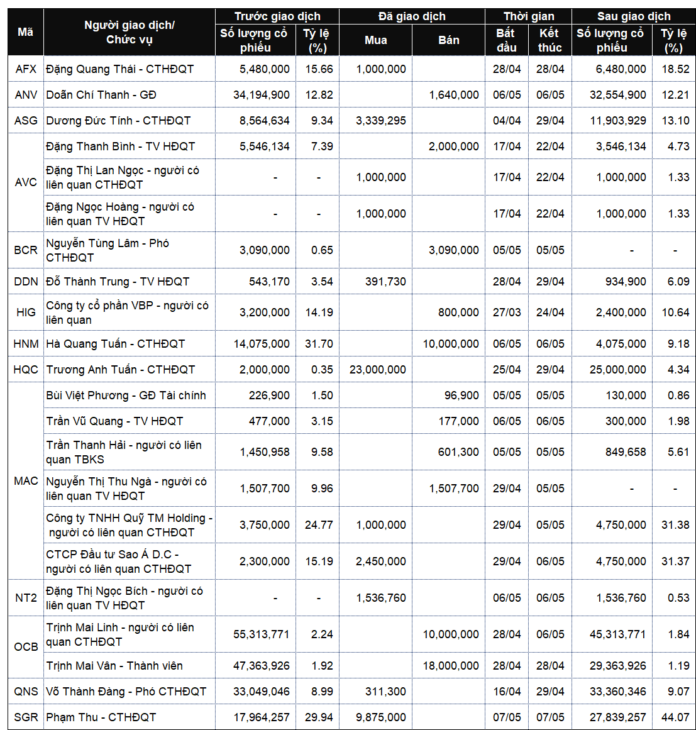

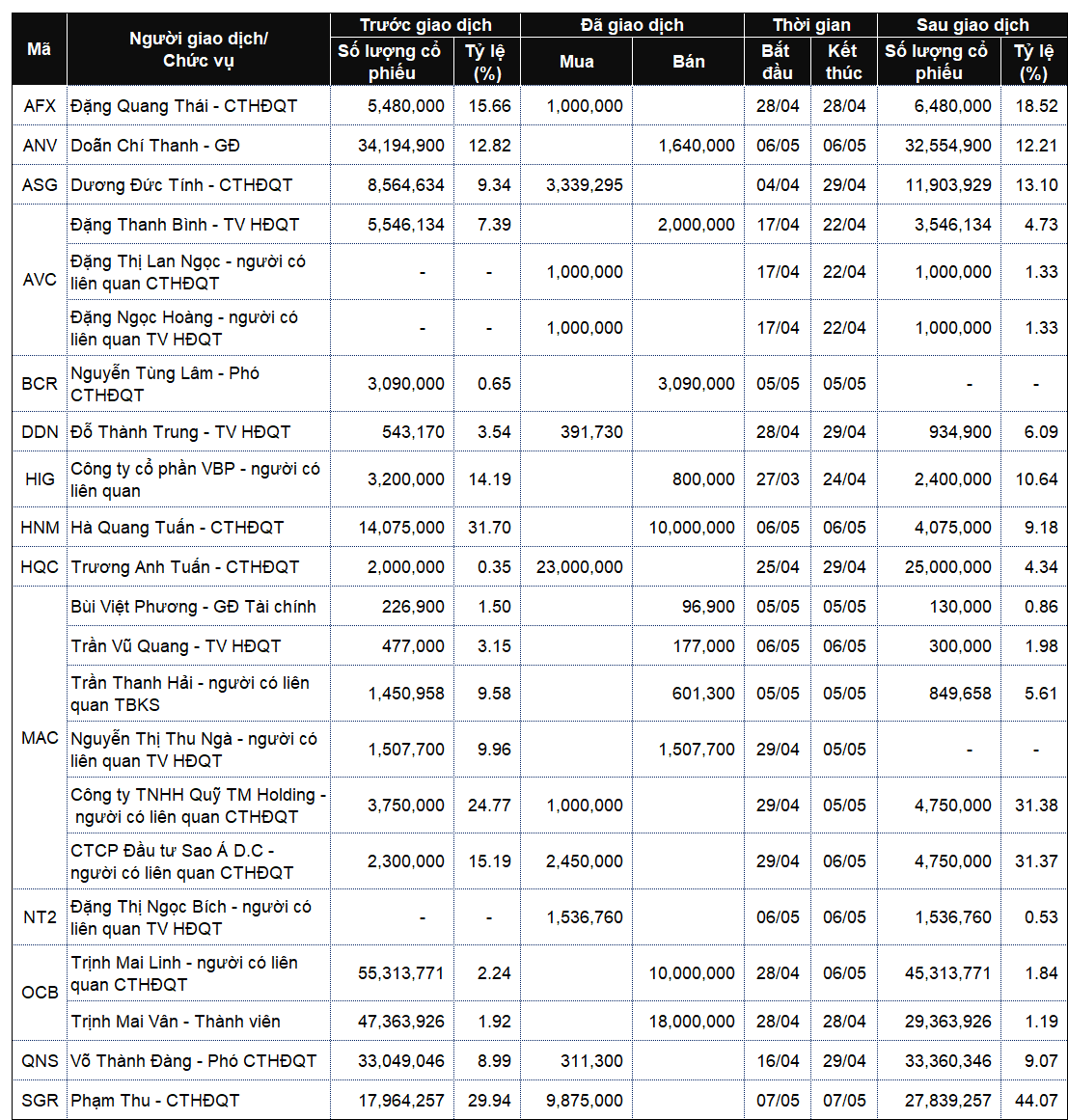

|

List of company leaders and relatives trading from May 12-16, 2025

Source: VietstockFinance

|

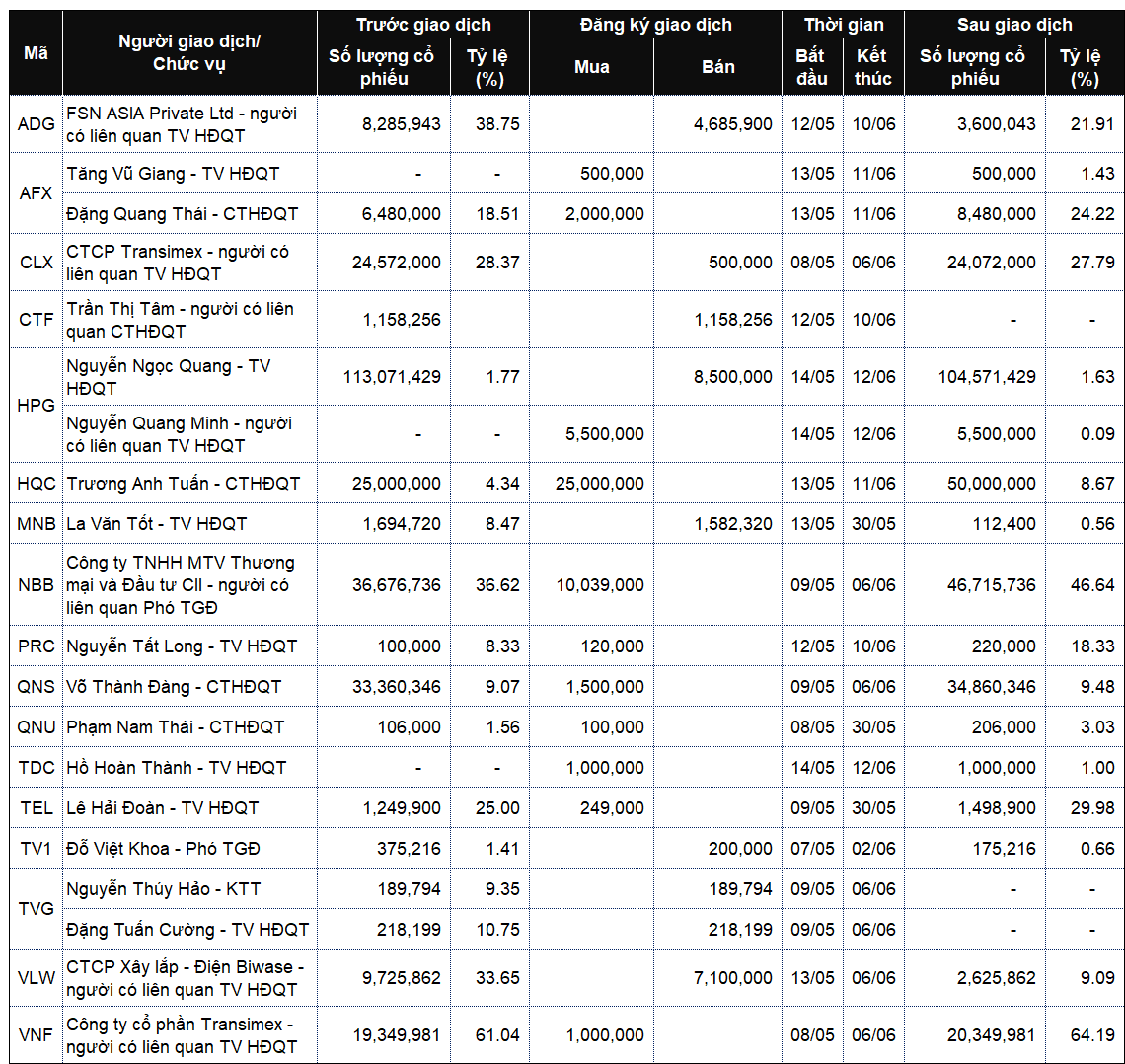

|

List of company leaders and relatives registering for trading from May 12-16, 2025

Source: VietstockFinance

|

– 14:00, May 12, 2025

The Strategic Capital Retreat: Biwase Members Plan Massive Divestment from Vwaco

Biwase Installation – Electricity Joint Stock Company (Biwelco) has registered to sell 7.1 million VLW shares of Vinh Long Water Supply Joint Stock Company (Vwaco, UPCoM: VLW) from May 13 to June 6, expecting to reduce its ownership from over 9.7 million shares (33.7%) to over 2.6 million shares (9.1%).

“The Upcoming Stock Offering: A Glimpse into the Future”

Becamex IJC is set to offer over 251.8 million shares, aiming to raise VND 2,518.3 billion to invest in various urban and BOT project developments.

The Billionaire Chairman: Investing in the Future with a $400 Million Stock Purchase

Mr. Pham Thu, Chairman of the Board of Directors of Saigon Real Estate Joint Stock Corporation, spent nearly VND 400 billion to purchase nearly 9.9 million SGR shares. Mr. Truong Anh Tuan, Chairman of the Board of Directors of Hoang Quan Trading Service Real Estate Consulting Joint Stock Company, registered to buy 25 million HQC shares worth nearly VND 83 billion.

Market Beat: VN-Index Sees Extended Tug-of-War as Caution Prevails

The market closed with the VN-Index down 2.5 points (-0.2%), settling at 1,267.3. The HNX-Index followed suit, dropping 1.08 points (-0.5%) to 214.13. The day’s trading saw a slight tilt towards decliners, with 396 stocks falling against 353 advancing. The VN30 basket mirrored this trend, showing a sea of red with 15 decliners, 8 gainers, and 7 stocks holding steady.

DGW to Pay Out $4.6 Million in Dividends in June

Digital World Joint Stock Company (HOSE: DGW) has just finalized its 2024 dividend payment plan, offering a 5% dividend rate (VND 500 per share). The ex-dividend date is set for May 23, with an expected payment date of June 4.