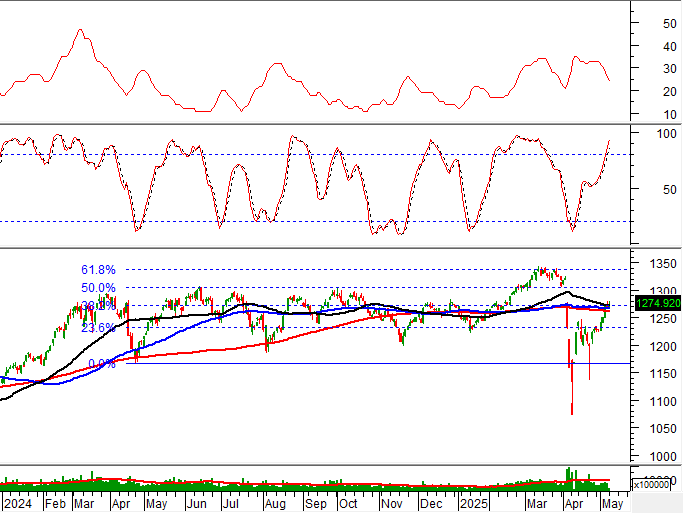

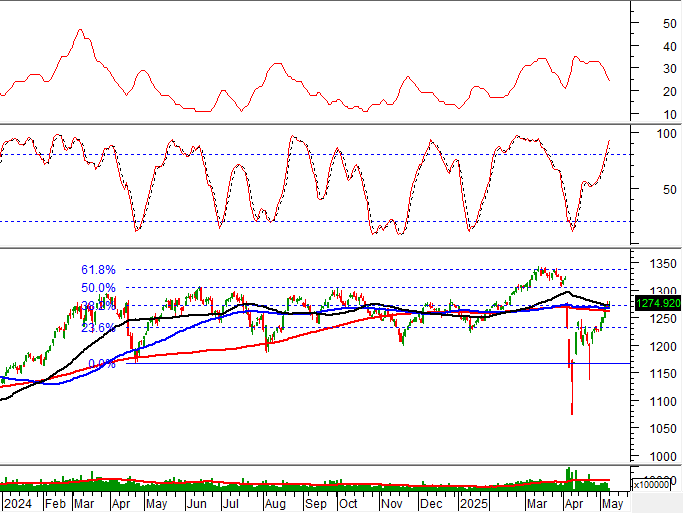

Technical Signals for VN-Index

During the trading session on the morning of May 12, 2025, the VN-Index witnessed an increase in points, coupled with a slight rise in trading volume, indicating a positive sentiment among investors.

Additionally, the VN-Index continues to test the group of 100-day SMA and 200-day SMA while the MACD indicator maintains its previous buy signal. If the index successfully surpasses this resistance level, the mid-to-long-term optimistic outlook may return in upcoming sessions.

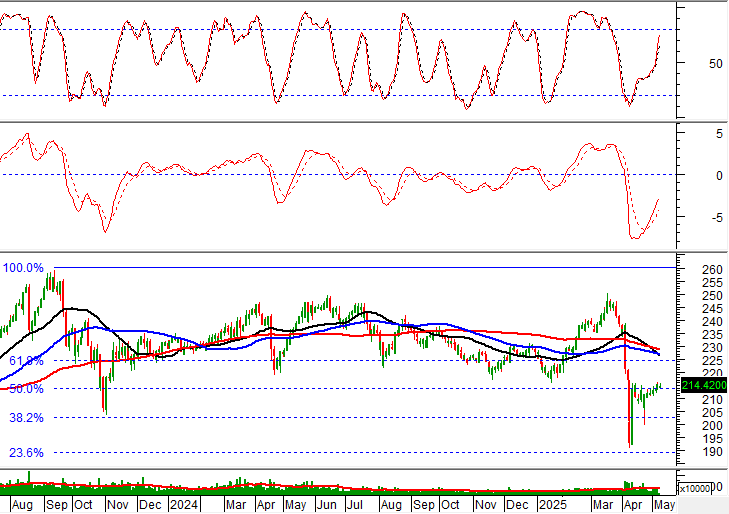

Technical Signals for HNX-Index

On May 12, 2025, the HNX-Index experienced an increase in points, but the trading volume remained unchanged, reflecting investors’ hesitation.

At present, the HNX-Index is retesting the 50% Fibonacci Retracement level (equivalent to the 210-215 point region) while the Stochastic Oscillator indicator gives a buy signal again. If the index successfully breaks through this resistance level, the recovery scenario could continue in the next sessions.

HPG – Hoa Phat Group Joint Stock Company

On the morning of May 12, 2025, HPG witnessed a decrease in price along with a trading volume exceeding the 20-session average, indicating investors’ pessimistic sentiment.

Currently, the stock price has dropped below the Middle line of the Bollinger Bands, while the Stochastic Oscillator indicator continues to dive into the overbought zone. If a sell signal reappears and the price falls out of this zone, the risk of adjustment will heighten in the upcoming sessions.

TPB – Tien Phong Commercial Joint Stock Bank

On the morning of May 12, 2025, TPB witnessed an increase in price along with trading volume surpassing the 20-session average, indicating active trading among investors.

Additionally, the stock price is heading towards testing the 50-day SMA while the MACD indicator continues to widen the gap with the Signal line after providing a previous buy signal. If the stock price successfully breaks through this resistance level, the mid-term optimistic outlook will return in the upcoming sessions.

Technical Analysis Department, Vietstock Consulting

– 12:00, May 12, 2025

Market Pulse, May 12: US-China Tariff Cuts Spur VN-Index Rally

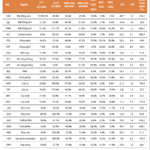

The market closed with positive gains; the VN-Index rose by 15.96 points (+1.26%), reaching 1,283.26, while the HNX-Index climbed 1.91 points (+0.89%) to 216.04. The market breadth favored the bulls with 502 gainers versus 260 decliners. A sea of green was seen in the VN30 basket, as 27 stocks advanced, 2 declined, and 1 remained unchanged.

“Pyn Elite Fund Boosts MWG Holdings, Elevates VIX Shares to Top 10 Portfolio Holdings.”

Pyn Elite Fund views the recent market correction as an opportune time to accumulate fundamentally strong stocks at attractive valuations.

Market Beat: Blue-Chip Stocks Keep VN-Index in the Green

The major indices remained in the green territory towards the end of the morning session. By lunch break, the VN-Index posted a gain of 7.62 points, reaching 1,274.92. Meanwhile, the HNX-Index edged slightly lower, settling at 214.42. Market breadth was positive, with 368 advancers outweighing 265 decliners.

The Crypto Report – May 2025 (Part 1): The Short-Term Tug-of-War

The world of cryptocurrency is ever-evolving, and keeping abreast of the latest trends is essential for investors. This analysis delves into the most prominent and sought-after digital currencies, offering insights for both short-term and long-term investment strategies. With a meticulous examination of market movements and expert insights, this article aims to provide a comprehensive guide to navigating the dynamic landscape of crypto investments.