Oil Prices Surge Over 4%

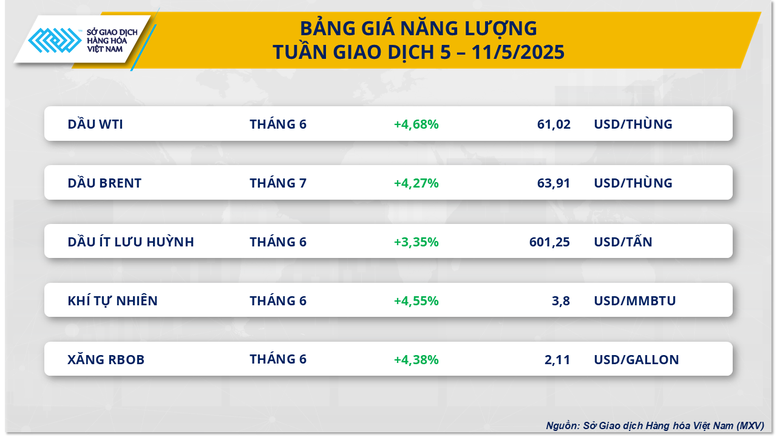

As observed by MXV, the energy sector led the market’s upward trajectory, with all five commodities closing in the green. Notably, crude oil prices rebounded, ending their two-week slump. Investor sentiment stabilized amid heightened focus on the trade negotiations between the US and China.

On May 9, Brent crude oil prices surged by 4.27%, settling at $63.91 per barrel. Meanwhile, WTI crude oil prices climbed to $61.02 per barrel, marking a significant increase of 4.68%.

At the start of the week, investor concerns about excess supply intensified as OPEC+ confirmed a substantial output increase for June. Following a one-hour virtual meeting on Saturday, May 3, involving eight member nations, OPEC+ agreed to boost production by 411,000 barrels per day in June, mirroring May’s output level. This decision triggered a sharp decline in oil prices early in the week due to fears of a resurgent oversupply, given the still-fragile global demand.

However, market sentiment turned positive towards the week’s end as US President Donald Trump and UK Prime Minister Keir Starmer announced a landmark bilateral trade deal. The agreement maintained a 10% tariff on imports from the UK while eliminating barriers for US goods, particularly agricultural products, automobiles, and metals, entering the UK market. This fueled optimism ahead of the US-China trade talks in Switzerland on May 10. At the conclusion of the first day of negotiations, President Trump characterized the meeting as “very good” and “constructive.” Moreover, US Treasury Secretary Scott Bessent stated on May 11 that the world’s two largest economies had made “significant progress” during the two-day talks. These positive signals contributed to a strong upward momentum in oil prices during the final two trading sessions of the week.

Additionally, the market continues to witness concerns about oil consumption in the US. Data from the US Energy Information Administration (EIA) revealed that while crude oil inventories declined by 2 million barrels in the week ending May 2, refinery inputs decreased by 7,000 barrels per day, and gasoline stocks rose by 188,000 barrels—a contrast to the typical summer trend of surging gasoline demand.

Usually, this period experiences a substantial rise in gasoline consumption due to increased travel. The latest EIA figures raise concerns about the outlook for retail gasoline consumption, particularly amid lackluster performance in key US economic indicators, such as the recently released first-quarter GDP growth rate.

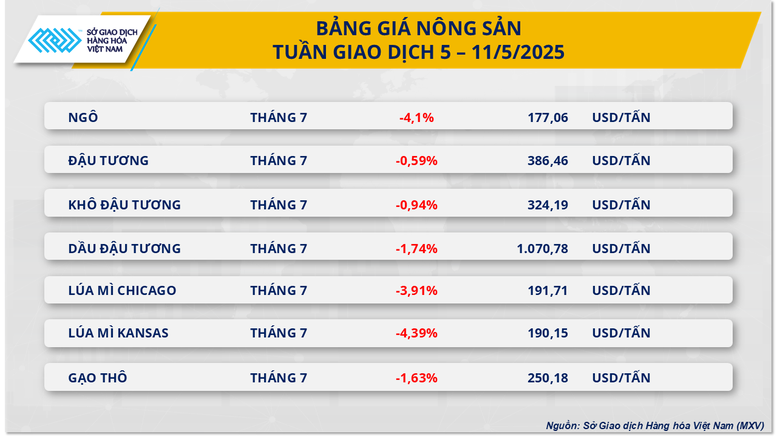

According to MXV, the soybean market concluded the past week with a slight decline of 0.59%, settling at $386 per ton. This reflects a tug-of-war between conflicting fundamental factors and investor caution ahead of imminent pivotal events. The price drop was primarily driven by expectations of a favorable US planting season and abundant global supply prospects. Nevertheless, supportive factors, including robust exports and trade hopes, curbed the price decline.

Inflation Management Must Stay Grounded in Reality from the Start

In 2024, the consumer price index (CPI) rose by an average of 3.63% compared to 2023, remaining below the target set by the National Assembly. This marks a decade of Vietnam’s successful inflation control, with an average rate below 4%. Experts suggest that maintaining a CPI increase of around 4.5% in 2025 to support a substantial 8-10% growth will be a challenging task, requiring decisive and meticulous management from governing bodies from the get-go.

China’s Trade Dependence on the US Plunges to a New Low

“This development comes as Beijing braces for the possibility of tariffs being imposed by U.S. President-elect Donald Trump when he assumes office on January 20th. With Trump’s return to the White House, there is anticipation and concern over potential new trade policies that could significantly impact China’s economy.”