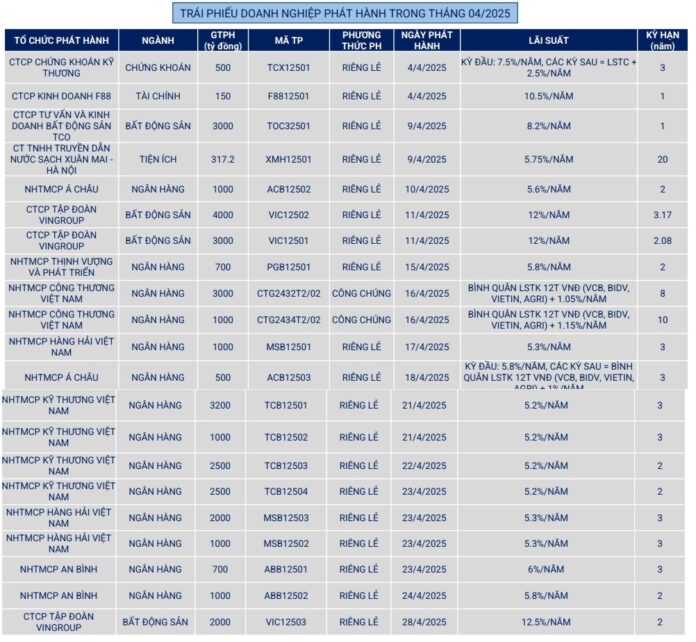

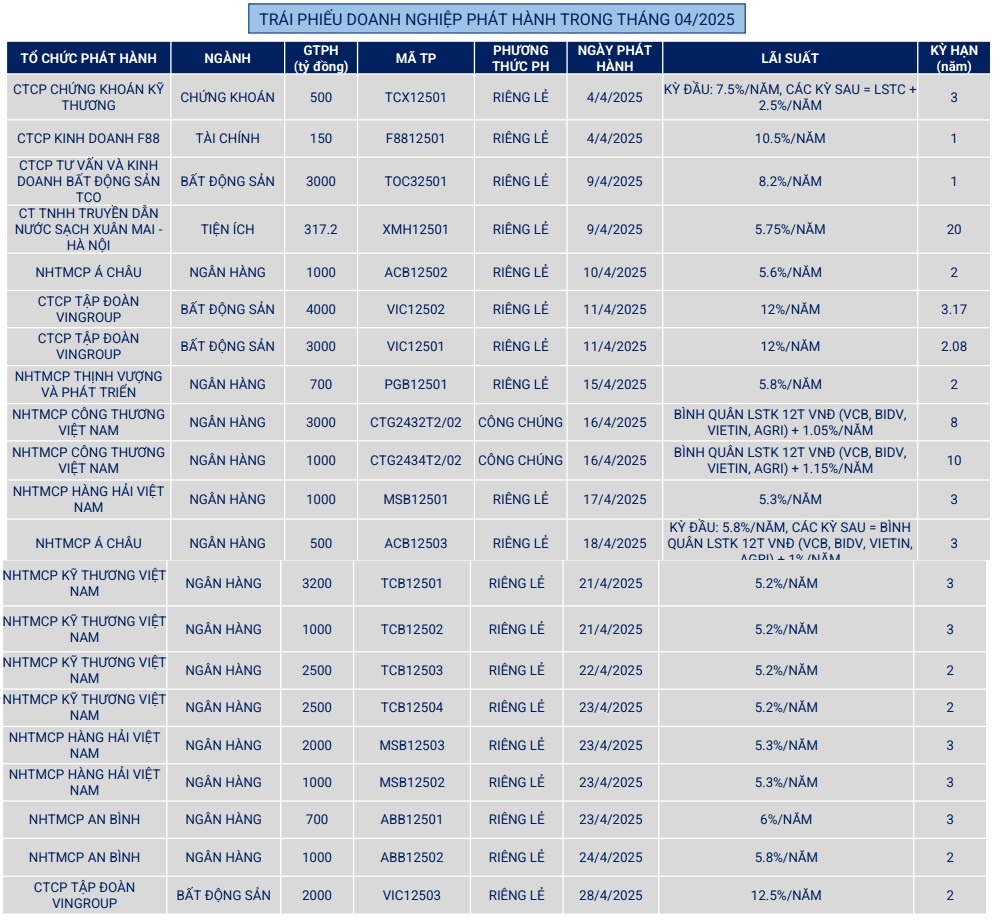

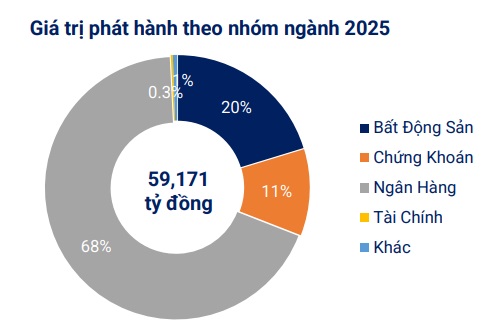

In detail, the issuances comprised 19 private placements worth over VND 30 trillion and two public offerings valued at VND 4 trillion.

Source: VBMA

|

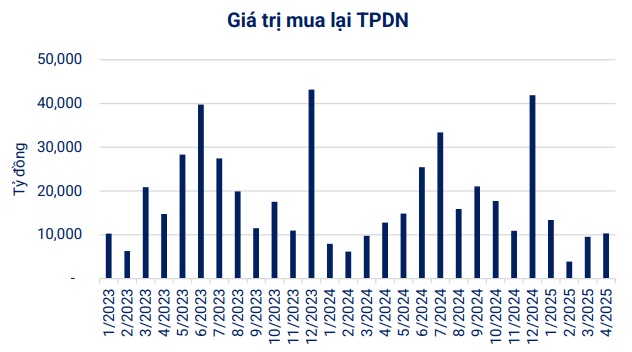

During April, enterprises repurchased over VND 10.3 trillion of bonds before maturity, a 20% decrease compared to the same period in 2024. For the remaining eight months of 2025, it is estimated that there will be over VND 163 trillion in maturing bonds, with 53% being real estate bonds (valued at more than VND 86.4 trillion).

Source: VBMA

|

Source: VBMA

|

Regarding abnormal information disclosure, there were two bond codes that delayed interest payments of VND 10.3 billion in April. In the secondary market, the total trading value of private placement corporate bonds in April 2025 reached nearly VND 100.5 trillion, averaging over VND 5 trillion per session, a 13% decrease compared to the previous month’s average.

In the coming time, there will be two notable issuances from Vingroup (Vingroup Joint Stock Company, HOSE: VIC) and BIDV (HOSE: BID).

Specifically, the VIC Board of Directors has approved a plan to issue private placement bonds, divided into five tranches in 2025. The total maximum issuance value is VND 10 trillion. These are “three-no” bonds: non-convertible, without warrants, and unsecured, with a par value of VND 100 million per bond. The bonds have a maximum term of two years and a fixed interest rate.

Regarding BIDV, the Bank’s Board of Directors has approved a plan to issue private placement bonds, divided into 50 tranches in 2025, with a total maximum value of VND 23 trillion. These are also “three-no” bonds, with an expected par value of VND 100 million per bond. The bonds have a minimum term of five years, with a combination of fixed and floating interest rates.

– 15:12 12/05/2025

“Anticipating the ‘Mega Expo’ and Dong Anh Mega City: Mr. Pham Nhat Vuong’s Company Unveils Unprecedented Plans”

In 2025, the company plans to embark on a series of large-scale projects, marking a significant year for its ambitious endeavors.