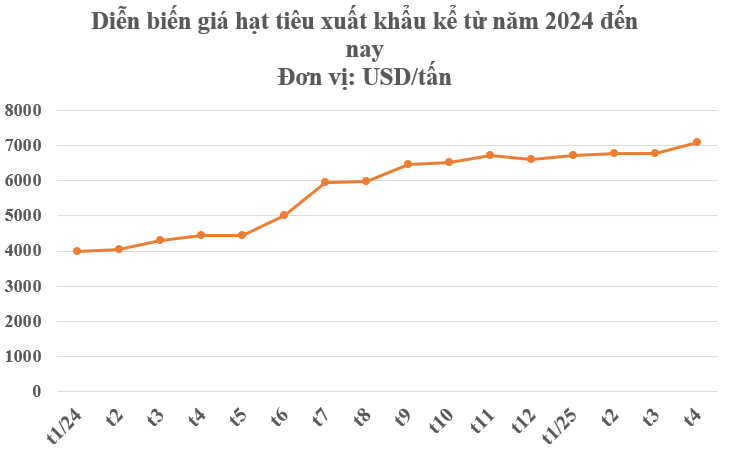

Vietnam has dominated the global pepper production and export industry for over two decades, accounting for 40% of output and 60% of market share. Preliminary statistics from the General Department of Customs show that Vietnam’s pepper exports in April reached over 26,000 tons, valued at more than $184 million, a significant increase of 31.7% in volume and 31.1% in value compared to the previous month.

Cumulative exports in the first four months of the year reached over 508 million dollars, with a volume of over 73,000 tons, an 11.3% decrease in volume but a substantial 44.4% increase compared to the same period in 2024.

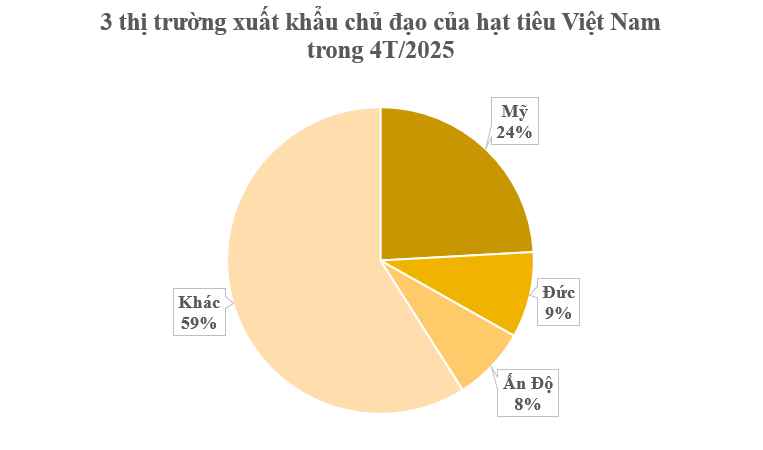

In terms of market performance, the United States has emerged as Vietnam’s largest pepper export destination, with over 17,000 tons valued at more than $132 million. This reflects a 22% decrease in volume but a remarkable 32% increase in value compared to the previous year. Notably, the average export price of pepper to the US surged by 70%, reaching $7,461 per ton.

Germany follows as the second-largest market, with exports totaling 6,600 tons and valued at $49 million, indicating a 21% volume increase and an impressive 87% value increase year-on-year. The average price surged by 55% compared to the previous year, reaching $7,401 per ton.

India stands as the third-largest export destination for Vietnamese pepper, with 5,700 tons valued at over $41 million. This represents a 4% volume increase and an astonishing 84% value increase, with the average export price reaching $7,139 per ton, a 77% surge.

The US market holds significant importance for the Vietnamese pepper industry. On April 5, 2025, the US imposed a temporary 10% retaliatory tax during a 90-day negotiation period on several countries, including Vietnam. The countervailing duty on Vietnam could reach 46%, the highest among the affected countries. If an agreement is not reached, Vietnamese pepper will lose its competitive advantage to countries with lower tax rates, such as Brazil (10%), Indonesia (32%), and Malaysia (24%).

The new tariff policy compels the pepper industry to restructure its export ecosystem and redistribute markets more flexibly. However, according to the Vietnam Pepper and Spice Association (VPSA), supply and demand will remain the decisive factors until the end of the year. Regardless of whether the US imposes countervailing duties on Vietnam, the world will still face a shortage of pepper, and prices may rise again.

The global pepper market is forecasted to grow from $7.51 billion in 2024 to $9.8 billion in 2032, representing a compound annual growth rate (CAGR) of 3.38%. Key drivers include trends toward natural, organic, and sustainable consumption; heightened awareness of health benefits (anti-inflammatory and antibacterial properties); and rising demand in developed markets like North America and Europe.

Vietnam’s pepper output for the 2024/25 crop year is expected to reach 172,000 tons, a 2% decrease from the previous year and a 47% drop from the 322,000 tons produced in the 2018/19 crop year. Global pepper production is anticipated to continue declining in 2025 due to reduced cultivation areas in Vietnam and unfavorable weather conditions in India. Global pepper production in 2025 is projected to decrease to 434,000 tons, while consumption demand remains high.

According to VPSA, the primary reason for the decrease in Vietnam’s supply is the lack of new land allocated for pepper cultivation. Farmers are shifting to other crops, such as durian and coffee, which offer higher profitability.

The Ultimate Vietnamese Produce: Our Country’s Exports Surpass the World’s Combined, Reaping Over $700 Million Since January

This particular species of nut-bearing tree has propelled Vietnam to the forefront of the global industry, with the country boasting an impressive 60% of the world’s export supply.

The Spice is Right: Black Pepper’s Billion-Dollar Comeback

The pepper market is booming, with prices soaring high and predicted to rise further due to strong global demand and limited supply. The Vietnam Pepper and Spice Association (VPSA) forecasts that the country’s pepper exports will surpass $1 billion this year, reclaiming its status as a billion-dollar industry.