As announced by DNSE, from May 1st, 2025, to September 30th, 2025, the company is waiving fees for derivative securities deposits/withdrawals to VSD and asset management service fees for investors trading derivatives at DNSE.

This is DNSE’s initiative to support derivative securities investors after the KRX system deployment, which brought about significant changes to the system and fee policies.

Currently, DNSE offers free derivative securities trading. When trading derivatives at DNSE, investors only need to pay the collection fees as stipulated by the state agencies.

The fees for derivative securities deposits/withdrawals to VSD are VND 5,500 per transaction, and the asset management service fee is calculated at 0.0024% of the cumulative balance of the pledged assets (cash and securities value according to par value)/account/month (maximum not exceeding VND 1,600,000/account/month and minimum not less than VND 100,000/account/month).

With this new policy, from May 1st, 2025, to September 30th, 2025, DNSE will bear these two fee items for customers.

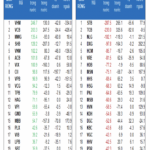

DNSE is currently ranked Top 2 in the derivative securities market share

|

Fees incurred in May will be deducted from the account as usual and refunded to customers within the first five business days of June 2025.

From June 1st, 2025, to September 30th, 2025, the system will automatically waive the fees directly in the securities account.

DNSE Securities has been making waves in the derivative securities industry, showcasing remarkable growth. In the second quarter of 2025, according to data from HNX, this tech-driven securities company captured a 16.7% market share in derivative trading, a 70% surge compared to the first quarter of 2025. This places them ahead of many long-established securities companies in the market and narrowing the gap with VPS, the top derivative securities market leader.

DNSE’s derivative trading features innovative tools that provide efficient support for trading activities, attracting and retaining a large number of investors over time. The system offers fast, stable trading, and a competitive margin ratio of only 18.48%.

Additionally, DNSE’s derivative system manages risks on a per-transaction and per-order basis, enabling better risk management for customers. The features include real-time profit and loss alerts and automatic profit-taking/stop-loss settings, which are pioneering tools trusted by many investors to respond promptly to the volatile derivative market.

DNSE offers pioneering features in derivative trading such as real-time profit and loss alerts and automatic profit-taking/stop-loss settings.

|

Furthermore, DNSE has attracted investors through its “Surfing Derivatives” contest, a vibrant arena that fosters the growth of the derivative securities community. The 2025 season, running from April 1st, 2025, to June 30th, 2025, offers prizes totaling over VND 220 million. The program has garnered enthusiastic responses, with over 16,400 registered participants and approximately VND 32,400 billion in total trading value after just one month.

|

For details on derivative securities trading fees and the program for free deposits/withdrawals and asset management service fees for derivative trading at DNSE, please refer to: https://hdsd.dnse.com.vn/san-pham-dich-vu/bieu-phi-dich-vu-dnse/bieu-phi-giao-dich-phai-sinh |

– 06:58 May 12th, 2025

The Foreign Block: A Surprising $1.3 Billion Net Buy Last Week

Foreign investors bought a net amount of 1,260.7 billion VND, with a net buy of 1,168.4 billion VND in matched orders. The key foreign net buys on the matched orders were in the Real Estate and Basic Resources sectors.

Market Pulse May 5: Real Estate Sector Leads, VN-Index Surges Over 12 Points

The market closed with positive gains, seeing the VN-Index rise by 12.32 points (+1%), finishing at 1,238.62. Likewise, the HNX-Index climbed 0.87 points (+0.41%), ending the day at 212.81. It was a predominantly green market with 476 gainers compared to 247 losers. Within the VN30 basket, bulls held sway with 19 gainers, 7 losers, and 4 stocks closing flat.

HoSE: Official Launch of the KRX System on May 5th

The Ho Chi Minh Stock Exchange (HoSE) is proud to announce the official launch of its new information technology system, effective May 5, 2025. This state-of-the-art technology infrastructure marks a significant milestone in the exchange’s journey towards becoming a leading stock exchange in the region.

The Unbelievable “Shock”: MBS Offers a Whopping 100% Margin Interest Gift to Traders in December

Belief in Vietnam’s ability to achieve or surpass its 7% growth target by the end of 2024 is fueling a stock market surge. In this context, MBS is rolling out its “Margin Shock” program for the first time, offering a market-leading 100% interest repayment to empower investors and boost the overall market.

“A Significant Spike in Margin Lending: DNSE’s Third-Quarter Report Shows a 65% Surge in Margin Debt Since the Start of the Year.”

In Q3 2024, DNSE Securities’ margin lending outstanding balance witnessed a remarkable 65% year-to-date surge, significantly contributing to the firm’s robust financial performance. This quarter, DNSE reported a 12% increase in revenue, totaling VND 193.7 billion, along with a 10% rise in net profit, amounting to VND 44.3 billion, compared to the same period in 2023.