## DNSE Waives Fees for Derivatives Investors

As announced by DNSE, from May 1st, 2025, to September 30th, 2025, the company is waiving fees for derivative investors, including the VSD derivative deposit/withdrawal fee and the asset management service fee. This is DNSE’s way of supporting investors after the KRX system implementation, which brought about changes in policies and fees.

Currently, DNSE offers free derivative securities trading. Investors only pay the state-mandated collection fee when trading derivatives with DNSE. The VSD derivative deposit/withdrawal fee is VND 5,500 per transaction, and the asset management service fee is calculated as 0.0024% of the cumulative value of the collateral assets (cash and securities at par value)/account/month, with a maximum cap of VND 1,600,000/account/month and a minimum of VND 100,000/account/month.

With this new policy, from May 1st to September 30th, DNSE will cover these two fees for its customers. Fees incurred in May will be deducted from the account as usual and refunded to customers within the first five business days of June 2025. From June 1st to September 30th, the system will automatically waive the fees directly in the securities account.

DNSE Ranks Top 2 in Derivatives Market Share

|

DNSE has made a name for itself with its impressive growth in the derivatives securities sector. In the second quarter of 2025, according to data from HNX, this tech-driven securities company achieved a 16.7% market share in derivatives trading, a 70% increase compared to the first quarter. This puts them ahead of many established securities companies and closing in on VPS, the top derivatives market leader.

DNSE’s derivatives trading features innovative tools that provide efficient support for traders, attracting and retaining a large number of investors. The system offers fast, stable trading, and a competitive margin rate of only 18.48%. Additionally, DNSE’s derivatives platform provides transaction and order-level risk management, along with real-time profit and loss alerts and automatic stop-loss/take-profit settings—pioneering tools trusted by many investors to react promptly to the volatile derivatives market.

DNSE Offers Pioneering Features in Derivatives Trading, Including Real-time Profit and Loss Alerts and Automatic Stop-loss/Take-profit Settings

|

DNSE also attracts investors through its “Surfing Derivatives” contest, a vibrant arena that fosters the growth of the derivatives community. The 2025 season, running from April 1st to June 30th, offers prizes totaling over VND 220 million. The program has received an enthusiastic response, with over 16,400 registered participants and a trading value of nearly VND 32,400 billion in just one month.

|

For details on DNSE’s derivatives trading fees and the program waiving the derivative deposit/withdrawal fee and asset management service fee, please visit: https://hdsd.dnse.com.vn/san-pham-dich-vu/bieu-phi-dich-vu-dnse/bieu-phi-giao-dich-phai-sinh |

– 06:58, May 12th, 2025

“Top 2 Brokerage Firm Waives Fees on Margin Trading for Derivatives”

DNSE, a leading securities firm with a top 2 market share in derivatives, is making a bold move by offering free deposit and withdrawal of collateral for derivative trades, as well as waiving asset management service fees.

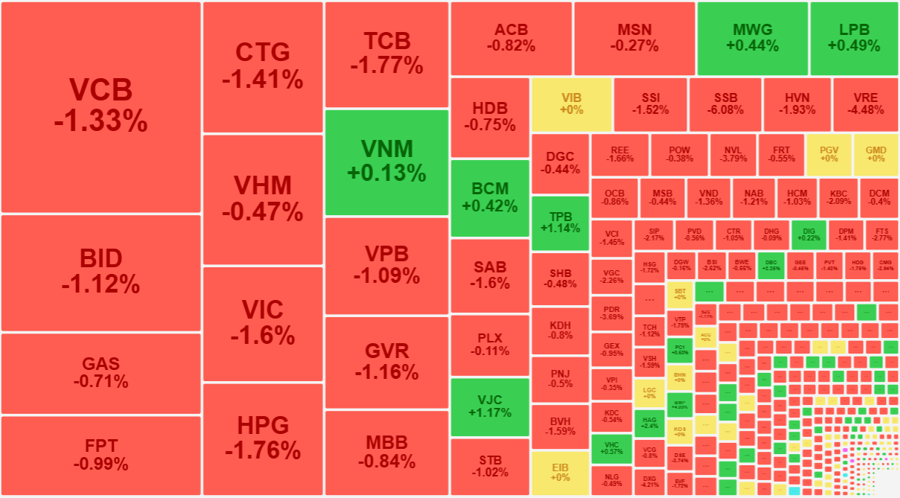

“Vietstock Daily: Caution Prevails Ahead of Long Weekend”

The VN-Index witnessed a slight dip with trading volumes remaining below the 20-day average, indicating a continued cautious sentiment among investors. The recent peak formed in mid-April 2025 (approximately 1,230 – 1,245 points) now acts as a short-term resistance level for the index.