On May 13, over 1.79 billion VPL shares of Vinpearl Joint Stock Company will officially be listed on HoSE. The reference price for the first trading day is VND 71,300/share, equivalent to a valuation of nearly VND 130,000 billion (~USD 5 billion).

This valuation places Vinpearl among the top 15 most valuable companies on the stock exchange, just behind VPBank and surpassing non-banking names like Vinamilk, GVR, and Masan.

Vingroup is currently Vinpearl’s largest shareholder, owning more than 1.5 billion VPL shares, or 85.5% of its charter capital. Temporarily calculated at the listing price, the market value of these shares amounts to over VND 110,000 billion.

The fifth billion-dollar “blockbuster” of billionaire Pham Nhat Vuong on the Vietnamese stock exchange

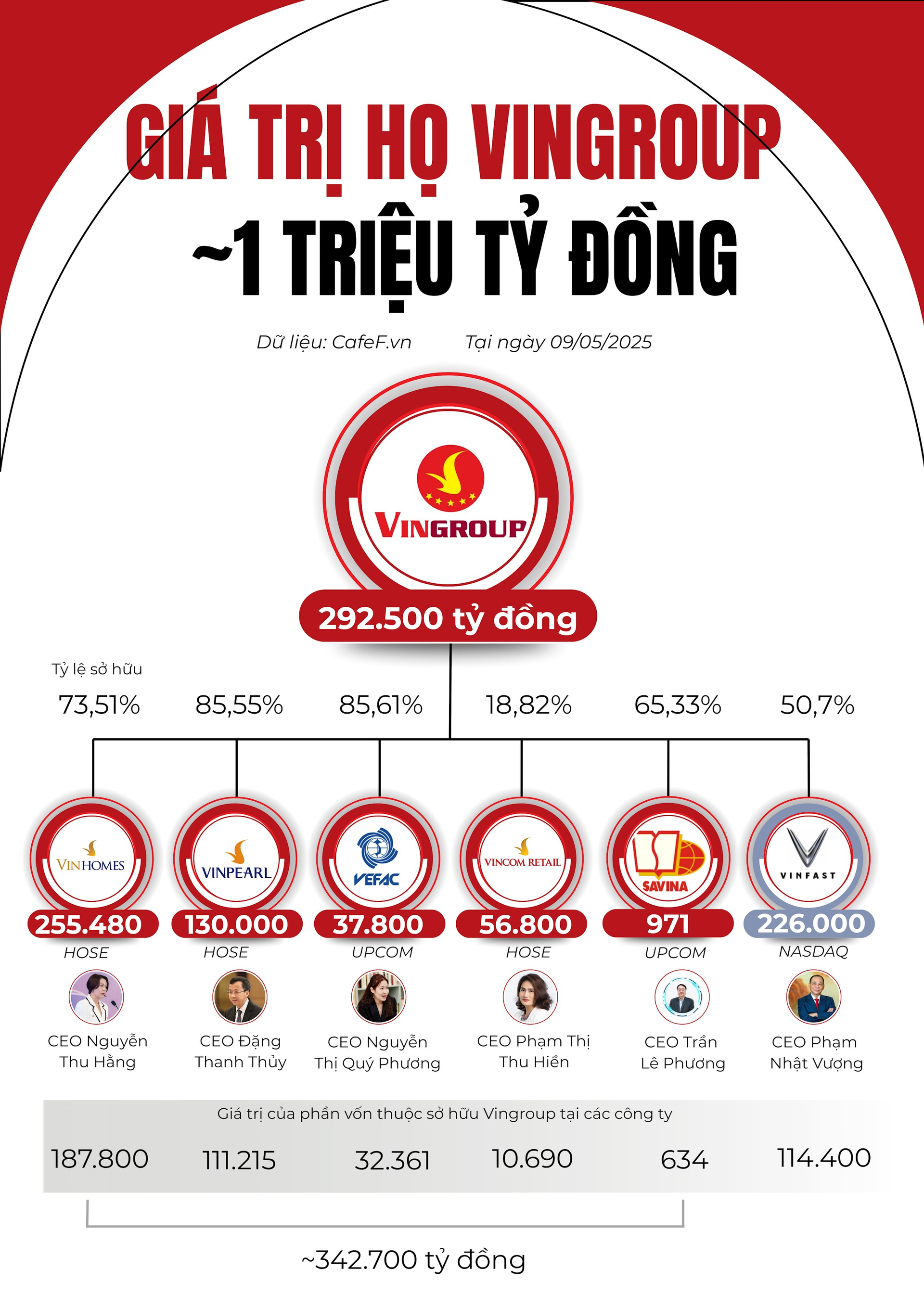

Thus, billionaire Pham Nhat Vuong will have another billion-dollar company on the stock exchange. As of the closing price on May 9, 2025, Vingroup’s market capitalization was VND 292,500 billion, Vinhomes was VND 255,480 billion, Vincom Retail was VND 56,800 billion, and VEFAC was VND 37,800 billion.

All of these companies have a market capitalization of over USD 1 billion. The smallest Vin Group company, not in the “billion-dollar club,” is Vietnam Book Joint Stock Company (code: VNB) with a market capitalization of VND 971 billion.

In addition, VinFast Joint Stock Company (code: VFS), listed on the Nasdaq (US), currently has a market capitalization of USD 8.7 billion (equivalent to over VND 226,000 billion) as of May 9, 2025. Vingroup’s equity interest in VinFast is 50.7%, and its voting rights are 99.9%.

The total market capitalization of the “VinGroup family” on the Vietnamese stock exchange reached nearly VND 774,000 billion. Including VinFast, the total market capitalization of VinGroup’s companies on the stock exchange is nearly VND 1,000,000 billion.

The total value of Vingroup’s holdings in the listed companies on the Vietnamese stock exchange is over VND 342,700 billion, 17% higher than the Group’s current market capitalization.

Vinpearl, formerly known as Hon Tre Tourism, Trade, and Service Development Joint Stock Company, was established in 2001 and renamed Vinpearl in 2006. Vinpearl was listed on HoSE in January 2008 but delisted in December 2011 to merge with Vingroup.

Vinpearl is a well-known brand in the resort real estate market. The company also introduces itself as Vietnam’s leading tourism, resort, and entertainment brand.

Vinpearl owns a diverse ecosystem with 31 five-star hotels and resorts offering over 16,100 rooms, accounting for nearly 20% of Vietnam’s five-star hotel rooms. It also boasts a chain of 12 amusement and entertainment parks, the largest in Vietnam, including four 35-50ha themed parks, five entertainment and career education centers, a nearly 500ha wildlife conservation and care park, the largest and first of its kind in Vietnam, the largest water park in North Central Vietnam, an equestrian academy, four international-standard golf courses ranging from 18 to 36 holes, and a culinary and convention center.

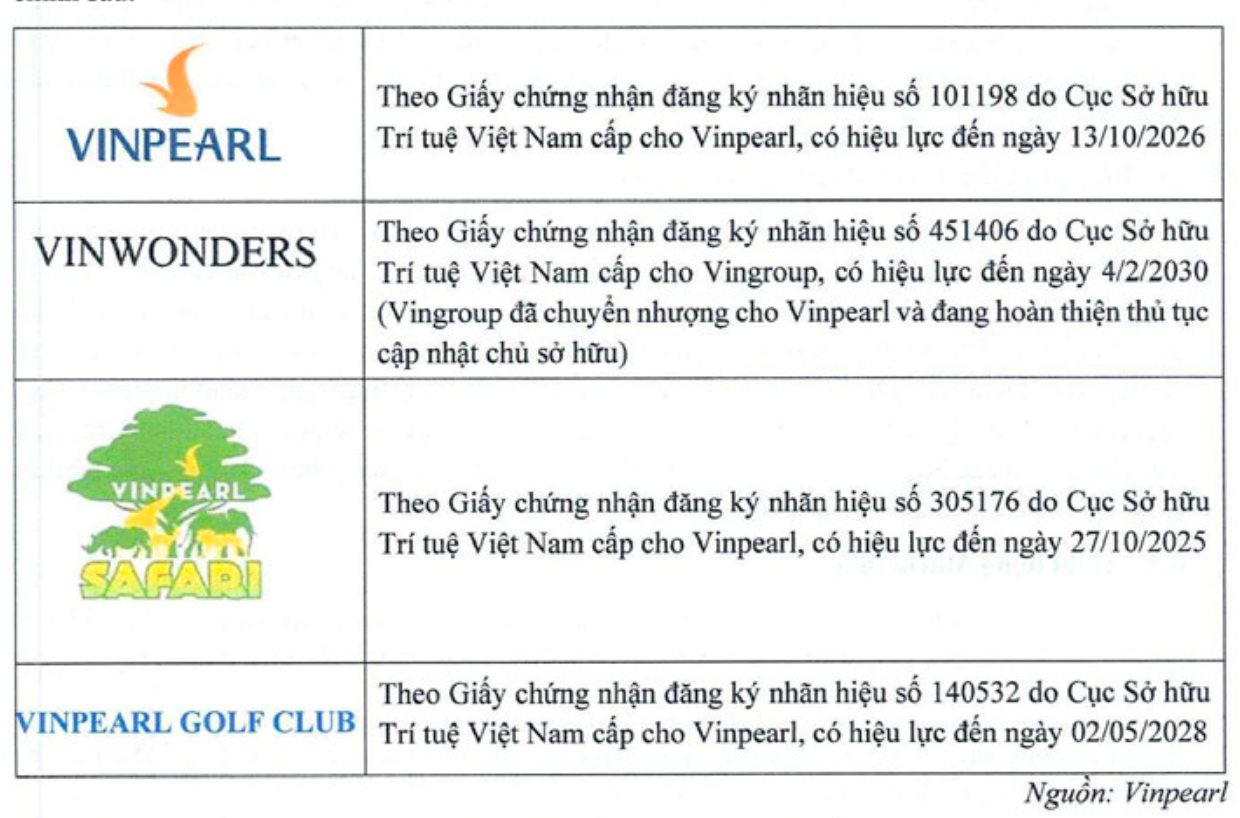

Vinpearl’s brands.

Q1/2025 revenue grew by 45%

In late 2024, Vinpearl was approved by the SSC to become a public company. In early February 2025, the company successfully raised over VND 5,000 billion from the issuance of over 70 million shares to 105 investors (priced at VND 71,350/share), thereby increasing its charter capital to VND 17,933 billion.

According to the initial issuance plan, Vinpearl will use the proceeds as follows:

+ VND 1,138 billion to contribute capital to Vinwonders Nha Trang JSC to invest in the Vinwonders Nha Trang Cultural Park project;

+ VND 1,855 billion to acquire 126.37 million shares, equivalent to 99.9% of the charter capital of Vinpearl Cua Hoi JSC (investor of Cua Hoi Amusement Park project) from Vingroup;

+ VND 495 billion to acquire a portion of the 1st floor and from the 5th to 19th floors of the commercial center – hotel project of the commercial center, hotel, and commercial townhouse project in Ha Giang;

+ VND 1,503 billion to repay debts and related expenses; and over VND 9 billion to supplement working capital.

Regarding business results, Vinpearl suffered heavy losses during the Covid-19 pandemic, with a loss of VND 9,570 billion in 2020 and VND 9,459 billion in 2021. However, the company returned to profitability in 2022 with a profit of VND 4,229 billion.

At the end of November 2023, Vinpearl split and established a new subsidiary named Vietnam Gemstone Joint Stock Company, with a charter capital of over VND 20,420 billion, of which Vingroup holds over 99.96% of the capital.

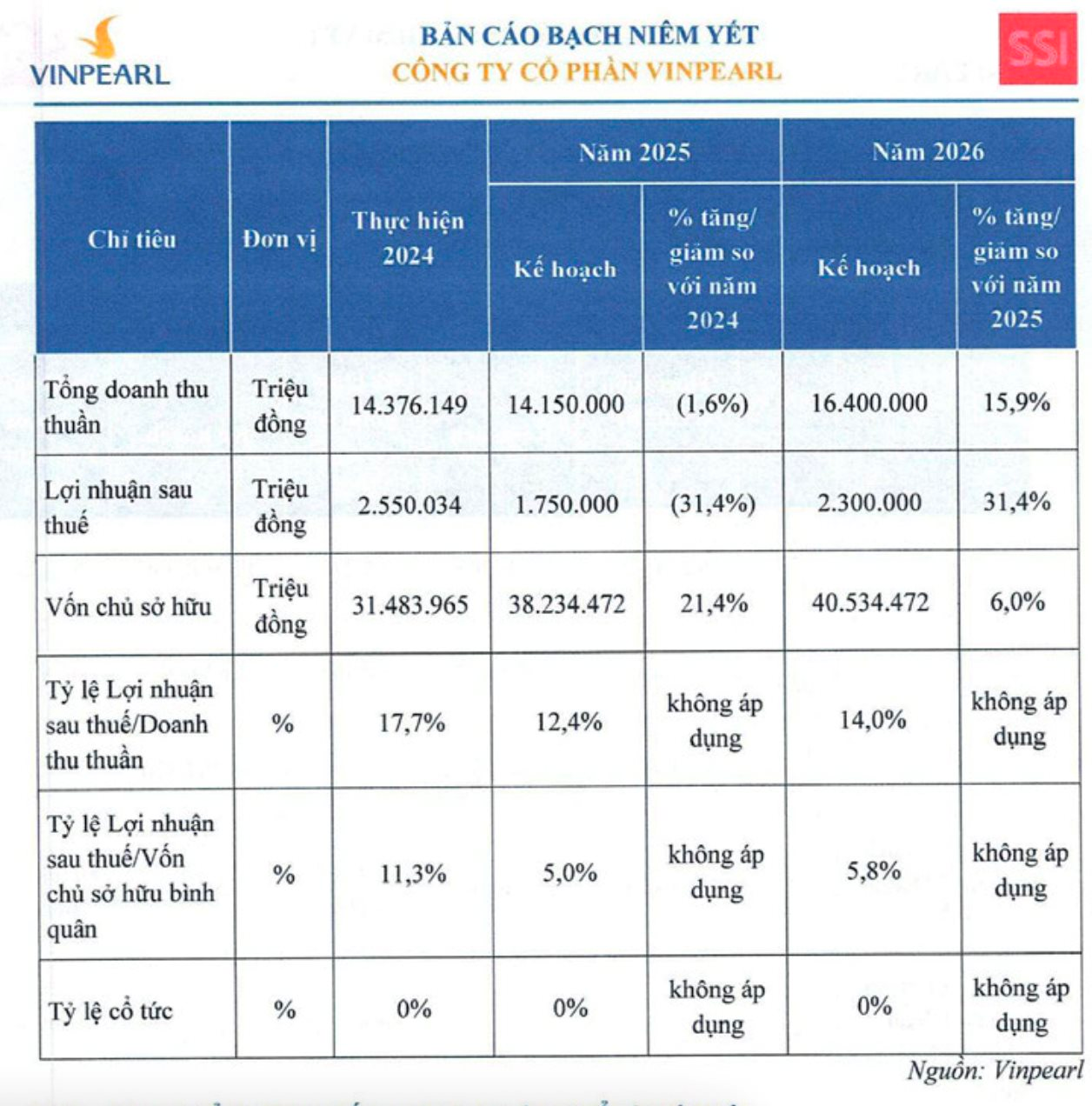

The subsequent financial statements of Vinpearl Joint Stock Company (after the split) showed that in 2024, the company achieved revenue of VND 14,376 billion, up 55% compared to 2023, with pre-tax profit of VND 2,940 billion and after-tax profit of VND 2,550 billion, 3.8 times higher than the previous year.

In 2025, Vinpearl targets revenue of VND 14,150 billion and expected after-tax profit of VND 1,750 billion.

In Q1/2025, Vinpearl recorded revenue of VND 2,435 billion, up 45% over the same period in 2024. After expenses, Vinpearl recorded a net profit of VND 90 billion.

Plan to increase owner’s equity to VND 40,534 billion in 2026

According to the Prospectus, the company expects a 16% increase in revenue to VND 16,400 billion in 2026, with a corresponding 31% increase in after-tax profit to VND 2,300 billion.

Currently, Vinpearl’s owner’s equity is VND 35,586.5 billion. In 2026, the company plans to further increase its owner’s equity to VND 40,534 billion.

As of March 31, 2025, Vinpearl’s total assets were VND 78,069 billion. Its total liabilities were VND 42,483 billion, including VND 12,055 billion in loans.