According to the financial report, as of December 31, 2024, F88 held 170,960 motorcycles and 13,149 automobiles as pledged assets. By the end of the year, the company had received 2.148 million assets, including 1.682 million motorcycles and 159,000 automobiles.

In addition to the pledged asset figures, the financial report also reflected the company’s business performance for the past year.

In 2024, F88 recorded consolidated revenue of VND 2,280.5 billion, an increase of 9.5% from the previous year. Of this, nearly 86% came from pawnshop lending and related services; insurance revenue accounted for 14%, with the remainder from other services.

Gross profit reached VND 626 billion, an improvement from a loss of VND 241 billion in 2023, thanks to a significant reduction in cost of goods sold. Financial income increased by 57%, reaching VND 447.8 billion; while financial expenses only increased by 1.7%, to VND 406 billion.

The net loss from business operations was VND 155 billion, but it narrowed compared to a loss of nearly VND 990 billion in the previous year. Other income reached VND 604.5 billion, nearly doubling. As a result, the company’s pre-tax profit was VND 449 billion and after-tax profit was VND 351 billion, a turnaround from a loss of VND 545 billion in 2023.

Staff salary and bonus expenses for 2024 amounted to VND 991.27 billion, accounting for 43% of revenue. This was the largest expense in the cost structure. Provision expenses ranked second at VND 919 billion (40% of revenue), a significant decrease from VND 1,550 billion in the previous year. Rental and marketing expenses accounted for 10% and 4% of revenue, respectively.

At the end of 2024, F88 had 4,030 employees, a reduction of over 100 people from the previous year. The average income was approximately VND 20.5 million per month.

In the first quarter of 2025, F88 disbursed VND 3,284 billion, an increase of 25% compared to the same period last year. Revenue and pre-tax profit for the first three months of the year increased by 21.5% and 204.1%, respectively.

Recently, F88 has become a public company. The enterprise aims to increase revenue and the number of customers by 30% in 2025.

“Boosting Pre-Tax Profits: Bac A Bank’s Strategic Focus Yields 8% Growth in Q1”

“Bac A Bank, a leading joint-stock commercial bank in Vietnam, has announced its consolidated profit for the first quarter of 2025. The bank reported a remarkable consolidated profit of over VND 367 billion, reflecting an impressive 8% increase compared to the same period last year. This significant growth showcases the bank’s strong performance and continued financial success.”

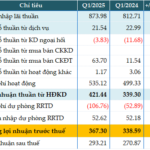

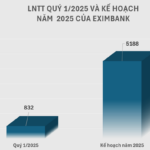

“A Profitable Quarter: Eximbank’s Pre-Tax Profits Soar by 26% in Q1 2025”

The first quarter of 2025 painted a diverse picture of profits in the banking industry, with a notable performance gap between private and large banks. While the big players maintained their steady growth trajectory, a few private banks, including Eximbank, stood out with impressive double-digit profit increases. This development underscores the evolving landscape of the banking sector, where smaller institutions are making their mark and challenging the traditional dominance of industry giants.

SIP Posts Highest Q1 Profit in 4 Years, Reaching Nearly 50% of Annual Target

Saigon VRG Joint Stock Company (HOSE: SIP) has announced its Q1 2025 financial results, reporting a net profit of over VND 351 billion, a remarkable 43% increase from the same period last year and the highest since Q1 2021. This achievement marks a strong start to the year, with the company already nearing 50% of its annual profit plan.

Vinamilk: Overseas Market Growth Continues in Q1 2025, Marking 7 Consecutive Quarters of Positive Performance

As of Q1 2025, Vinamilk (HOSE: VNM) recorded a consolidated net revenue of over VND 12.9 trillion, an 8% decrease compared to the same period last year, achieving over 20% of its annual plan. The domestic and overseas markets contributed over VND 10 trillion and over VND 2.9 trillion, respectively.