Skyrocketing Prices: Hanoi’s Main Street Properties Now Rival Suburban Townhouses in Price

According to PropertyGuru Vietnam, real estate prices for Hanoi’s main street properties are surging. In Q1 of 2025, compared to Q1 of 2023, prices surged by 30%, from an average of 337 million VND/sqm to 437 million VND/sqm. This price range is now on par with suburban townhouses.

Specifically, in the Ba Dinh district, on major roads such as Nguyen Cong Hoan, prices range from 430-520 million VND/sqm, a 15% increase from the previous year; on Cao Ba Quat street, prices increased from 240-320 million VND/sqm to 280-370 million VND/sqm, a 12-15% rise; on Ngoc Ha street, prices rose from 310-540 million VND/sqm to 360-620 million VND/sqm; and on Kim Ma street, prices climbed from 400-680 million VND/sqm to 440-730 million VND/sqm.

In the Dong Da district, main street property prices have also reached new heights. Within a year, property prices on Hoang Cau street increased from 380-470 million VND/sqm to 425-516 million VND/sqm. Properties on Yen Lang street experienced a rise from 330-490 million VND/sqm to 370-560 million VND/sqm. Even properties on Hoang Ngoc Phach street saw an increase from 350-370 million VND/sqm to 380-440 million VND/sqm.

As for properties on Huynh Thuc Khang street, despite already being at a high price point, they still witnessed a 7-10% increase, establishing a new price range of 550-770 million VND/sqm from the previous 520-710 million VND/sqm.

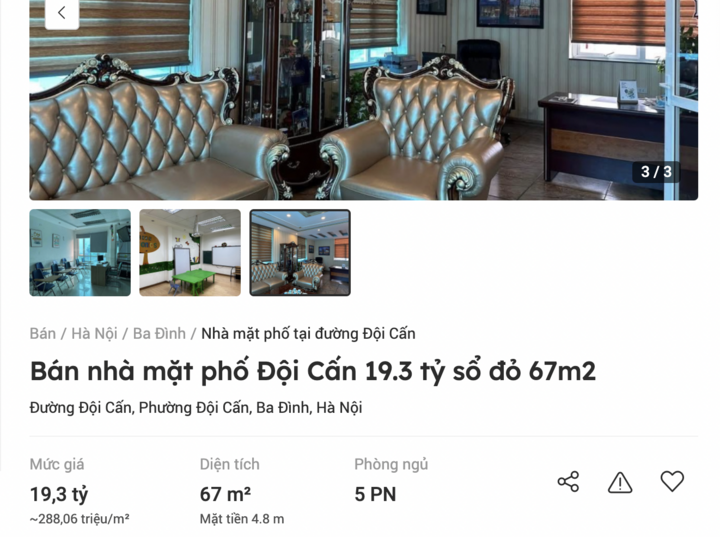

Many main street properties in Hanoi’s center are now priced similarly to suburban townhouses. (Screenshot)

This 10-15% increase within a year is also reflected in properties in the Cau Giay district. On Duy Tan street, depending on location and area, prices have risen from 230-520 million VND/sqm to an average of 265-580 million VND/sqm. Properties on Hoang Quoc Viet street have also increased in price from 380-550 million VND/sqm to 420-600 million VND/sqm. Nguyen Van Huyen street has set a new benchmark, with prices climbing from 365-570 million VND/sqm to 400-620 million VND/sqm.

Why Are Main Street Properties Attracting Buyers?

Ms. Nguyen Thi Han, a real estate broker in the Cau Giay district, expressed surprise at the doubled interest and inquiries about this segment, with a 20% increase in liquidity compared to the end of last year.

According to Ms. Han, main street properties in Hanoi’s center tend to be more selective in their target market compared to other segments like alley houses or apartments due to their high prices, with each property costing tens of billions of VND. Therefore, the recent buzz could be attributed to the spillover effect from the hot trend of land plots or certain urban projects, which has influenced the prices and attention given to this segment.

Mr. Pham Hoang Cuong, a real estate broker in the Dong Da district, shares a similar observation, stating that low-interest rates and the increasingly positive signals in the market have boosted investors’ confidence in this high-value property type.

In the current context, with prices starting from 20 billion VND per property, many investors are debating between villas, townhouses in urban areas, and main street properties in the city center. The immediate cash flow potential from renting out main street properties gives them an edge.

Mr. Cuong also believes that the prices of main street properties in Hanoi’s center will continue to rise due to the limited land availability in the area, preventing any new supply from entering the market. Additionally, the annual land price adjustments will further contribute to the increase in property prices.

Meanwhile, Mr. Nguyen Ngoc Giao, a real estate broker in the Ba Dinh district, attributes the recent attraction of main street properties to the skyrocketing prices of townhouses and villas in Hanoi’s peripheral areas. Previously, with just 6-7 billion VND, one could purchase a townhouse ranging from 80-100 sqm in the suburban areas. Now, these same townhouses are priced at around 15 billion VND, which is comparable to the price of a main street property in Hanoi’s center.

For instance, a 70 sqm townhouse in Gia Lam district is currently listed at 310 million VND/sqm, totaling nearly 22 billion VND. With this amount, buyers could opt for a main street property on Doi Can street (Ba Dinh district) with a similar area.

”

Hanoi’s main street properties have consistently demonstrated strong growth, excellent rental potential, and monthly cash flow. Notably, they possess high liquidity even during market downturns. In the past, this segment received less attention from investors due to its high prices. However, with the recent surge in prices across all segments, especially with many suburban townhouses and villas now reaching similar price ranges, investors are returning to main street properties

“, Mr. Giao analyzed.

According to experts, main street properties are a very sensitive type of real estate with excellent rental potential, making them valuable even during market downturns. (Illustration: Cong Hieu)

Caution: The Risk of Capital Entrapment

Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, analyzed that Hanoi’s main street properties represent a resilient real estate segment with enduring value, even during market downturns. Notably, this property type is highly sensitive to rental potential.

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, also assessed that main street properties and other commercial real estate in the core areas of the capital city, despite their exorbitant prices, always attract investors’ attention. Investors understand that over time, the scarcity of these properties will lead to exceptional price growth, surpassing any other form of real estate investment.

However, investing in main street properties is suitable for those with strong financial capacity and a long-term vision. While they offer potential for price appreciation and good liquidity, the high prices also bring the very real risk of capital entrapment. Therefore, it is crucial not to borrow funds for this type of investment.

Another noteworthy point is that while main street properties hold their value well, their price appreciation margin is lower compared to other types of real estate. Specifically, when the market performs well, other segments may see price increases of 30-100% per year, while this segment typically only experiences an average increase of 15-20% annually.

Mr. Nguyen The Diep, Vice President of the Hanoi Real Estate Club, shared that segments like main street properties and detached houses are currently considered safe havens for capital preservation in the context of the real estate market’s gradual recovery.

According to Mr. Diep, one drawback of this property type is its high selling price, often in the range of tens of billions of VND per property, which significantly limits the number of potential buyers. To optimize profits, buyers of Hanoi’s main street properties should carefully study the legal aspects and construction quality of the properties. Alternatively, if they already own such a property, they can consider renting it out or utilizing it for business and trading purposes.

Danang – From a Tourist Hotspot to the Promised Land for Settling Down

“With a new focus on becoming a high-tech economic and financial hub, Danang is poised to attract new residents and fuel the growth of the real estate market. Tourism has long been the driving force of the city, but this new direction will create a fresh dynamic, drawing in a new demographic and shaping the future of this vibrant city.”

What’s New at Long Thanh Airport?

The Ministry of Construction has made a local adjustment to the planning of the Long Thanh International Airport in Dong Nai. This includes reducing the width of the second runway from 60m to 45m. The planning of parallel taxiways, rapid exit taxiways, connecting taxiways, and common technical infrastructure has been adjusted to ensure synchronized operation with the first runway.

Unleashing Huế’s Potential: Revitalizing Stalled Projects and Reclaiming the Billion-Dollar Golf Course Land

The city of Hue is taking a stand against the wasteful practice of stalled projects that have been left idle for years, squandering land and resources. In a decisive move, the city has initiated a comprehensive review and is taking action to address delayed constructions, with the first step being the reclamation of land earmarked for a golf course project in Thuy Duong.

“The Rise of Bac Giang: Sustaining High Economic Growth”

As of April, Bac Giang province continued its high economic growth trajectory, with industry remaining the key driver. This was affirmed by the Provincial People’s Committee of Bac Giang.

The Strategic Alliance for Sustainable Growth: Bien Hoa Consumer & UOB Venture Management

“TTC Agri-Biotech Joint Stock Company, a proud member of the TTC AgriS family, is thrilled to announce that it has successfully raised capital from UOB Venture Management Pte Ltd (UOBVM). This significant milestone marks a new chapter in our journey towards becoming a leading consumer goods company in Vietnam and beyond.”