Services

From Traditional Financial Cooperation to the Journey of Building a Comprehensive Agricultural Finance Ecosystem

On May 8, 2025, AgriS and Military Commercial Joint Stock Bank (MB) signed a Memorandum of Understanding (MOU), establishing a strategic partnership aimed at building a comprehensive digital agriculture-finance ecosystem. According to the agreement, the two parties will collaborate to implement financial solutions for AgriS’s entire agricultural value chain, including specialized credit products for Farmers, Suppliers, Distributors, Customers, and other Related Parties. The cooperation will also involve developing financial products to support specific ESG goals, contributing to AgriS’s strategy of participating in the global FBMC value chain and its net-zero emissions commitment.

Signing ceremony of the strategic cooperation between AgriS and MB, establishing a strategic partnership towards building a comprehensive digital agriculture-finance ecosystem

|

The products will be designed specifically for the agricultural industry, taking into account the seasonal nature of farming, with a focus on investing in high-tech agricultural initiatives to optimize cash flow, from production to processing, consumption, and expansion into international markets, thereby enhancing capital efficiency and competitiveness across the entire ecosystem. Specifically, AgriS and MB will collaborate to offer short-term credit products with automated and semi-automated disbursements to farmers for investing in supplies, caring for, harvesting, and transporting sugarcane raw materials. They will also provide medium and long-term credit financing for purchasing machinery and equipment, leasing land, and developing infrastructure, as well as establishing credit policies for outlets. For suppliers and distributors, AgriS and MB will offer financial support through methods such as payment guarantees, credit line extensions, and automated/semi-automated disbursements on a digitized integrated platform.

Prior to this, AgriS had established partnerships with several prominent domestic and international financial institutions. In October 2024, AgriS successfully raised $42 million from two European financial organizations, SACE (Italy) and ING (Netherlands). In February 2025, in Hanoi, the company signed a Comprehensive Cooperation Agreement for the 2025-2030 period with BIDV Bank to build a sustainable financial connectivity platform and enhance value across the entire agricultural chain. Earlier in May, AgriS concluded another capital raising transaction with UOB Venture Management to serve its new development strategy for the next phase. Within a short period, AgriS has become a hub for connecting multiple domestic and foreign financial institutions, forming a strategic alliance to usher in a new era of sustainable agricultural finance in Vietnam.

AgriS continuously forges strategic relationships with leading financial institutions, building a sustainable agricultural finance ecosystem

|

Three Strategic Pillars Shaping AgriS’s Agricultural Finance Ecosystem

AgriS’s position as a top destination for financial institutions investing in sustainable agriculture can be attributed to its well-structured strategy for building an agricultural finance ecosystem, which comprises three main pillars.

Digital Technology: AgriS has been a pioneer in applying the most advanced technologies to agricultural production, including smart farming, blockchain for traceability, AI in cultivation analysis, and IoT for farm monitoring. These technologies form the foundation for AgriS’s digitization of the entire production process, from inputs (seeds, supplies, fertilizers) to outputs (transportation, distribution, consumption), thereby enhancing production efficiency and capital utilization.

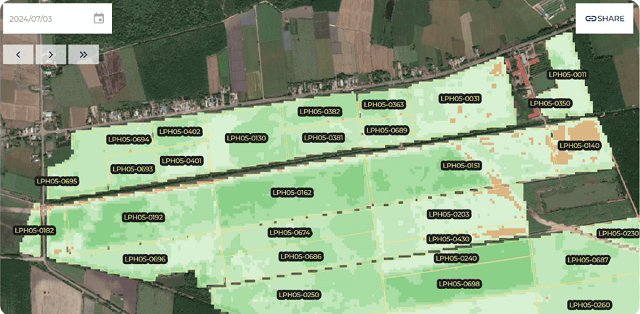

AgriS utilizes satellite imagery for field management, collecting crop images to assess and analyze sugarcane growth (Source: AgriS Annual Report 2023-2024)

|

Data and Analytics: With a comprehensive digitized operating system and a large-scale production advantage, AgriS has established a extensive database covering the entire production and consumption process within the agricultural value chain. These data not only support efficient investment analysis and decision-making but also optimize the entire supply chain. As a result, AgriS can develop financial products that meet the practical needs of each entity in the agricultural value chain, delivering the highest practical efficiency.

Chain Finance: Based on its digital technology foundation and analytical data system, AgriS has developed a chain finance model for the agricultural value chain, working with financial partners to design credit packages tailored to each production stage. This model enables real-time capital control, risk minimization, and optimized capital efficiency. Consequently, the related parties in AgriS’s value chain can access capital more quickly, flexibly, and diversely, rather than relying solely on traditional collateralized assets.

AgriS serves as the nucleus, connecting relevant parties in the value chain to ensure that each link maximizes its potential and sustainably benefits from the ecosystem.

|

Embarking on a New Era of Vietnamese Agricultural Finance