In his presentation, Minister of Finance Nguyen Van Thang proposed a 2% reduction in the VAT rate for goods and services currently subject to a 10% rate (resulting in an 8% rate) with certain exceptions. These exceptions include telecommunications, financial activities, banking, securities, insurance, real estate, metal products, mining products (excluding coal), and special consumption tax items (excluding gasoline). This policy will be effective from July 1, 2025, to December 31, 2026.

Minister of Finance Nguyen Van Thang. Photo: Pham Thang

Compared to previous VAT reductions, the government has proposed a wider scope of items eligible for reduced rates. Newly added items include information technology products such as washing machines, microwaves, data processing services, leasing and related activities, and web portals.

Regarding gasoline and oil, the drafting agency stated that while gasoline is subject to special consumption tax and oil is a refined petroleum product, they are essential for various industries and people’s livelihoods. Therefore, fluctuations in the prices of gasoline and oil directly impact domestic production, consumption, and macroeconomic stability.

The proposed VAT reduction is expected to result in a decrease in state budget revenue of approximately VND 121,740 billion for the last six months of 2025 and the whole of 2026. According to the government, this reduction will contribute to lowering the cost of goods and services, thereby boosting production and business activities, creating more jobs for workers, and supporting macroeconomic stability and economic growth in the latter half of 2025 and throughout 2026.

For citizens and businesses, the 2% VAT reduction will directly reduce their expenses on consuming goods and services. Simultaneously, it will help businesses lower production costs, reduce product prices, and enhance their competitiveness.

Chairman of the National Assembly’s Committee for Economic and Financial Affairs, Phan Van Mai, presents the verification report. Photo: Pham Thang

Verifying the content, Mr. Phan Van Mai, Chairman of the National Assembly’s Committee for Economic and Financial Affairs, stated that the majority of the Committee agreed with the necessity to issue a resolution to continue the VAT reduction policy.

According to the verifying agency, the continued issuance of this policy can be considered a measure to stimulate domestic consumption and promote growth, contributing to achieving the set target of 8% growth.

However, some opinions disagreed, stating that the continued proposal to issue this policy is inappropriate and unlikely to achieve the intended goal of stimulating consumption, as the policy’s stimulating effect may have already reached its limit after a long period.

Mr. Phan Van Mai also conveyed that some opinions expressed concern that repeatedly extending the implementation of the policy sets a negative precedent, undermining the stability and consistency of tax policies. Additionally, the shrinking fiscal and policy space may hinder the ability to respond effectively to more severe economic crises in the future.

Some opinions suggested that expanding the scope of reduced taxes should be carefully considered, given the current stable economic growth. They believed that proposing to expand the scope of reduced taxes is not truly appropriate at this time.

From 2022 to the first half of 2025, the National Assembly resolved to reduce the VAT rate by 2% for goods and services subject to the 10% rate, with certain exceptions.

The VAT reduction, along with other tax, fee, and charge support solutions, has significantly helped businesses reduce production costs, increase profits, and stimulate demand.

“The Power of Private Enterprise: A Special Resolution for Economic Growth”

The National Assembly’s resolution on special mechanisms and policies to promote the private sector is a concise and groundbreaking document. Its drafters have worked diligently to ensure its passage by the end of this week.

The Ultimate Guide to Crafting Compelling Copy: “Unveiling the New: 12 Projects in Hai Phong”

On May 11, 2025, the People’s Committee of Hai Phong City held a grand ceremony to inaugurate and launch 12 key projects and works in the city. This is a core activity leading up to the 70th anniversary of Hai Phong’s Liberation – the Heroic City and the Red Flamboyant Festival – Hai Phong 2025.

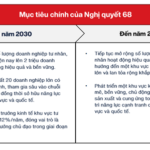

Unlocking Vietnam’s Economic Potential: Resolution 68 and the Rise of the Private Sector

The Politburo has issued Resolution 68 – a significant directive that is expected to bring about a major shift in the orientation of private sector development in Vietnam. Marked as a historic turning point, this Resolution elevates the private sector’s status, clearly recognizing it as the “most important driving force of the national economy.”