397 Joint Stock Company (Stock Code: BCB) announces the record date for the 2024 cash dividend.

Accordingly, the record date is May 30, with expected payment on June 20, 2025. The company will pay dividends in cash at a rate of 28.10%/share, equivalent to VND 2,810 per share.

BCB maintains a share price of only VND 700/share. Thus, the cash dividend yield on this share price is over 400%.

With 5.7 million shares currently in circulation, 397 Joint Stock Company is estimated to spend approximately VND 16 billion on dividend payments to shareholders.

More than half of this amount, approximately VND 8.16 billion, will go to its parent company, Dong Bac Corporation, which is under the Ministry of Defense and holds a 51% stake.

In addition to the parent company, 397 Joint Stock Company has two other major shareholders: Quang Thanh Construction Company Limited (holding 20%) and Tho Huan Construction, Trading and Services Joint Stock Company (holding 11.46%). They will respectively receive VND 3.2 billion and VND 1.8 billion in this dividend payout.

Since its listing on the UPCoM in 2018, the annual dividend rate has consistently been in the double digits (ranging from 16-37%), while the share price has been “cheaper than iced tea”. Along with a concentrated shareholder structure, these factors have kept BCB in a constant state of sell-side pressure in the market.

It is known that 397 Joint Stock Company was formerly the First Coal Mining Team, established in June 1996 under the Dong Bac Corporation of the Ministry of Defense, and transformed into a joint-stock company in December 2017.

Its main business is the mining and collection of hard coal, mainly in the Nam Trang Bach mine, with an area of 187.31 hectares and reserves of 4.8 million tons. The company is also engaged in wholesale fuel sales, pipeline cargo transportation, equipment repair, etc.

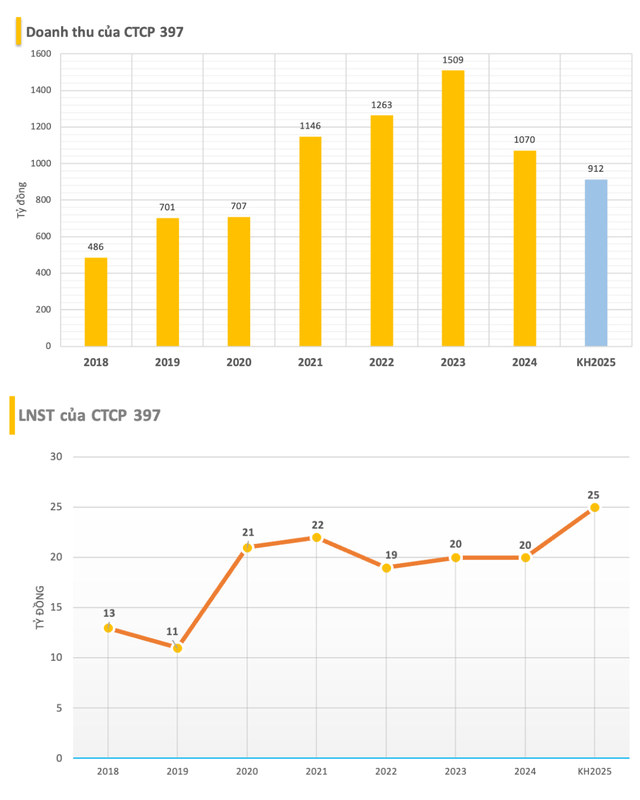

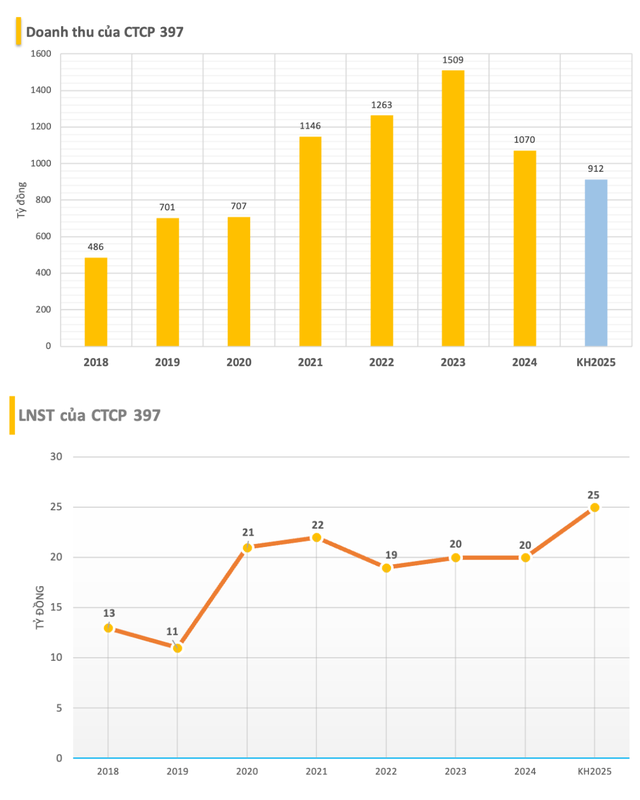

From 2021 to the present, the company has consistently achieved revenue of over VND 1,000 billion, but profits have hovered around VND 20 billion.

In 2024, the company’s revenue reached over VND 1,070 billion, a decrease of 30%, but its after-tax profit remained almost unchanged from the previous year at approximately VND 20 billion, exceeding the set plan.

This is the fourth consecutive year that the company has maintained revenue above VND 1,000 billion.

For the 2025 plan, BCB expects to achieve revenue of VND 912 billion, a decrease of 14.7% compared to the 2024 performance. However, the expected pre-tax profit is VND 25 billion, an increase of 25% compared to the 2024 performance.

The Booming Agri-Business Mogul of Long An: A Sudden Surge in Profits, Surpassing Industry Giants

GreenFeed witnessed a remarkable surge in its financial performance, recording an impressive after-tax profit of over 2,106 billion VND in 2024, marking a substantial 382% increase compared to the previous year. This unprecedented achievement sets a new record for the company, highlighting its exceptional growth and success.

“Gelex Electric Ventures into Tech with a New Subsidiary”

Introducing the newly established subsidiary, Gelex Technology Limited, with a chartered capital of VND 50.84 billion. Gelex Electric, a key contributor, invested nearly VND 25.93 billion, acquiring a 51% stake in the company.

“Harec Building Owner Locks in 30.5% Dividend Yield.”

The Harec Investment and Trading JSC (UPCoM: HRB), owner and operator of the prestigious Harec Building in Hanoi, has announced the record date for shareholders to receive cash dividends for the year 2024. Shareholders on record as of May 21st, 2025, will be eligible to receive this dividend payment.

The Ultimate Windfall: Unveiling the Secrets Behind a Vietnamese Company’s Stellar Performance with a 444% Surge in Q1 Profits, Positioning Itself as a Global Leader in the Highly Coveted Mineral Industry.

“With this latest announcement, the total cash dividend for 2024 amounts to an impressive 138% (VND 13,800 per share), marking a historic high for the company. This unprecedented payout underscores our commitment to sharing our success with our valued shareholders and reinforces our position as a leader in the industry.”