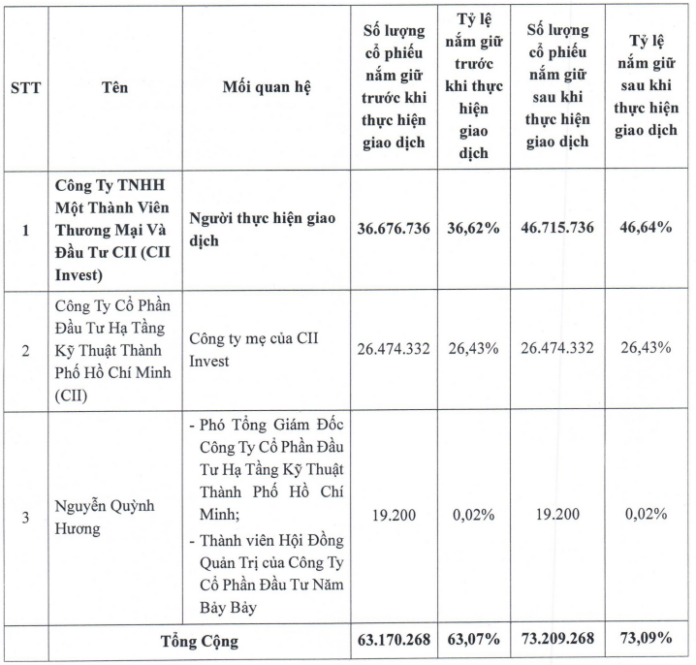

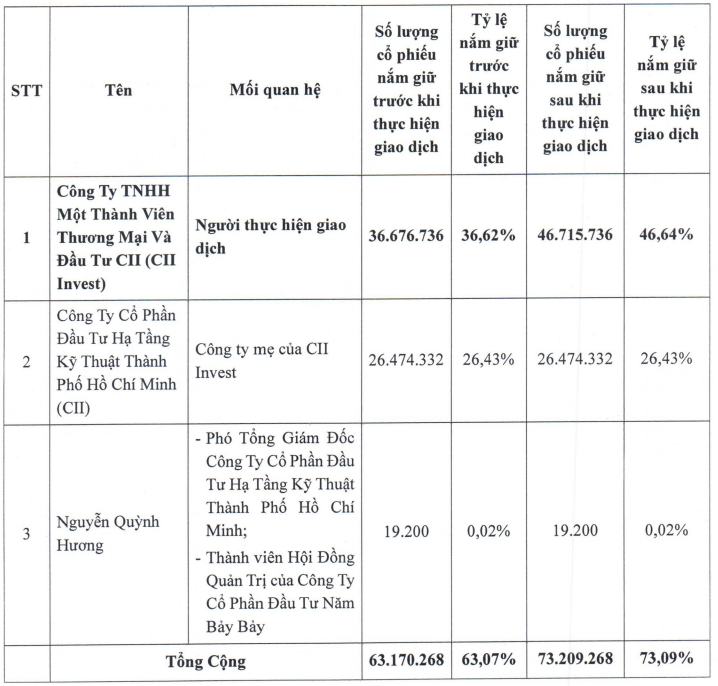

As a result, CII Invest’s ownership stake in NBB increased from 36.62% to 46.64%, equivalent to over 46.7 million shares. Based on the closing price on May 12, the transaction value is estimated at nearly VND 235 billion.

After this transaction by CII Invest, the total ownership ratio of this unit, together with its parent company, Ho Chi Minh City Infrastructure Investment Joint Stock Company (HOSE: CII), and related party, Nguyen Quynh Huong, increased from 63.07% to 73.09%, equivalent to over 73 million shares.

|

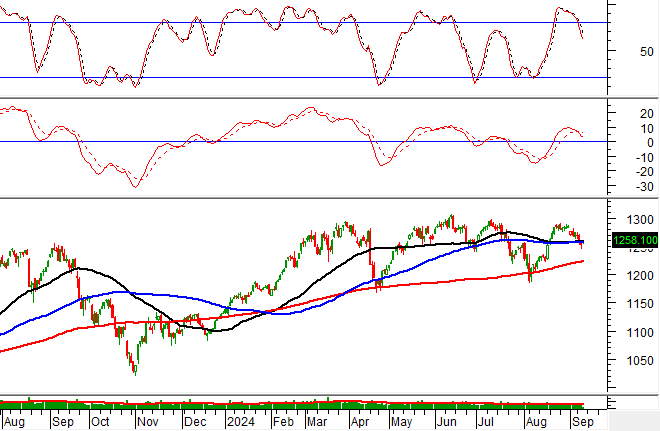

Ownership ratio of the CII group of shareholders in NBB at the end of the May 12, 2025 trading session

Source: CII Invest

|

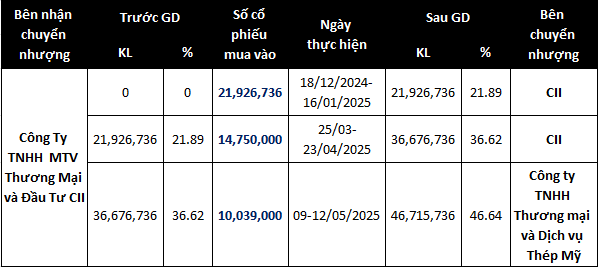

Prior to receiving the transfer from My Steel, CII Invest had purchased nearly 37 million NBB shares (36.62%) through a negotiated deal with its parent company, CII, between December 18, 2024, and April 23, 2025.

|

Process of CII Invest accumulating NBB shares from December 2024 up to now

Compiled by the author

|

The move by CII Invest to accumulate shares took place against the backdrop of the NBB Board of Directors’ approval on March 17 to accept cooperation from CII Invest for an investment project with a value of VND 650 billion. According to the consolidated financial statements for the first quarter of 2025, as of March 31, 2025, the above amount of VND 650 billion was accounted for by NBB as short-term loans for cooperation in the Son Tinh project (Quang Ngai province), with an interest rate of 12% per annum and maturity date of March 17, 2026.

In addition, CII Invest also provided NBB with long-term loans amounting to VND 940 billion to recapitalize its investments in assets and real estate projects that NBB is currently developing. The loan has an interest rate of 9.6% per annum and a term of 60 months.

– 10:25, May 13, 2025

“Vietnam’s Largest Private Bank Prepares for an Imminent Cash Dividend Payout”

With a rate of 5% per par value (VND 500/share), the bank plans to allocate VND 3,967 billion for dividend distribution.

The Young Man’s Debt: A Tale of a 3.7 Billion Dong Debt and a Missing Debtor

Introducing the master of deception, Dat, who weaves lies to secure loans, leaving a trail of broken promises and unpaid debts in his wake. With his silver tongue, he spins tales of financial need, ensnaring unsuspecting lenders in his web of deceit. This crafty individual manipulates the system, using loans to settle scores with banks, only to default on his obligations.

Shinhan Bank: Empowering SMEs with Comprehensive Financial Solutions

“Shinhan Bank is committed to empowering small and medium-sized enterprises (SMEs) and micro-businesses with comprehensive financial solutions. Our goal is to provide a robust financial foundation for the sustainable growth of businesses, offering a wide range of tailored services to meet their unique needs and help them thrive in a competitive market.”

“DXS Acquires Dat Xanh Mekong From Cara Group Subsidiary”

On April 29, 2025, the Board of Directors of Dat Xanh Real Estate Service Joint Stock Company (HOSE: DXS) approved the acquisition of nearly 2.3 million shares of Cara Group Joint Stock Company in Dat Xanh Tay Nam Service Joint Stock Company (DXMT).