With 3 million shares in circulation, the Company is estimated to spend around VND 6.6 billion. Payment will be made from May 28 onwards.

Source: VietstockFinance

|

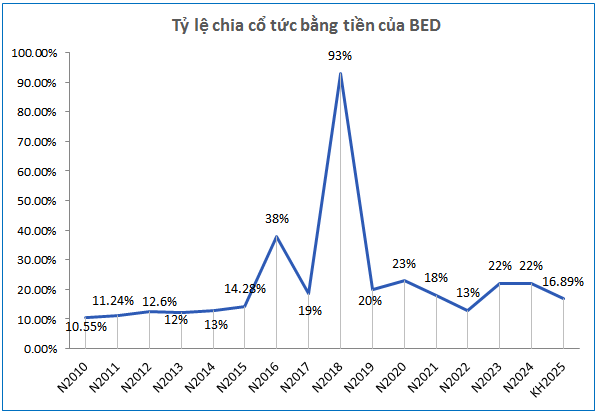

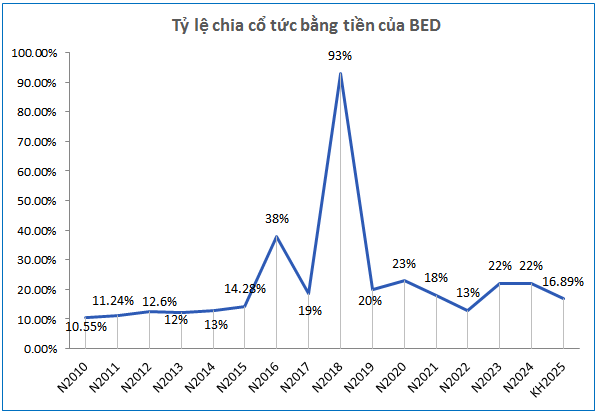

In 2024, BED recorded nearly VND 80 billion in revenue and over VND 7 billion in net profit, a decrease of 4% and 8%, respectively, compared to 2023. However, the Company maintained the same dividend payout as the previous year.

Excluding 2018, when BED paid out an unusually high dividend of 93% due to extraordinary profits from the transfer of land in Ho Chi Minh City, the Company typically maintains a dividend payout ratio ranging from 11% to 38%.

Source: VietstockFinance

|

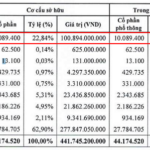

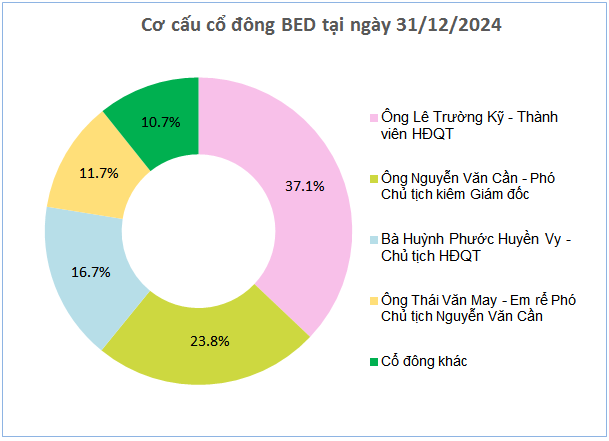

As of the end of 2024, over 89% of BED‘s capital was held by four major shareholders, all of whom are insiders. Mr. Le Truong Ky, a member of the Board of Directors, is the largest shareholder with a 37.1% stake and is expected to receive more than VND 2.4 billion from this dividend payout.

For 2025, BED targets revenue similar to the previous year (VND 80 billion) but expects a 29% decrease in net profit to over VND 5 billion, mainly due to anticipated increases in management expenses.

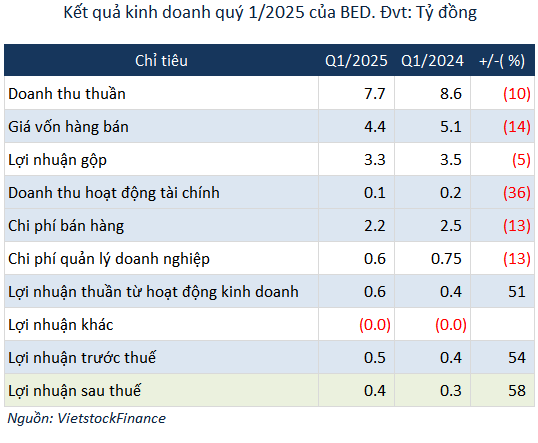

In the first quarter of 2025, BED recorded nearly VND 8 billion in revenue, a 10% decrease compared to the same period last year. However, thanks to a more significant reduction in cost of goods sold (14%), gross profit decreased by only 5%, amounting to over VND 3 billion. After deducting selling expenses of more than VND 2 billion and management expenses of over VND 500 million (both down 13%), the Company’s net profit was over VND 400 million, up 58% from VND 254 million in the first quarter of 2024.

According to BED, the revenue decline in the first quarter was due to lower sales across most product categories, including textbooks, children’s books, fiction, stationery, cultural products, printing services, and office rentals.

| Share price movement of BED from the beginning of 2024 to May 14, 2025 |

Due to the concentrated shareholder structure, BED shares have low liquidity, and the market price has remained unchanged at VND 30,800 per share for over a year.

– 11:08 14/05/2025

The Ultimate Windfall: Unveiling the Secrets Behind a Vietnamese Company’s Stellar Performance with a 444% Surge in Q1 Profits, Positioning Itself as a Global Leader in the Highly Coveted Mineral Industry.

“With this latest announcement, the total cash dividend for 2024 amounts to an impressive 138% (VND 13,800 per share), marking a historic high for the company. This unprecedented payout underscores our commitment to sharing our success with our valued shareholders and reinforces our position as a leader in the industry.”

“NHA to Pay Dividends After 5 Years”

Introducing the Urban and Southern Hanoi Housing Development and Investment Corporation (HOSE: NHA), a powerhouse in the real estate industry, as they announce their latest dividend offering. Shareholders, take note: May 27th is the crucial date for entitlement, as the company gears up to distribute its 2024 dividend entirely in shares.