“Blockbuster” Hits the Market After a Long Absence

On May 13, over 1.79 billion VPL shares of Vinpearl Joint Stock Company officially started trading on the HoSE, with a reference price of 71,300 VND/share on the first trading day. VPL shares were in high demand and soared to the daily limit of 85,500 VND/share, pushing Vinpearl’s market capitalization above 150 trillion VND, entering the top 10 listed companies.

The last time a billion-dollar company was listed on the stock exchange was in 2018 when Vinhomes ( VHM ) was listed with a valuation of about $10 billion. After a long quiet period due to the absence of “blockbusters” on the market, Vinpearl’s listing is expected to create a boost for the Vietnamese stock market.

Vinpearl operates in the tourism and hospitality industry, a sector with high growth potential due to the recovery of international tourism and the growing middle class in Vietnam. The presence of Vinpearl offers investors an alternative to traditional sectors such as finance and real estate.

According to Dang Van Cuong, Investment Consulting Director at Mirae Asset, Vinpearl’s listing will create a positive sentiment in the stock market as it has been a while since Vietnam had a “blockbuster” IPO. Besides offering investors a new option in a promising field, Vinpearl, with its large scale and strong potential, is expected to contribute to the goal of reaching a stock market capitalization of 120% of GDP by 2030.

For Vingroup, Vietnam’s largest private enterprise, this listing adds another member, bringing the total market capitalization of the group (Vingroup, Vincom Retail , Vinhomes, Vinpearl, VinFast, Vefac, and Savina) to nearly 1 quadrillion VND. With diverse business sectors and clear strategies for each unit, this ecosystem will continue to thrive as the private sector becomes a vital driver of the economy and receives supportive policies.

With the impressive recovery of the tourism industry, especially the number of international visitors to Vietnam surpassing pre-pandemic levels, Vinpearl’s business results are expected to continue improving, contributing to the group’s overall performance. Additionally, the listing will make it easier for Vinpearl to raise capital for future expansion plans.

Perfect Timing for Listing

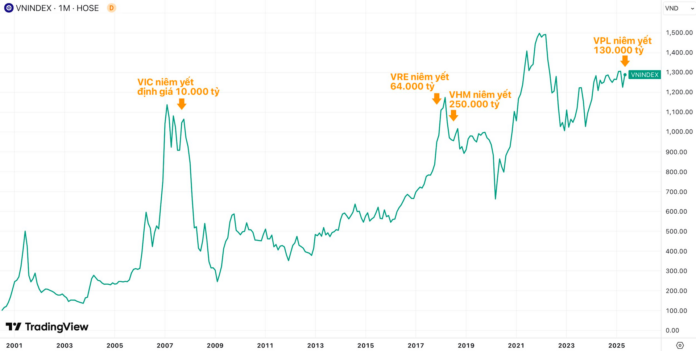

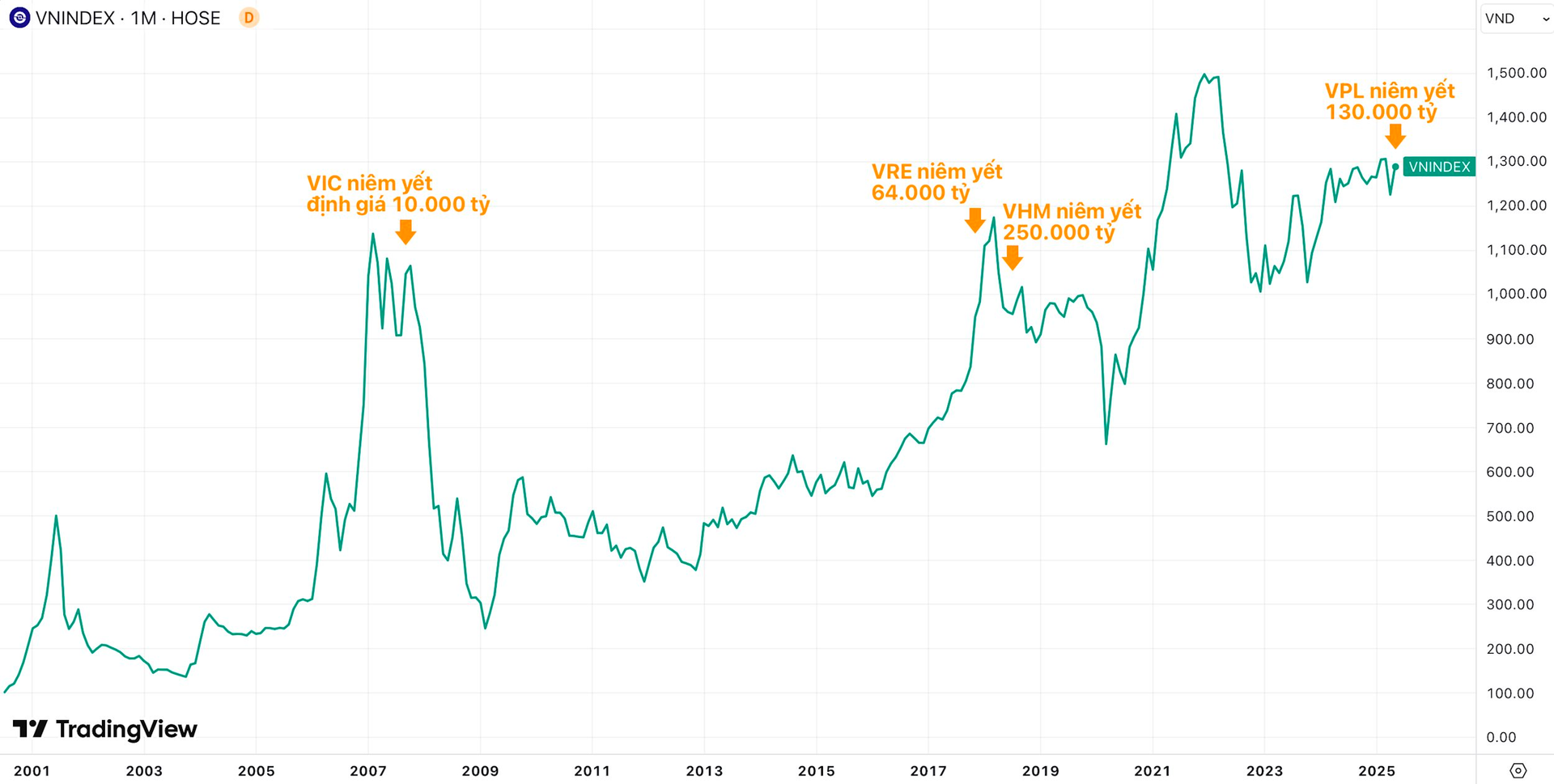

Looking back, it is evident that the stock market’s significant surges were often marked by “blockbuster” IPOs. For example, during the 2006-07 period, prominent companies going public pushed the VN-Index close to the 1,200-point mark. Similarly, in the 2015-18 period, a series of large state-owned and private enterprises went public, and the index returned to the 1,200-point threshold after a decade.

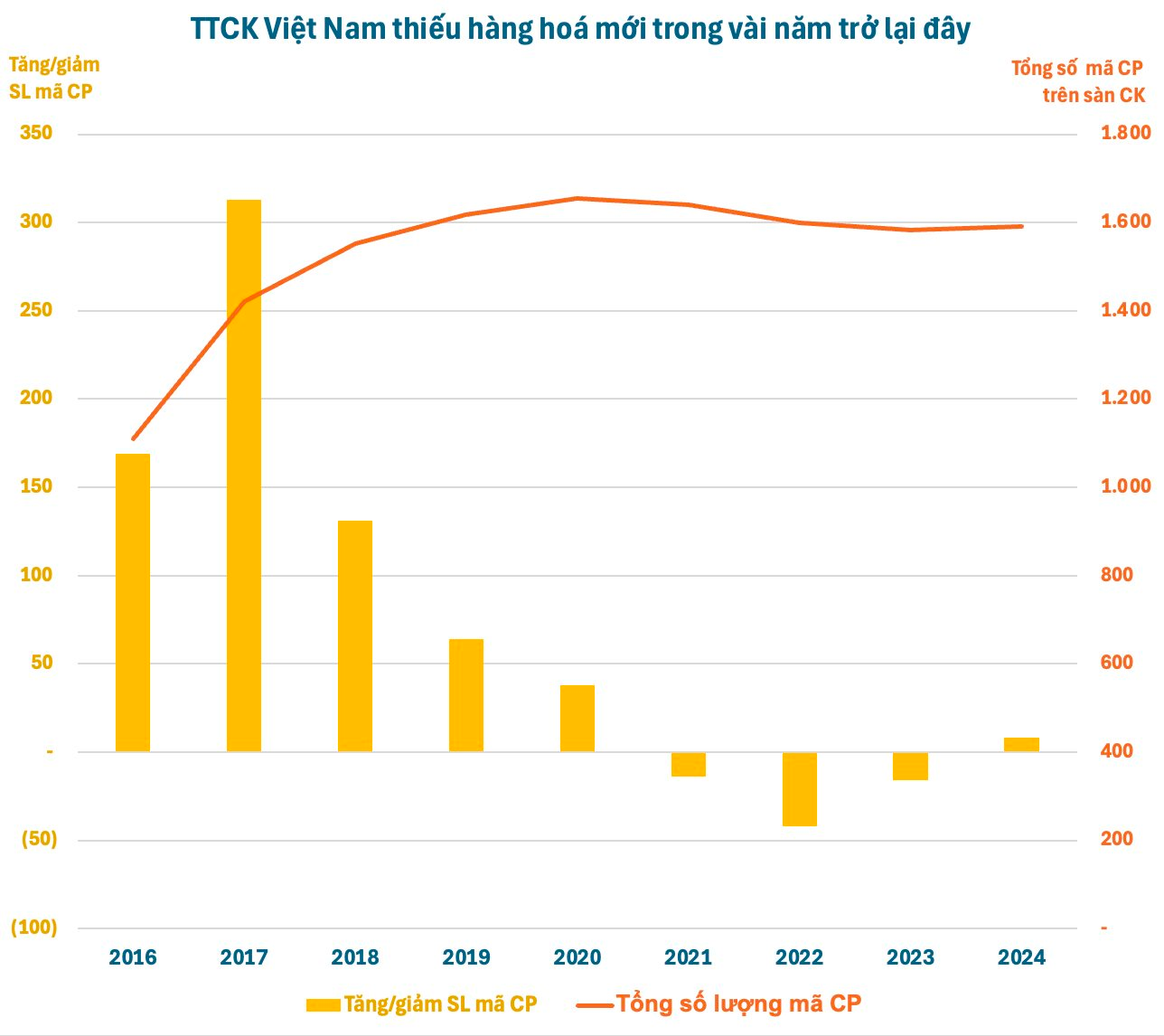

Most recently, in 2020-21, alongside the story of cheap money, the wave of bank stocks listing was one of the essential drivers pushing the market continuously upward, setting a historical peak of over 1,500 points. Evidently, new and high-quality stocks are indispensable catalysts in each historical wave of the stock market, yet they have been lacking in recent years. Vinpearl’s listing is expected to trigger a “domino effect,” attracting more “blockbusters” to go public in the coming time.

Following Vinpearl, notable names such as TCBS and F88 are also preparing for their IPOs and aiming for a stock exchange listing. Looking further ahead, the market can anticipate the likes of THACO AUTO, Bach Hoa Xanh, Golden Gate, and Highlands Coffee, VPS, Viettel IDC, Misa, VNPay, and Long Chau. At the Investor Day earlier this year, Le Anh Tuan, Investment Director of Dragon Capital, predicted that the stock market would welcome an IPO wave with a scale of $47 billion in the 2027-2028 period.

According to some assessments, this is the golden time for enterprises to be listed as the stock market stands at an opportunity to attract large amounts of capital. After the efforts of the management agency, the prospect of an upgrade for Vietnam’s stock market is becoming clearer. If the upgrade is successful, billions of dollars could flow into the market.

Moreover, Vietnam is in a pivotal phase of transforming its economic structure, prioritizing the development of science and technology (Resolution 57) and promoting the private economy (Resolution 68). This is a crucial driver for businesses to grow and expand globally, contributing to the country’s new era of advancement.

The Japanese Company Expanding its Horizons: A $132 Million Investment in Hung Yen to Quadruple Production Capacity

“Nitto Vietnam Limited (a wholly-owned Japanese company) received an investment certificate for a $132 million project in Hung Yen province in September 2023. In a recent development, the company has been granted approval to increase its investment capital to $160 million, marking a substantial increment of $28 million.”

“US-Vietnam Trade Agreement: A Mutually Beneficial Partnership”

On May 13, Prime Minister Pham Minh Chinh met with representatives of the American business community investing and operating in Vietnam. The purpose of this meeting was to listen to and address any challenges they may face, as well as to discuss proposals to enhance Vietnam-US investment and business cooperation.