Vinamilk Sees Almost 40% Increase in Domestic Sales

At a recent investor briefing on Q1 financial results, Vinamilk’s CFO, Mr. Le Thanh Liem, revealed that domestic sales for April showed a growth of over 10% year-on-year and an impressive nearly 40% increase compared to the average monthly sales of Q1.

Mr. Liem attributed this growth mainly to the traditional channel, which remains the company’s primary distribution channel. The positive results also reflect the successful restructuring of their distribution system, especially the traditional channel.

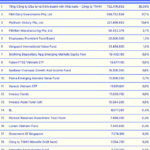

In Q1, Vinamilk’s consolidated net revenue reached VND 12,935 billion, completing over 20% of the annual plan. The domestic market contributed VND 10,011 billion (77%) while overseas markets accounted for VND 2,924 billion (23%). Consolidated gross profit for the quarter stood at VND 5,210 billion.

Overseas markets showed a nearly 12% increase year-on-year, driven by strong export performance, maintaining seven consecutive quarters of positive growth. For the first time, overseas markets contributed over 20% to the consolidated net revenue.

Vinamilk has expanded its reach to two new export markets, bringing the total cumulative export markets to 65. The company’s Q1/2025 export revenue reached VND 1,620 billion, a nearly 25% increase year-on-year.

Vinamilk has been consistently innovating its product portfolio.

To enter these new export markets, Vinamilk’s products had to undergo stringent inspections by international organizations such as Bureau Veritas, Intertek, and TUV.

During the quarter, Vinamilk proactively restructured its domestic distribution and business system as part of its post-packaging redesign strategy. While these changes may have a short-term impact on financial results, they are expected to drive sustainable growth and reinforce Vinamilk’s position as the leading dairy company in Vietnam.

At the 2025 Annual General Meeting, Vinamilk approved a plan for net revenue and pre-tax profit of VND 64,505 billion and VND 12,102 billion, respectively, representing a 4.3% increase year-on-year.

BAF Vietnam Achieves Record-Breaking Performance

In a recent investor update, BAF Vietnam’s Deputy General Director, Mr. Ngo Cao Cuong, shared that global pork prices in Q1 showed a slight increase compared to February and the previous year, reaching 118 points. This upward trend was mainly due to Germany’s successful eradication of foot-and-mouth disease (FMD), leading major trading partners like the UK to lift import bans.

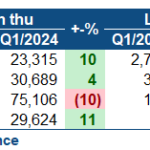

In Q1, BAF Vietnam recorded over VND 1,100 billion in net revenue (a 10% decrease year-on-year) and a net profit of VND 132 billion (an 11% increase). BAF attributed the revenue decrease to the strategic decision to minimize low-margin agricultural produce trading and focus on livestock farming. Through continuous expansion, BAF’s total herd size has reached nearly 800,000, double the size from 2023.

BAF Vietnam broke records in April with VND 450 billion in monthly revenue.

Mr. Cuong revealed that BAF set a new record in April, achieving their highest-ever monthly revenue of VND 450 billion.

“From now until the end of the year, we expect to bring additional new farms online and expand existing ones, which should lead to even better results,” said Mr. Cuong.

According to Mr. Cuong, pork prices in Vietnam are unlikely to drop below VND 60,000/kg and may even increase to VND 80,000/kg due to the complex epidemiological situation. While US tariffs may increase pork imports, they are not expected to significantly impact prices due to Vietnam’s consumption habits.

Moreover, with the current favorable hog prices (above VND 70,000/kg) and BAF’s 2025 AGM plan based on a hog price of only VND 58,000/kg, the company is well-positioned to exceed its profit plan for the year.

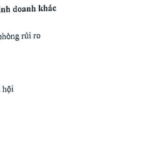

The Pain of Q1: Oil & Gas Sector’s Struggles

The sharp decline in global oil prices in Q1 has taken a toll on businesses in the petroleum sector, with most companies experiencing a significant downturn compared to the previous year. This development aligns with the predictions made by several securities firms.

Vinamilk Shareholders to Receive Cash Dividends of VND 2,000 per Share

The Vinamilk Board of Directors (HOSE: VNM) approved on April 29th the distribution of the remaining 2024 dividend in cash, with a payout of VND 2,000 per share.

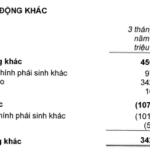

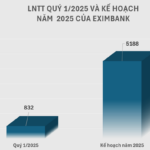

“A Profitable Quarter: Eximbank’s Pre-Tax Profits Soar by 26% in Q1 2025”

The first quarter of 2025 painted a diverse picture of profits in the banking industry, with a notable performance gap between private and large banks. While the big players maintained their steady growth trajectory, a few private banks, including Eximbank, stood out with impressive double-digit profit increases. This development underscores the evolving landscape of the banking sector, where smaller institutions are making their mark and challenging the traditional dominance of industry giants.