The latest report on non-financial corporate bond issuance for 2025 by VIS Rating offers interesting insights. The report predicts a stable outlook for bond issuance by non-financial firms, with residential real estate investors continuing as the primary drivers of the market. Meanwhile, the automotive and power sectors show promising potential for new issuance growth, while industrial real estate businesses may face challenges due to tariff-related concerns.

INCREASED BOND ISSUANCE ACROSS MULTIPLE SECTORS

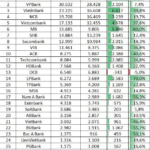

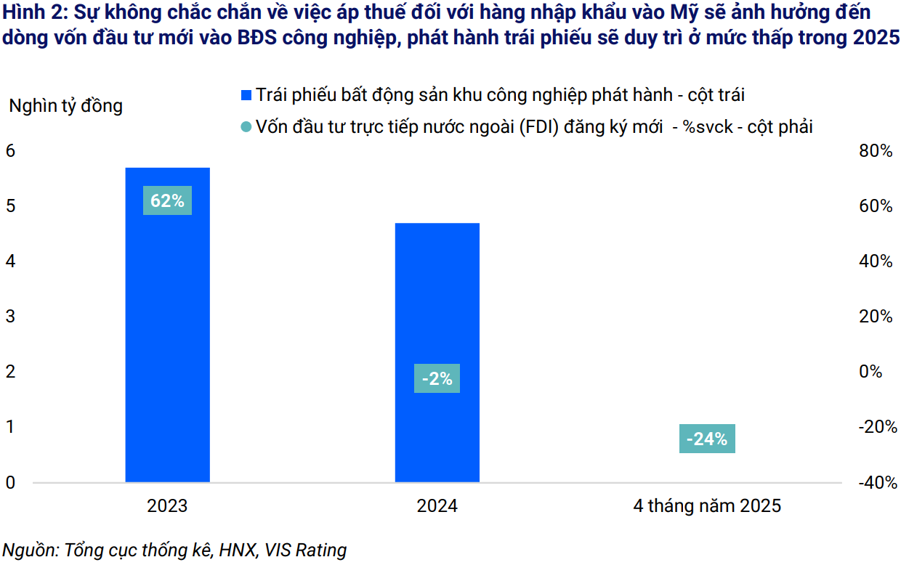

According to VIS Rating, new foreign direct investment (FDI) registrations continue to decline, falling by 24% in the first four months of 2025, following a 3% drop in the previous year. Uncertainties surrounding tariffs on imports into the US are expected to impact investment and development in new industrial real estate projects. This may cause investors to delay business expansions and new investments. While industrial real estate investors have benefited from improved access to bank credit since the beginning of 2024 (with a 34% increase in bank loans to the top 30 listed industrial real estate investors in 2024), their bond issuance is still expected to be limited in 2025.

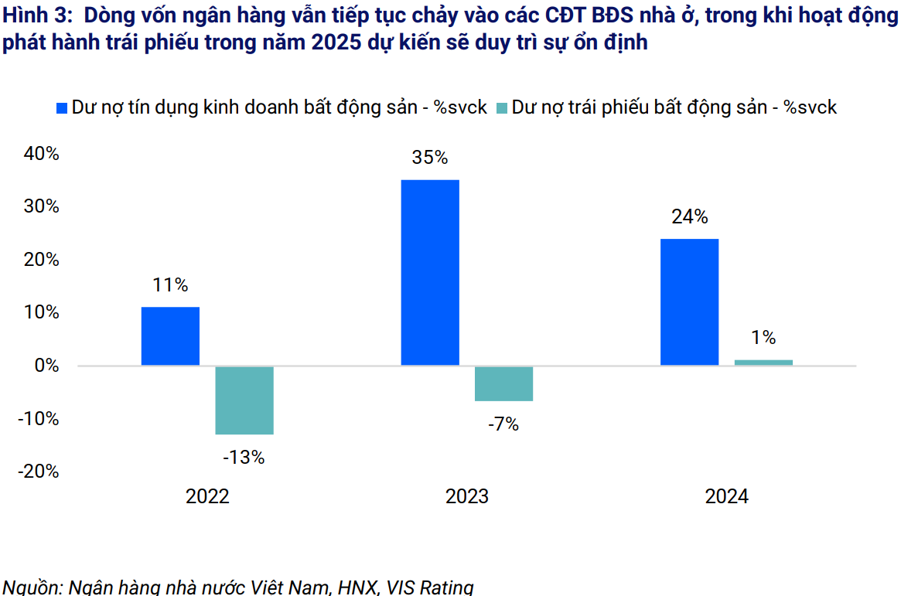

In contrast, issuers in the residential real estate sector (including the resort segment), automotive, and power industries are anticipated to exhibit stronger growth prospects. Domestic demand and supportive government policies are key drivers in these sectors. Residential real estate businesses, including the resort segment, are expected to accelerate project development upon completing legal procedures, given the rising demand for housing. The growth rate of bond issuance in this sector for 2025 is forecasted to match the 13% increase achieved in 2024.

In the automotive sector, the elimination of import tariffs on auto parts since February 2025 is considered a positive factor. Companies like VinFast and Tasco plan to expand domestic production and may turn to the bond market for capital. Bond issuance activity in the automotive industry is expected to remain high, equivalent to a 33% increase compared to the same period in 2024.

In the power sector, recent positive developments regarding pricing mechanisms for new renewable energy projects are expected to improve project feasibility and encourage companies to expand their investments. Consequently, bond issuance in the power sector is projected to surge towards the end of 2025.

DEBT RESTRUCTURING RISKS REMAIN MANAGEABLE

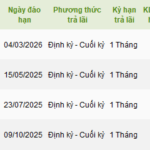

Despite a 9% year-on-year increase in the total value of non-financial bonds maturing in 2025 to VND 151 trillion, debt restructuring risks are assessed to be well-controlled. In the first four months of 2025, many organizations proactively repurchased and prepaid bonds, with a total value increasing by 97% compared to the same period last year.

For businesses with weak cash flows, extending bond maturities is considered a viable solution to avoid debt restructuring risks. Improved bond market liquidity will also support issuers during the debt restructuring process. Notably, approximately 73% of the VND 13.2 trillion in new bonds issued in the first four months were intended for debt restructuring purposes.

According to VIS Rating, about 60% of the bonds maturing in 2025 are in the residential real estate sector. With a favorable market outlook and efficient access to capital, investors are expected to smoothly repay maturing bonds or reach agreement on extensions with bondholders.

In the power sector, approximately 30% of the total VND 4.1 trillion in maturing bonds are related to transitional renewable energy projects, which are currently facing challenges with principal and interest repayments. However, the completion of power purchase agreements and the commencement of commercial operations for these projects are expected to improve cash flows, enhancing their ability to meet debt obligations. Bond repayment activities, including early buybacks, have doubled in the first four months of 2025.

The Top 5 Shareholders Related to Chairman Bui Thanh Nhon Have Registered to Sell Nearly 18.8 Million Novaland Shares

Novagroup is set to offer a substantial number of shares, with a planned sale of over 3.9 million NVL stocks. Diamond Properties is also looking to offload a significant amount, totaling 3.2 million shares. In a separate move, the wife and children of Bui Thanh Nhon, Chairman of the Board of Directors, are seeking to sell a combined total of nearly 11.6 million shares.

“Tariff Turbulence Curtails Industrial Real Estate Investors’ Bond Issuance in 2025”

In the major bond-issuing sectors, the industrial real estate industry will be the most affected by the tariff risks.

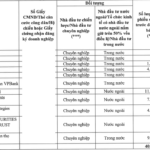

The VDS Issuance of Corporate Bonds: An Exclusive Offering of 800 Billion VND

The Board of Directors of Rong Viet Securities Corporation (VDSC, HOSE: VDS) approved a plan to issue the second tranche of bonds worth VND 800 billion to professional investors on May 7th, 2025. This move aims to restructure the company’s debt and strengthen its financial position. With this new issuance, VDSC demonstrates its commitment to optimizing its capital structure and ensuring long-term financial stability.

KBC Plans to Release 250 Million Privately Placed Shares at VND 25,000 per Share

The Board of Directors of Kinh Bac City Development Holding Corporation (HOSE: KBC) has approved a plan to raise capital through a private placement of shares.