According to the Hanoi Stock Exchange (HNX), Hai Phat Investment Joint Stock Company (HPX) recently announced adjustments to certain terms related to the bond code HPXH2123008.

Specifically, according to NQNSHTP No. 59/NQ-DDNSHTP dated April 29, 2025, the bondholder agreed to extend the maturity date of the HPXH2123008 bond from April 28, 2025, to June 30, 2025.

The applicable interest rate for the above extension is 13.5%. The bond debt during this extension period is VND 60 billion.

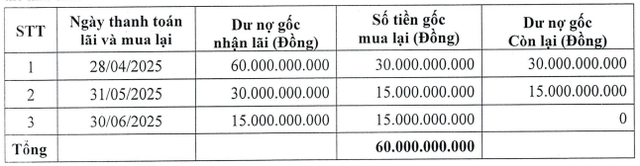

Along with this, Hai Phat committed to paying the accrued interest and repurchasing the bonds in advance according to the following schedule:

Source: HPX

The HPXH2123008 bond was issued on October 28, 2021, with a total issuance value of VND 250 billion. The bond initially had a term of 24 months, maturing on October 28, 2023.

In July 2024, the bond term was extended from 24 months to 36 months, with a new maturity date of October 28, 2024.

In October 2024, the bond term was further extended from 24 months to 42 months, an additional 1.5 years, with a new maturity date of April 28, 2025.

However, after two extensions, Hai Phat has not fully repaid the debt and has further extended the maturity of this bond to June 30, 2025.

In other news, at the 2025 Annual General Meeting held on April 26, Hai Phat’s management announced that they would completely settle bond debts and committed to increasing share ownership to strengthen internal capabilities and accompany shareholders in the process of restructuring and recovering business operations.

Specifically, before the meeting, Hai Phat had fully repaid VND 300 billion and planned to buy back an additional VND 30 billion in bonds in the second half of this year, bringing the bond debt down to approximately VND 500 billion in 2025.

Hai Phat Invest’s management has worked with financial institutions to secure capital for key projects, including phase 2 of the Cao Bang project, four high-rise buildings in Bac Giang, and projects in Lao Cai and Hai Yen.

By the end of 2024, the company had completed the Bac Giang project, finished phase 1 and commenced phase 2 of the Cao Bang project, and acquired land for a portion of the Mai Pha project (Lang Son). The projects in Lao Cai, Phu Yen, and Hai Yen are also in the process of preparing for sales and business operations.

In addition, Hai Phat does not plan to pay dividends for 2024. All profits will be used to settle maturing financial obligations and strengthen investment capacity for strategic projects. The company stated that dividend payments will be considered at a more appropriate time when cash flow stabilizes and financial performance improves.

Consecutively forgoing dividend payments for two years, Hai Phat considers this a necessary measure to ensure financial safety, maintain stable operations, and lay the foundation for sustainable growth from 2025 onwards.

For the 2025 business plan, Hai Phat aims for consolidated revenue of VND 2,327 billion and consolidated after-tax profit of VND 137 billion, increasing by 37% and 122.2%, respectively, compared to the 2024 performance. For the parent company, the revenue target is VND 1,606 billion, and the after-tax profit target is VND 58 billion.

Market Beat: Blue-Chip Stocks Keep VN-Index in the Green

The major indices remained in the green territory towards the end of the morning session. By lunch break, the VN-Index posted a gain of 7.62 points, reaching 1,274.92. Meanwhile, the HNX-Index edged slightly lower, settling at 214.42. Market breadth was positive, with 368 advancers outweighing 265 decliners.

“Vicostone’s First Quarter Net Profit Down Nearly 20% Year-on-Year”

As of Q1 2025, Vicostone recorded a revenue of over VND 1,018 billion, a 5.2% decrease compared to the same period last year. Despite this, the company managed to maintain a strong profit with an after-tax profit of nearly VND 164.6 billion, reflecting a resilient performance in a challenging economic climate.

The Foreigners’ Sell-Off: A Mid-March Meltdown?

“In contrast, VHM stocks witnessed a significant net buying position with a substantial investment of 124 billion VND, while VCI stocks also experienced robust net buying, totaling 99 billion VND.”