Gelex Electric JSC (Gelex Electric, Stock Code: GEE, HoSE) has announced its decision to invest in a new subsidiary.

The new subsidiary, named Gelex Technology Co., Ltd., will be located on the 23rd floor of the Gelex Building, 52 Le Dai Hanh Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi.

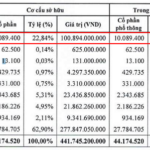

The company has a chartered capital of VND 50.84 billion, with Gelex Electric contributing nearly VND 25.93 billion, equivalent to a 51% ownership stake.

As of March 31, 2025, Gelex Electric owned eight direct subsidiaries. With this decision, the number of direct subsidiaries has increased to nine.

Illustrative image

In another development, April 29, 2025, was the last day for Gelex Electric shareholders to register their rights to receive new shares issued by the company to increase its charter capital.

As planned, the company will issue 61 million shares to existing shareholders at a ratio of 5:1, meaning that for every 5 shares owned, shareholders will receive 1 new share.

The right to receive shares issued due to the capital increase from the owner’s equity is not transferable. However, the additional issued shares are not restricted from being transferred.

The total issuance value at par value is VND 610 billion. The issuance funds will be sourced from the surplus capital on the audited separate financial statements of Gelex Electric for 2024.

If the issuance is successful, the number of GEE shares traded on the market will increase from 305 million to 366 million, equivalent to an increase in Gelex Electric’s charter capital from VND 3,050 billion to VND 3,660 billion.

It is worth noting that this capital increase plan was approved by Gelex Electric shareholders at the 2025 Annual General Meeting of Shareholders held on March 25, 2025.

Additionally, on April 15, 2025, the company will pay the remaining 2024 dividend to its shareholders at a rate of 20% per share, meaning that for every share owned, shareholders will receive VND 2,000.

With 305 million GEE shares currently traded on the market, Gelex Electric is expected to pay approximately VND 610 billion for this dividend payment.

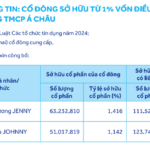

As of March 31, 2025, Gelex Electric’s parent company, Gelex Group JSC (Stock Code: GEX, HoSE), owns 78.69% of Gelex Electric’s charter capital, equivalent to more than 240 million GEE shares. Thus, Gelex Group is expected to receive over VND 480 billion from this dividend payment.

“Harec Building Owner Locks in 30.5% Dividend Yield.”

The Harec Investment and Trading JSC (UPCoM: HRB), owner and operator of the prestigious Harec Building in Hanoi, has announced the record date for shareholders to receive cash dividends for the year 2024. Shareholders on record as of May 21st, 2025, will be eligible to receive this dividend payment.

The Ultimate Windfall: Unveiling the Secrets Behind a Vietnamese Company’s Stellar Performance with a 444% Surge in Q1 Profits, Positioning Itself as a Global Leader in the Highly Coveted Mineral Industry.

“With this latest announcement, the total cash dividend for 2024 amounts to an impressive 138% (VND 13,800 per share), marking a historic high for the company. This unprecedented payout underscores our commitment to sharing our success with our valued shareholders and reinforces our position as a leader in the industry.”

“NHA to Pay Dividends After 5 Years”

Introducing the Urban and Southern Hanoi Housing Development and Investment Corporation (HOSE: NHA), a powerhouse in the real estate industry, as they announce their latest dividend offering. Shareholders, take note: May 27th is the crucial date for entitlement, as the company gears up to distribute its 2024 dividend entirely in shares.