The Ho Chi Minh City Stock Exchange (HOSE) announces a supplementary list of securities ineligible for margin trading.

Accordingly, HOSE adds three funds: Thiên Việt 3 Growth Investment Fund (code FUCTVGF3); Thiên Việt 4 Growth Investment Fund (code FUCTVGF4) and Thiên Việt 5 Growth Investment Fund (code FUCTVGF5). These public investment funds have had a minimum of one month with a net asset value (NAV) per fund certificate unit lower than the par value, based on the monthly net asset value change reports for three consecutive months.

As a result, the number of securities ineligible for margin trading from May 9 to May 12, 2025, increases to 67.

This list also includes funds such as FUCVREIT of Techcom Vietnam Real Estate Investment Fund; FIJEA BVND of ABFVN DIAMOND ETF; FUEIP 100 of IPAAM VN100 ETF; and FUEKI V30 of KIM Growth VN30 ETF. These public investment funds have had a minimum of one month with an NAV per fund certificate unit lower than the par value, based on the monthly NAV change reports for three consecutive months.

Additionally, the FUET CC50 code of the TECHCOM CAPITAL VNX50 ETF has been listed for less than six months.

The list includes stocks with plummeting business results, leading to margin cuts for several stocks, including AAM, APG, CMX, DQC, EVE, HAS, HID, ITD, LDG, NVL, PGV, SBV, TLH, and TTE. The reason is that the profit of the parent company’s shareholders/consolidated net profit in the reviewed semi-annual financial statements for 2024 is negative.

GIL and VTB are also on the list, facing margin cuts as the companies received conclusions from tax authorities regarding their violation of tax laws.

HoSE: Official Launch of the KRX System on May 5th

The Ho Chi Minh Stock Exchange (HoSE) is proud to announce the official launch of its new information technology system, effective May 5, 2025. This state-of-the-art technology infrastructure marks a significant milestone in the exchange’s journey towards becoming a leading stock exchange in the region.

“Domesco Stake Sale: SCIC Offers Nearly 12.1 Million Shares, Starting Bid Over VND 1.5 Trillion”

The State Capital Investment Corporation (SCIC) plans to auction off a significant stake in Domesco Medical Import-Export Joint Stock Company (HOSE: DMC). The auction block comprises nearly 12.1 million shares, representing 34.71% of DMC’s charter capital. Bidding will start at a premium, with an opening price set at over VND 1,531 billion for the entire lot, equating to approximately VND 127,000 per share – a substantial figure that doubles the closing price from the April 18 session.

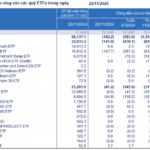

Are Bond Funds Losing Interest in Bonds?

According to VietstockFinance, the movement in the first nine months of 2024 within bond investment funds showcased a collective shift towards reducing bond holdings and significantly increasing bank deposits.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)