These are the insights shared by Mr. Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBankS), at the Vietnam and Indexes program on May 12, 2025.

Mr. Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBankS)

|

Trump is De-escalating after Significant Damage

In the recent phase, the Trump administration has been de-escalating after a fierce escalation. The imposed tariffs on various countries were unimaginable, such as 46% on Vietnam and over 200% on China. Statistics show a rapid decline in imports into the US, with a significant drop in container port traffic and a decrease in tourists from Canada, Europe, South America, and Asia. This indicates that the US economy has been impacted by the trade escalation.

China has shifted from importing crude oil from the US to Canada. By the end of March, crude oil imports from the US reached a very low level, causing losses for American exporters. Simultaneously, US agricultural producers (soybeans, beef) are affected as China turns to Mexico and Brazil for imports. Regarding industrial production, China has also stopped importing Boeing airplanes.

After such actions, the impact on the US economy is evident. However, there may be a time lag, and the effects will be reflected in the May-June data ahead.

Therefore, the de-escalation will positively impact US trade with other nations. As of the end of March, the US reduced imports from China but increased imports from other countries. Recently, to avoid price hikes, the US had to lower tariffs on some items, such as electronic equipment, to near zero, as these goods are produced by American companies in China and must be imported. Meanwhile, China maintains a tariff rate of around 10% on the same products.

The US trade agreement with the UK is also a clear de-escalation step. In this agreement, car import tariffs from the UK to the US have been reduced from 27% to 10%, and steel, aluminum, engines, and aircraft parts are exempt. In return, the UK pledged to purchase $10 billion worth of Boeing airplanes and pay a 10% tariff on other items.

With China, imports into the US have plummeted by about 18% by the end of March. Goods like machinery, textiles, basic metals, plastics, and rubber have decreased by 14-33%. In April, these figures could be even lower. As of March, less than 9% of US imports came from China—the lowest since the 2008 and 2020 recessions and equivalent to the 2001-2002 period.

The trade impact between the US and China is significant, so Mr. Son expects the US to pursue agreements to ensure a recovery in production.

Foreign Investors Returning to the Market

Statistics show that foreign investors have returned to Asia and Southeast Asia for about four weeks. After the sharp declines in most markets due to US tariff policies, international investors are showing signs of returning to emerging and frontier markets.

Following the Trump administration’s statements, the USD has weakened significantly, leading many investors and analysts to believe that USD-denominated assets will become less attractive. They also recognize the unpredictability of US trade policies. To safeguard their assets, they have reduced their investment proportions in the US. As the USD weakens, currencies in emerging markets show signs of appreciation, including the Japanese Yen, South Korean Won, British Pound, and Euro.

Comparative analysis reveals that since the April lows, the S&P 500 has underperformed, falling nearly 4% year-to-date, while emerging markets, frontier markets, and the MSCI Europe have rebounded strongly and are up more than 5% year-to-date. This indicates a reallocation of capital back into these markets.

In this context, the Vietnamese market has also seen net buying of over VND 1,000 billion across the three exchanges, indicating very positive signals from the region. Mr. Son expects this buying streak to continue, as Vietnam and several other countries anticipate negotiations with the US.

Recently, the UK has had positive preliminary negotiation results. Initial negotiations between China and the US will help both sides reduce losses. For Vietnam, Mr. Son hopes for an early positive outcome to support the market.

Expectations for the Fed to Cut Rates Three More Times in 2025

In the Fed’s early May meeting, Mr. Son observed positive signals. If the Fed were to ease policy in June or July, it could backfire, suggesting that the Fed confirms issues with the US economy. It is evident that the market reacted positively when the Fed almost maintained its interest rate policy at 4.25-4.5%.

Regarding the 0.3% decline in Q1 GDP, the Fed emphasized that it was due to rapid imports, with about 45% of goods imported at the end of March. Meanwhile, domestic spending and personal consumption remained robust, increasing by about 3%. The job market remained strong, with unemployment at 4.2% and an average of 155,000 new jobs per month. Another factor was the positive inflation report.

In his speech, Mr. Jerome Powell expressed concern about the potential rise in inflation due to the trade war. Therefore, the Fed will await further information on the job market and the impact of the trade war on inflation before determining its next steps.

VPBankS specialists forecast that, in the absence of significant influences, the Fed may cut rates in July, October, and December.

Equity Strategies: Focus on Bottoming-out Stocks and Sector Leaders

According to Mr. Son, the market’s condition in the previous phase could be divided into two groups. The first group comprises sectors that have regained important moving averages, including chemicals, logistics, and banks, which have almost returned to an “uptrend” state.

In this phase, investors seeking new entry points can consider stocks with solid fundamentals that have genuinely bottomed out in the previous period and are still far from their correction levels. An example is industrial real estate, employing a strategy of buying discounts and riding the recovery wave. Secondly, investors can also focus on deeply corrected stocks that have formed a bottom and rebounded, such as technology stocks. This is the phase where stocks recover as the US and its major trading partners return to the negotiating table.

In the short term, Mr. Son leans towards the scenario where bank stocks will lead the market. During the recent holiday, bank stocks paused their rally but have since regained momentum.

[1] Huy Khai

– 10:43 13/05/2025

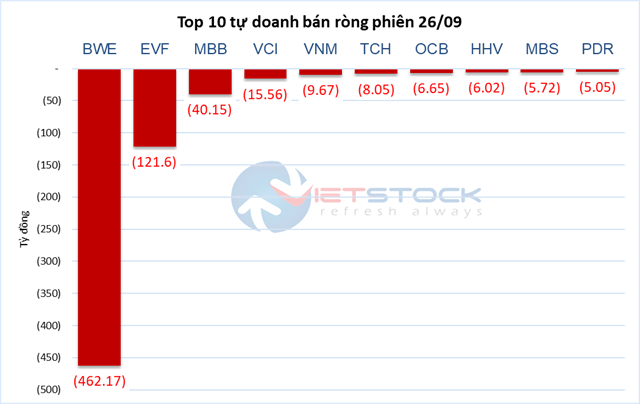

The Smart Money Sells: Foreigners Dump Vietnamese Shares, Offloading Bank Stocks

The sell-off continued into the afternoon session, with VCB and VHM bearing the brunt of it. VCB witnessed a substantial sell-off, with approximately VND 184 billion changing hands, while VHM followed suit with a notable sell-off of VND 134 billion.

Market Beat: Energy & Real Estate Sectors Surge, VN-Index Rallies Further

The market closed with positive gains, seeing the VN-Index rise by 8.42 points (+0.68%), settling at 1,250.37. Likewise, the HNX-Index witnessed an increase of 0.52 points (+0.24%), ending the day at 213.41. The market breadth tilted in favor of the bulls, with 402 gainers versus 337 losers. The VN30 basket saw a similar trend, with 14 gainers outperforming 11 losers, while 5 stocks remained unchanged, adding a slight tilt to the bullish sentiment.

Crafting an Ecosystem from FTAs to Adapt to Trade Wars and the US’ Countervailing Duty Policies

Leveraging Free Trade Agreements (FTAs) in production strategy, optimizing input sourcing strategies, and ensuring compliance with rules of origin to enhance competitiveness and adapt to the trade war and the US’ countervailing duty policies.