On May 13, KIS announced that it had received a decision from the Tax Authority on May 09 regarding remedial measures for under-declared taxes.

As a result, KIS was not administratively sanctioned due to the expiration of the sanctioning period. However, the company must implement three remedial measures, including additional tax collection of over 491 million VND, late payment interest of over 458 million VND, and a reduction in tax credit of over 301 million VND. In total, KIS is required to pay and rectify 1.25 billion VND.

|

Article 110. Statute of Limitations for Tax Offenses – Law on Tax Administration of 29/11/2006 and Law Amending and Supplementing a Number of Articles of the Law on Tax Administration of 20/11/2012 1. For violations of tax procedures, the statute of limitations is two years from the date of the violation. 2. For tax evasion and fraud not subject to criminal prosecution, and for under-declaration of payable taxes or over-declaration of refundable taxes, the statute of limitations is five years from the date of the violation. 3. If the statute of limitations for tax offenses has expired, the taxpayer will not be subject to administrative sanctions but must still pay the full amount of underpaid, evaded, or defrauded taxes, as well as late payment interest, for up to ten years from the date of detection. In cases where the taxpayer is not registered, they must pay the full amount of underpaid, evaded, or defrauded taxes, plus interest, for the entire period from the date of detection.” |

Recently, KIS also made headlines when it encountered a technical issue and had to temporarily halt trading of UPCoM stocks during the KRX go-live session.

KIS’s announcement stated that on May 05, the company experienced an information technology incident that affected securities transactions for its clients. As a result, the company temporarily suspended order acceptance for UPCoM stock transactions from 10:04 am on May 05. KIS resumed order acceptance for the UPCoM market from May 06.

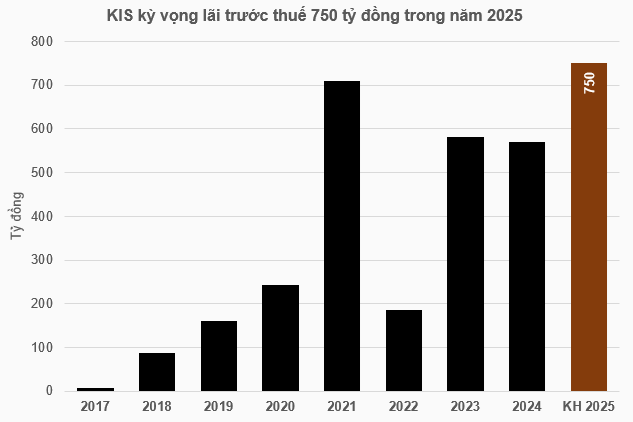

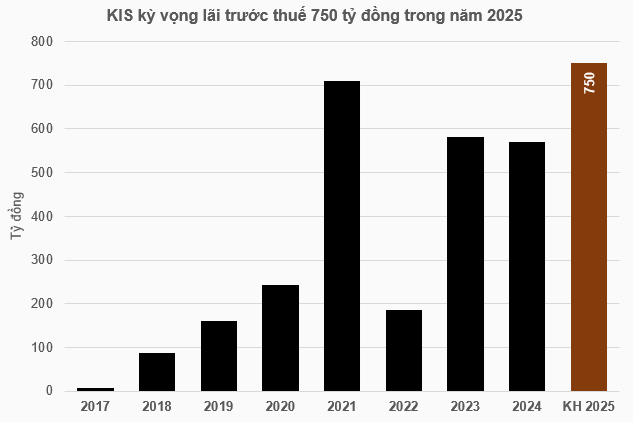

Earlier, at the 2025 Annual General Meeting of Shareholders held on April 03, KIS shareholders approved the 2025 business plan with a target of 1,125 billion VND in net revenue. This includes 577 billion VND in interest income from lending activities, 273 billion VND in transaction fees, and 219 billion VND in profits from other business segments such as investment banking (IB), covered warrants (CW), and ETF certificates; with the remaining 55 billion VND contributed by IB interest income.

The company expects a record pre-tax profit of 750 billion VND, a 32% increase compared to 2024’s performance.

Source: VietstockFinance

|

In the first quarter of 2025, the company recorded a pre-tax profit of over 128 billion VND, a 34% decrease compared to the same period last year, and achieved 17% of its annual plan. Finally, the company’s net profit was nearly 103 billion VND, a 34% decrease.

KIS attributed the decline in profits in the first quarter to the poor performance of proprietary trading, securities and warrant trading, while management expenses increased by 17%, mainly due to higher management personnel costs.

Also at the recent Annual General Meeting of Shareholders, a plan to handle irrecoverable debts was approved. This plan applies to long-standing debts for which necessary measures have been taken but remain uncollected. The company has made a 100% provision for these debts, including an amount of over 126 billion VND as of December 31, 2021, and nearly 10 billion VND as of December 31, 2022, all of which are from individual customers.

– 19:15 13/05/2025

The Big Vimeco Shareholder Sells Off at a Loss, New Investors Scoop Up Bargain Shares.

In less than four months as a major shareholder, Phan Tran Hieu offloaded his entire stake of nearly 22% in Vimeco, incurring an estimated loss of over VND 25 billion. Following the transaction, Vimeco welcomed two new individual shareholders at a time when the company’s stock price took a significant hit.

The DSN Leadership’s Decision to Discontinue Free Entry Tickets for Shareholders: Unveiling the Reasons Behind the Change

At the 2025 Annual General Meeting, held on the morning of February 24th, the leadership team of Dam Sen Water Park JSC (HOSE: DSN) provided insights into their upcoming investments and addressed shareholders’ concerns regarding the discontinuation of complimentary water park entry tickets for attendees of the Annual General Meeting.

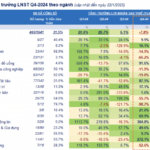

The Profit Picture: 465 Businesses Report Q4 Earnings, Revealing a Slowdown in Banking and a Surge in Construction

As of the fourth quarter of 2024, 465 listed companies, representing 31.5% of the total market capitalization, have released their official or preliminary financial statements. However, the profit landscape paints a less optimistic picture, with nearly half of these businesses reporting a decline compared to the previous year’s fourth quarter.