The HNX-Index and UPCoM-Index also rose by nearly 2 points and 1 point, respectively.

|

Source: VietstockFinance

|

Utilities were the only sector to witness a decline, with GAS, POW, REE, TDM, GEG, and PPC all trading lower, pulling the benchmark index below the reference level.

The real estate sector, however, managed to escape losses thanks to a slight uptick in VIC. In reality, numerous real estate stocks closed the session in the red, including NVL, VHM, VRE, and CII.

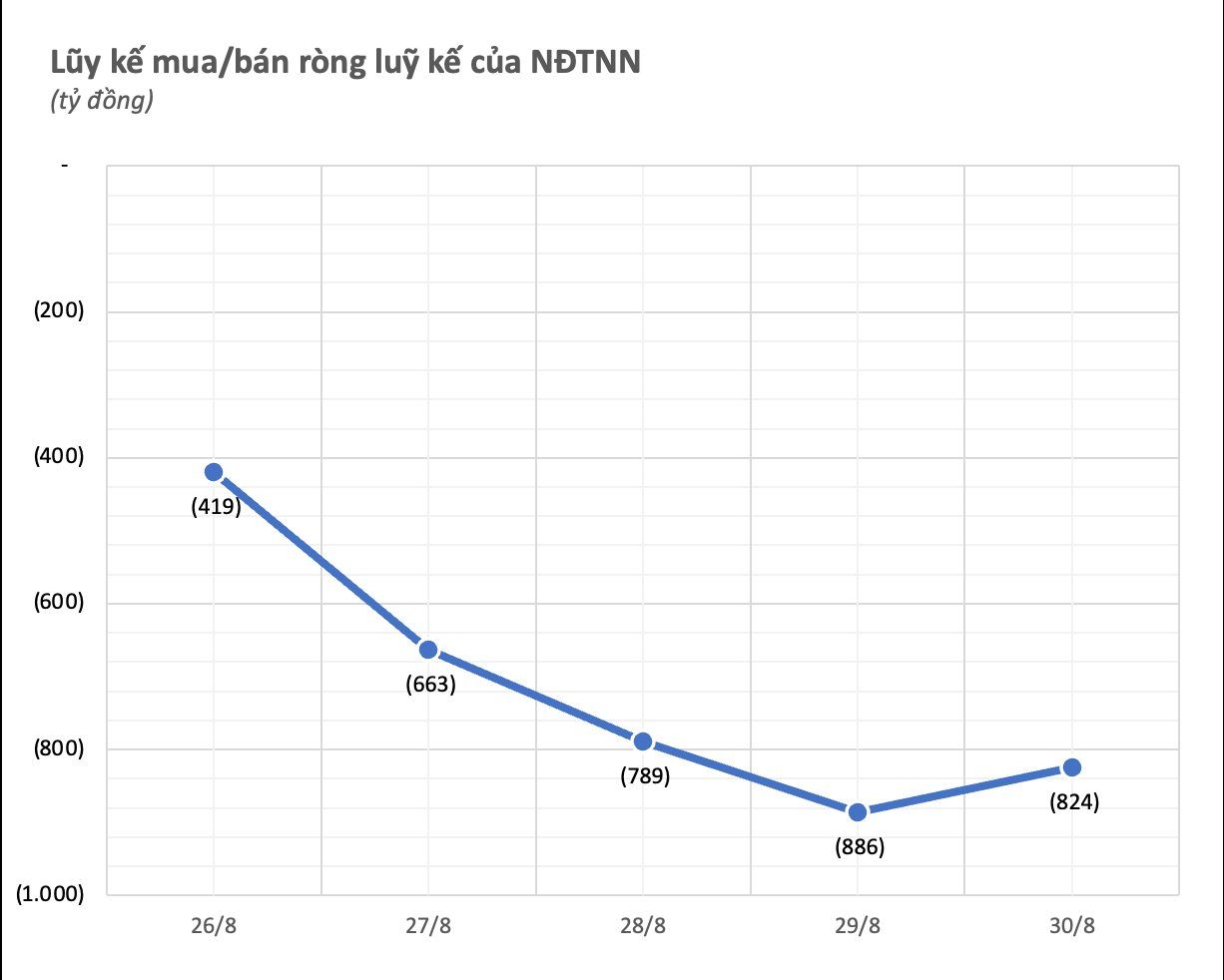

Today’s highlight was foreign investors’ net buying of nearly VND950 billion. MBB, MWG, PNJ, CTG, and FPT were the top five stocks with net purchases totaling over VND1,200 billion.

| Foreign Trading Activity |

| Top 10 Stocks Net Foreign Buying/Selling on May 13, 2025 |

The market’s trading value reached VND27.1 trillion, with approximately VND24 trillion coming from matched orders. Capital is returning to the market with a comfortable sentiment. Since the beginning of May, the VN-Index has risen from 1,240 to 1,293 points. The prospect of conquering the 1,300 mark remains open.

| HOSE Liquidity |

Morning Session: Real Estate Sector Faces Selling Pressure

By the end of the morning session, the market maintained a broad-based gain. The VN-Index rose nearly 6 points, closing in on the 1,289.3 mark. The HNX-Index gained nearly 2 points, approaching the 218 level.

Despite the dominant buying force, sellers gradually became more vocal. In the financial sector, STB, TPB, LPB, and VIB turned red. The real estate sector experienced the most intense selling activity. In addition to the Vingroup family, NVL, DXG, TCH, VPI, HDC, and HQC all declined.

In the materials sector, DGC, DCM, HSG, BFC, and VTZ joined the losers’ group.

VPL soared to the ceiling price in its debut session on the HOSE. With a 20% fluctuation band for newly listed stocks, this stock is pushing the VN-Index up by more than 7 points.

| Top 10 Stocks Influencing the VN-Index on May 13, 2025 |

Compared to the opening, the pharmaceutical group has joined the losing team alongside real estate and utilities. IMP, DVN, DBD, and TRA all traded lower, with IMP falling nearly 4%.

Market liquidity reached VND13.2 trillion in the morning session. VIX, SHB, MBB, NVL, and SSI were among the top volume leaders on the HOSE. Meanwhile, on the HNX, SHS, CEO, MBS, and PVS took the lead.

At 10:30 am: Vinpearl Stock Hits Ceiling Price

After a period of intense fluctuation at the beginning of the session, the VN-Index entered a stable zone. As of 10:25 am, the index maintained a gain of 5-6 points.

The market situation remained similar to the opening, with green dominating various sectors but facing downward pressure from the real estate industry. The Vingroup trio (VRE, VHM, VIC) and NVL were the main negative influences on the index.

Today marks the first trading day of another Vingroup member, VPL (Vinpearl), on the HOSE. This stock has been trading at the ceiling price since the opening bell. By 10:30 am, buy orders at the ceiling price reached nearly 1.6 million units, with a trading volume of 4,800 shares.

Source: VietstockFinance

|

Apart from real estate stocks, the utilities sector also moved against the broader market. GAS, POW, PGV, GEG, and NT2 witnessed declines. Within the sector, REE, DTK, BWS, and DNW maintained their gains, but the increases were modest, unable to offset the losses incurred by industry heavyweights like GAS, POW, and PGV.

Foreign investors were net buyers, with a net purchase value of over VND340 billion. MWG, PNJ, FPT, and MBB were net bought in the range of VND100-120 billion.

Opening: Broad-Based Positivity, But Real Estate Sector Curbs Enthusiasm

The market opened on May 13 with a positive tone across the board. As of 9:25 am, nearly 400 stocks advanced, outnumbering the 110 declining ones. In the initial minutes, the VN-Index climbed nearly 9 points.

After the first 30 minutes of trading, the red in the real estate sector hindered the index’s ascent. NVL fell more than 3%. VIC dropped 3%, VRE lost 2.3%, and VHM slipped 1.3%. Additionally, other real estate stocks like TCH, NLG, and TIG also declined, exerting significant pressure.

Financial stocks demonstrated resilience. Securities firms unanimously climbed, with SSI, VIX, SHS, HCM, and FTS rising between 2% and 3%. Bank stocks posted milder gains of less than 1%. The optimistic outlook for the stock market following favorable news on tariffs likely served as the primary catalyst for the rally in securities stocks.

In the materials sector, steel stocks showed strength. HPG and NKG advanced over 2%.

Stocks in the APEC family soared to the ceiling price. APS, API, and IDJ all surged 7% from the previous session.

Yến Chi

– 15:35, May 13, 2025

“Vietstock Daily: Sustaining the Uptrend”

The VN-Index surged significantly, closely tracking the upper band of the Bollinger Bands. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating an encouraging influx of capital into the market. If this positive momentum persists in upcoming sessions, the index could potentially ascend towards the 1,300-point mark. This level serves as a crucial resistance threshold, and the outcome of testing this region will dictate the index’s trend in the foreseeable future. Presently, the MACD indicator sustains a buy signal, concurrently crossing above the zero mark, portending continued optimism in the short term.

Mirae Asset: VN-Index to Extend its Recovery in May

In their latest strategic report, Mirae Asset Vietnam Securities predicts a continued recovery for the VN-Index in May. With countries entering trade negotiations, the market sentiment is expected to turn more positive as this could reduce the frequency of unpredictable news from the US, leading to a more stable environment.

Technical Analysis for May 14: The Emergence of Diversification

The VN-Index and HNX-Index exhibited a contrasting performance, with one index rising while the other fell. This movement comes amidst a backdrop of the MACD indicator maintaining its previous buy signal, suggesting an improvement in the short-term outlook.

Market Beat: Foreigners Ramp Up Buying, VN-Index Surges Past 1,300 Points

The trading session concluded with impressive gains, as the VN-Index surged by 16.3 points (+1.26%), closing at 1,309.73. Simultaneously, the HNX-Index displayed a notable increase of 0.95 points (+0.44%), finishing the day at 218.88. The market breadth tilted strongly in favor of advancers, with 426 tickers in the green and only 322 in the red. Within the VN30 basket, bullish momentum prevailed, evidenced by 22 gainers, 7 losers, and 1 unchanged stock.